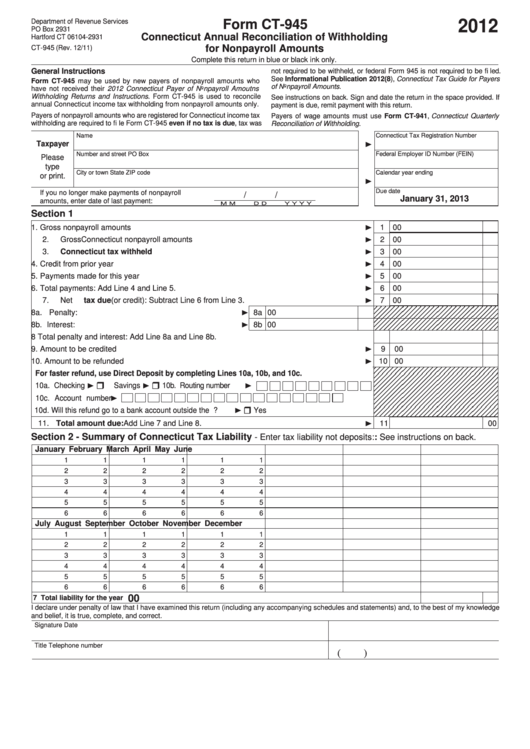

Form Ct-945 - Connecticut Annual Reconciliation Of Withholding For Nonpayroll Amounts - 2012

ADVERTISEMENT

Department of Revenue Services

2012

Form CT-945

PO Box 2931

Connecticut Annual Reconciliation of Withholding

Hartford CT 06104-2931

for Nonpayroll Amounts

CT-945 (Rev. 12/11)

Complete this return in blue or black ink only.

General Instructions

not required to be withheld, or federal Form 945 is not required to be fi led.

See Informational Publication 2012(8), Connecticut Tax Guide for Payers

Form CT-945 may be used by new payers of nonpayroll amounts who

of Nonpayroll Amounts.

have not received their 2012 Connecticut Payer of Nonpayroll Amoutns

Withholding Returns and Instructions. Form CT-945 is used to reconcile

See instructions on back. Sign and date the return in the space provided. If

annual Connecticut income tax withholding from nonpayroll amounts only.

payment is due, remit payment with this return.

Payers of nonpayroll amounts who are registered for Connecticut income tax

Payers of wage amounts must use Form CT-941, Connecticut Quarterly

withholding are required to fi le Form CT-945 even if no tax is due, tax was

Reconciliation of Withholding.

Name

Connecticut Tax Registration Number

Taxpayer

Number and street

PO Box

Federal Employer ID Number (FEIN)

Please

type

City or town

State

ZIP code

Calendar year ending

or print.

Due date

If you no longer make payments of nonpayroll

/

/

January 31, 2013

amounts, enter date of last payment:

M M

D D

Y Y Y Y

Section 1

1. Gross nonpayroll amounts .....................................................................................................

1

00

2. Gross Connecticut nonpayroll amounts .................................................................................

2

00

3. Connecticut tax withheld ....................................................................................................

3

00

4. Credit from prior year ............................................................................................................

4

00

5. Payments made for this year .................................................................................................

5

00

6. Total payments: Add Line 4 and Line 5. ................................................................................

6

00

7. Net tax due (or credit): Subtract Line 6 from Line 3. .............................................................

7

00

8a. Penalty: .........................................................................

8a

00

8b. Interest: .........................................................................

8b

00

8 Total penalty and interest: Add Line 8a and Line 8b. ...............................................................

8

00

9. Amount to be credited ...........................................................................................................

9

00

10. Amount to be refunded .........................................................................................................

10

00

For faster refund, use Direct Deposit by completing Lines 10a, 10b, and 10c.

10a. Checking

Savings

10b. Routing number

10c. Account number

10d. Will this refund go to a bank account outside the U.S.?

Yes

11

11. Total amount due: Add Line 7 and Line 8. ..........................................................................

00

Section 2 - Summary of Connecticut Tax Liability

- Enter tax liability not deposits:: See instructions on back.

January

February

March

April

May

June

1

1

1

1

1

1

2

2

2

2

2

2

3

3

3

3

3

3

4

4

4

4

4

4

5

5

5

5

5

5

6

6

6

6

6

6

July

August

September

October

November

December

1

1

1

1

1

1

2

2

2

2

2

2

3

3

3

3

3

3

4

4

4

4

4

4

5

5

5

5

5

5

6

6

6

6

6

6

00

7 Total liability for the year

I declare under penalty of law that I have examined this return (including any accompanying schedules and statements) and, to the best of my knowledge

and belief, it is true, complete, and correct.

Signature

Date

Title

Telephone number

(

)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1