Form Ct-941 - Connecticut Quarterly Reconciliation Of Withholding - 2001 Page 2

ADVERTISEMENT

INSTRUCTIONS FOR COMPLETING FRONT OF FORM CT-941 (DRS)

for the late filing of any return or report that is required by law to

be filed. Interest: Interest will be computed on the underpayment

Line 1: Enter the total amount of wages paid to all employees and

of tax at the rate of 1% (.01) per month or fraction of a month.

nonpayroll amounts subject to withholding paid during this quarter.

Line 9: Enter amount of tax credit from Line 7 to be applied to next quarter.

Line 2: Enter the total amount of Connecticut wages paid and Connecticut

Line 10: Enter amount of tax credit from Line 7 to be refunded.

nonpayroll amounts subject to withholding paid during this quarter.

Line 11: Add Line 7 and Line 8 if the amount on Line 7 is a net tax due. This

Line 3: Enter the total amount of Connecticut income tax withheld on

is the total amount now due.

wage and nonpayroll amounts during this quarter. (This should

equal Total Liability for Quarter below.)

INSTRUCTIONS FOR COMPLETING BACK OF FORM CT-941 (DRS)

Line 4: Enter any credit from the previous quarter as a result of

All Filers: Any employer with a Connecticut withholding tax liability of

overpayment, if applicable.

less than $500 for a calendar quarter need not complete Schedule A or

Line 5: Enter the sum of all payments made for this quarter.

Schedule B below.

Line 6: Add Line 4 and Line 5. This is the total of your payments and

Schedule A: Federal monthly schedule depositors complete Schedule A

credits for this quarter.

below. Schedule A is a summary of your monthly Connecticut tax liability,

Line 7: Subtract Line 6 from Line 3 and enter the result on Line 7. This is

not a summary of deposits made.

the amount of tax due or credit. If Line 6 is more than Line 3,

complete Line 9 and Line 10.

Schedule B: Federal semiweekly schedule depositors or monthly schedule

Line 8: Enter penalty on Line 8a and interest on Line 8b, and enter the total

depositors whose tax liability on any day is $100,000 or more, complete

on Line 8. Late Payment Penalty: The penalty for late payment

Schedule B. Each numbered space on Schedule B corresponds to dates

or underpayment of income tax is 10% (.10) of such amount due.

during the quarter. Enter your Connecticut tax liability on the date wages

Late Filing Penalty: In the event that no tax is due, the

were paid, not the date of deposit.

Commissioner of Revenue Services may impose a $50 penalty

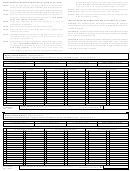

All filers: If your Connecticut liability is less than $500 for a calendar quarter, do not complete Schedule A or Schedule B

Monthly schedule depositors: Complete Schedule A

Semiweekly schedule depositors or depositors whose tax liability on any day is $100,000 or more: Complete Schedule B

Schedule A Monthly Summary of Connecticut Tax Liability

Total Liability for Quarter

(a) First Month Liability

(b) Second Month Liability

(c) Third Month Liability

Schedule B Employer’s Record of Connecticut Tax Liability (Show tax liability here, not deposits.)

(A) First Month of Quarter

(B) Second Month of Quarter

(C) Third Month of Quarter

1

17

1

17

1

17

2

2

18

2

18

18

3

19

3

19

3

19

4

20

4

20

4

20

5

21

5

21

5

21

6

22

6

22

6

22

7

23

7

23

7

23

8

24

8

24

8

24

9

9

25

9

25

25

10

26

10

26

10

26

11

11

27

11

27

27

12

28

12

28

12

28

13

29

13

29

13

29

14

30

14

30

14

30

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0

15

31

15

31

15

31

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0

16

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

16

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0

16

Total for first month

A

Total for second month

Total for third month

B

C

<

This should equal Line 3

Total Liability for Quarter (add amounts from A, B, and C)

CT-941 BACK

on the front of this return.

(Rev. 12/00)

All filers: If your Connecticut liability is less than $500 for a calendar quarter, do not complete Schedule A or Schedule B

Monthly schedule depositors: Complete Schedule A

Semiweekly schedule depositors or depositors whose tax liability on any day is $100,000 or more: Complete Schedule B

Schedule A Monthly Summary of Connecticut Tax Liability

Total Liability for Quarter

(a) First Month Liability

(b) Second Month Liability

(c) Third Month Liability

Schedule B Employer’s Record of Connecticut Tax Liability (Show tax liability here, not deposits.)

(A) First Month of Quarter

(B) Second Month of Quarter

(C) Third Month of Quarter

1

17

1

17

1

17

2

18

2

18

2

18

3

19

3

19

3

19

4

4

20

4

20

20

5

21

5

21

5

21

6

6

22

6

22

22

7

23

7

23

7

23

8

24

8

24

8

24

9

25

9

25

9

25

10

26

10

26

10

26

11

27

11

27

11

27

12

28

12

28

12

28

13

13

29

13

29

29

14

30

14

30

14

30

15

15

31

15

31

31

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0

16

16

16

Total for first month

A

Total for second month

Total for third month

B

C

<

This should equal Line 3

Total Liability for Quarter (add amounts from A, B, and C)

CT-941 BACK

on the front of this return.

(Rev. 12/00)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2