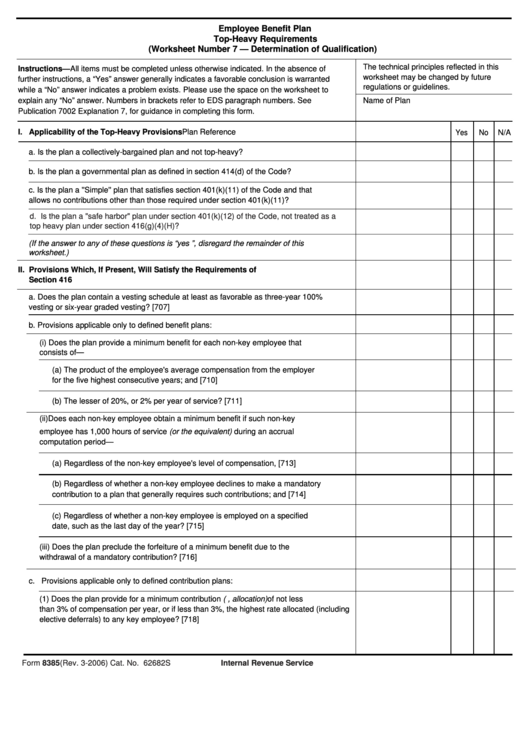

Employee Benefit Plan

Top-Heavy Requirements

(Worksheet Number 7 — Determination of Qualification)

The technical principles reflected in this

Instructions—All items must be completed unless otherwise indicated. In the absence of

worksheet may be changed by future

further instructions, a “Yes” answer generally indicates a favorable conclusion is warranted

regulations or guidelines.

while a “No” answer indicates a problem exists. Please use the space on the worksheet to

explain any “No” answer. Numbers in brackets refer to EDS paragraph numbers. See

Name of Plan

Publication 7002 Explanation 7, for guidance in completing this form.

I. Applicability of the Top-Heavy Provisions

Plan Reference

Yes

No

N/A

a. Is the plan a collectively-bargained plan and not top-heavy?

b. Is the plan a governmental plan as defined in section 414(d) of the Code?

c. Is the plan a ''Simple'' plan that satisfies section 401(k)(11) of the Code and that

allows no contributions other than those required under section 401(k)(11)?

d. Is the plan a "safe harbor" plan under section 401(k)(12) of the Code, not treated as a

top heavy plan under section 416(g)(4)(H)?

(If the answer to any of these questions is “yes ”, disregard the remainder of this

worksheet.)

II. Provisions Which, If Present, Will Satisfy the Requirements of

Section 416

a. Does the plan contain a vesting schedule at least as favorable as three-year 100%

vesting or six-year graded vesting? [707]

b. Provisions applicable only to defined benefit plans:

(i) Does the plan provide a minimum benefit for each non-key employee that

consists of—

(a) The product of the employee's average compensation from the employer

for the five highest consecutive years; and [710]

(b) The lesser of 20%, or 2% per year of service? [711]

(ii) Does each non-key employee obtain a minimum benefit if such non-key

employee has 1,000 hours of service (or the equivalent) during an accrual

computation period—

(a) Regardless of the non-key employee's level of compensation, [713]

(b) Regardless of whether a non-key employee declines to make a mandatory

contribution to a plan that generally requires such contributions; and [714]

(c) Regardless of whether a non-key employee is employed on a specified

date, such as the last day of the year? [715]

(iii) Does the plan preclude the forfeiture of a minimum benefit due to the

withdrawal of a mandatory contribution? [716]

c. Provisions applicable only to defined contribution plans:

(1) Does the plan provide for a minimum contribution (i.e., allocation) of not less

than 3% of compensation per year, or if less than 3%, the highest rate allocated (including

elective deferrals) to any key employee? [718]

Form 8385 (Rev. 3-2006) Cat. No. 62682S

Department of the Treasury-Internal Revenue Service

1

1 2

2 3

3