Form 8387 - Employee Benefit Plan Required Distributions 0norksheet Number 9 - Determination Of Qualification) Form

ADVERTISEMENT

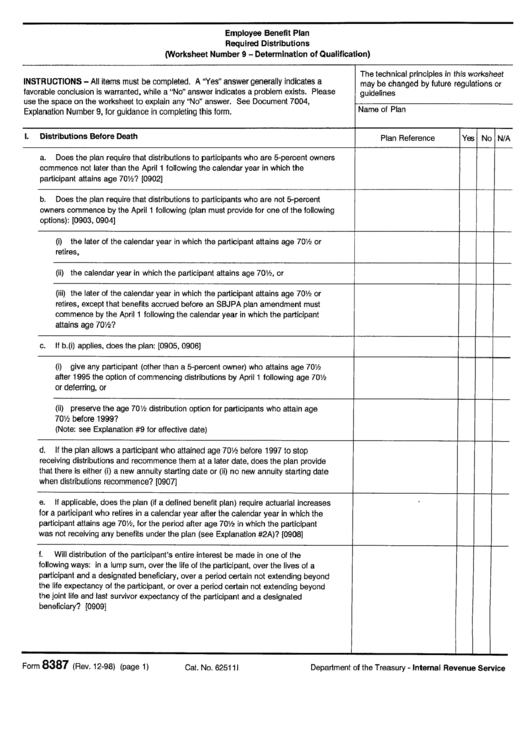

Employee Benefit Plan

Required Distributions

0Norksheet Number 9 - Determination of Qualification)

INSTRUCTIONS - All items must be completed. A "Yes" answer generally indicates a

favorable conclusion is warranted, while a "No" answer indicates a problem exists. Please

use the space on the worksheet to explain any "No" answer. See Document 7004,

Explanation Number 9, for guidance in completing this form.

The technical principles in this

worksheet

may be changed by future regulations or

guidelines

Name of Plan

I.

Distributions Before Death

Plan Reference

a.

Does the plan require that distributions to participants who are 5-percent owners

commence not later than the April 1 following the calendar year in which the

participant attains age 701/2? [0902]

Yes No N/A

b.

Does the plan require that distributions to participants who are not 5-percent

owners commence by the April 1 following (plan must provide for one of the following

options): [0903, 0904]

(i)

the later of the calendar year in which the participant attains age 701/2 or

retires,

(ii) the calendar year in which the participant attains age 701/2, or

(iii) the later of the calendar year in which the participant attains age 701/2 or

retires, except that benefits accrued before an SBJPA plan amendment must

commence by the April 1 following the calendar year in which the participant

attains age 701/2?

c.

If b.(i) applies, does the plan: [0905, 0906]

(i)

give any participant (other than a 5-percent owner) who attains age 701/2

after 1995 the option of commencing distributions by April 1 following age 701/2

or deferring, or

(ii) preserve the age 701/2 distribution option for participants who attain age

701/2 before 1999?

(Note: see Explanation #9 for effective date)

d.

If the plan allows a participant who attained age 701/2 before 1997 to stop

receiving distributions and recommence them at a later date, does the plan provide

that there is either (i) a new annuity starting date or (ii) no new annuity starting date

when distributions recommence? [0907]

e.

If applicable, does the plan (if a defined benefit plan) require actuarial increases

for a participant who retires in a calendar year after the calendar year in which the

participant attains age 701/2, for the period after age 701/2 in which the participant

was not receiving any benefits under the plan (see Explanation #2A)? [0908]

f.

Will distribution of the participant's entire interest be made in one of the

following ways: in a lump sum, over the life of the participant, over the lives of a

participant and a designated beneficiary, over a period certain not extending beyond

the life expectancy of the participant, or over a period certain not extending beyond

the joint life and last survivor expectancy of the participant and a designated

beneficiary? [0909]

Form

8387

(Rev. 12-98) (page 1)

Cat. No. 625111

Department of the Treasury - Internal Revenue Service

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2