Clear Form

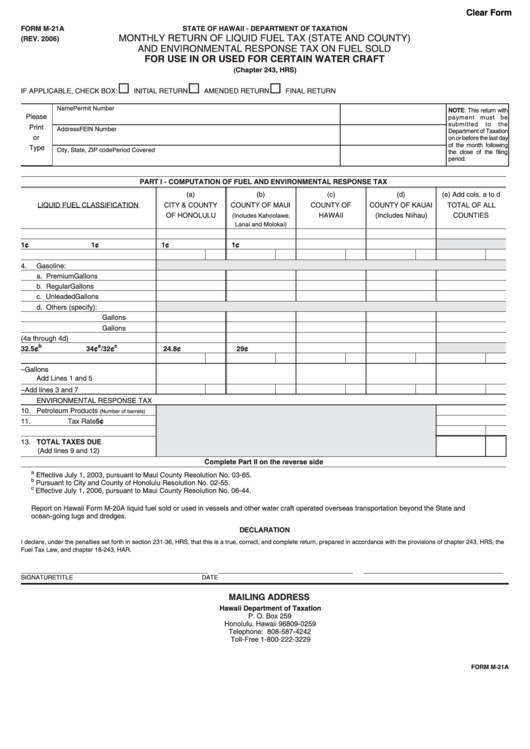

FORM M-21A

STATE OF HAWAII - DEPARTMENT OF TAXATION

MONTHLY RETURN OF LIQUID FUEL TAX (STATE AND COUNTY)

(REV. 2006)

AND ENVIRONMENTAL RESPONSE TAX ON FUEL SOLD

FOR USE IN OR USED FOR CERTAIN WATER CRAFT

Chapter 243, HRS)

(

¨

¨

¨

IF APPLICABLE, CHECK BOX:

INITIAL RETURN

AMENDED RETURN

FINAL RETURN

Name

Permit Number

NOTE: This return with

Please

payment must be

submitted

to

the

Print

Address

FEIN Number

Department of Taxation

or

on or before the last day

of the month following

Type

City, State, ZIP code

Period Covered

the close of the filing

period.

PART I - COMPUTATION OF FUEL AND ENVIRONMENTAL RESPONSE TAX

(a)

(b)

(c)

(d)

(e) Add cols. a to d

LIQUID FUEL CLASSIFICATION

CITY & COUNTY

COUNTY OF MAUI

COUNTY OF

COUNTY OF KAUAI

TOTAL OF ALL

OF HONOLULU

HAWAII

(Includes Niihau)

COUNTIES

(Includes Kahoolawe,

Lanai and Molokai)

1.

Diesel Oil

Gallons

2.

Tax Rate

1¢

1¢

1¢

1¢

3.

Total tax for Diesel Oil

4.

Gasoline:

a. Premium

Gallons

b. Regular

Gallons

c. Unleaded

Gallons

d. Others (specify):

Gallons

Gallons

5.

Total (4a through 4d)

b

a

c

6.

Tax Rate

32.5¢

34¢

/32¢

24.8¢

29¢

7.

Total tax for Gasoline

8.

Grand Total–Gallons

Add Lines 1 and 5

9.

Tax–Add lines 3 and 7

ENVIRONMENTAL RESPONSE TAX

10. Petroleum Products

(Number of barrels)

11.

Tax Rate

5¢

12. Environmental Response Tax

13. TOTAL TAXES DUE

(Add lines 9 and 12)

Complete Part II on the reverse side

a

Effective July 1, 2003, pursuant to Maui County Resolution No. 03-65.

b

Pursuant to City and County of Honolulu Resolution No. 02-55.

c

Effective July 1, 2006, pursuant to Maui County Resolution No. 06-44.

Report on Hawaii Form M-20A liquid fuel sold or used in vessels and other water craft operated overseas transportation beyond the State and

ocean-going tugs and dredges.

DECLARATION

I declare, under the penalties set forth in section 231-36, HRS, that this is a true, correct, and complete return, prepared in accordance with the provisions of chapter 243, HRS, the

Fuel Tax Law, and chapter 18-243, HAR.

SIGNATURE

TITLE

DATE

MAILING ADDRESS

Hawaii Department of Taxation

P. O. Box 259

Honolulu, Hawaii 96809-0259

Telephone: 808-587-4242

Toll-Free 1-800-222-3229

FORM M-21A

1

1 2

2