Form Sc1065 - Instructions Sheet For South Carolina Partnership Return Page 2

ADVERTISEMENT

TREATMENT OF DIVIDENDS, REAL ESTATE GAINS AND GUARANTEED PAYMENTS

Dividend income is taxed only to partners who are residents of South Carolina. If dividend income is included in the line 1

amount of a multi-state partnership, such income would not be subject to apportionment. For purposes of apportionment,

dividend income is subtracted on line 3 prior to apportionment.

Income (loss) from sale of real property is generally allocated to the state where it is located. If any of such income (loss) is

included in the line 1 amount, it would be eliminated on line 3 for purposes of allocation only, and if the real property is located in

South Carolina, the income (loss) is included in the line 10 amount after apportionment. Other directly allocated income (loss)

would be treated in the same manner.

Guaranteed payments for services performed for a multi-state partnership are not subject to apportionment. Guaranteed

payments for services rendered are fully taxable to residents of South Carolina no matter where performed, and fully taxable to

nonresidents if paid for services performed in South Carolina. Such guaranteed payments to nonresidents are added to the

amount in line 2 of Schedule W-H. (Guaranteed payments for capital are subject to apportionment.)

APPORTIONMENT OF INCOME

If the entire trade or business of a partnership is carried on in this state, enter 100% on line 9.

Multi-state partnerships whose principal profits are derived from manufacturing, producing, collecting, buying, assembling, processing,

selling, distributing or dealing in tangible personal property compute the portion of business income that is attributable to South

Carolina by applying the "four factor apportionment formula." Lines 5, 6, 7 and 8 summarize the computation of the South Carolina

percent of property, sales and payroll. The average percent on line 9 is determined by adding the South Carolina percentages for

property, sales and payroll (with sales counted twice) and dividing by four. Compute all percentages to four decimal places.

If the principal profits or income of a multi-state partnership are derived from sources other than manufacturing, producing, collecting,

buying, assembling, processing, selling, distributing or dealing in tangible personal property, the partnership must compute the income

attributable to this state upon a ratio of gross receipts from within this state to total gross receipts. Complete line 5 and do not divide

by four.

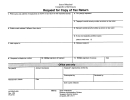

WHEN AND WHERE TO FILE

A South Carolina Partnership return of income should be completed after the federal Partnership return is completed, but is due no

later than the 15th day of the 4th month after the close of the taxable year. Returns should be mailed to SC Department of Revenue,

Partnership Return, Columbia, SC 29214-0008. Failure to file the return on time may subject the Partnership to penalty. If additional

time is needed to file your SC1065 you may file SC4868 by the due date of the return. SC Department of Revenue will accept a

federal extension for a partnership in lieu of SC4868. If you intend to use the federal extension in lieu of South Carolina's

extension, it is not necessary to send South Carolina a copy of the federal form by the due date of the tax return. Simply attach a copy

of the federal extension when you file the tax return within the extended period.

Note: Upon request the IRS grants partnerships an automatic three month extension, which is honored by SC, but which is shorter

than SC's 120 day extension. The IRS requires a second request for an additional extension of up to three months (6 months total),

which is also honored by SC (6 months total).

Partners' returns are extended separately.

A copy of each federal K-1 is required to be attached to Form SC1065. Partners with income or loss must file a tax return regardless

of tax liability. See Schedule SC-K for instructions on information to be furnished to partners.

INSTRUCTIONS - Schedule SC-K

This schedule is continued primarily as a worksheet to make South Carolina adjustments to federal Schedule K items and to show the

amount of these items that are apportioned or allocated to South Carolina. Column B additions to and subtractions from federal

taxable income include the same adjustments possible for an individual.

The items appearing at numbers 1 through 7 on the federal Schedule K are generally classified as business related using South

Carolina apportionment and allocation rules. If the Partnership has multi-state operations, these items are subject to apportionment

using the same (apportionment) ratio as determined on lines 5 through 9 of page 1, form SC1065. See exceptions in instructions to

line 3, page 1, form SC1065.

Column (E) shows the Column (C) items after application of the apportionment and allocation rules. The amounts in Column (E) are

taxable by the state of South Carolina.

NON-REFUNDABLE TAX CREDITS

Enter non-refundable credits on SC1040TC and attach to this return. Non-refundable credits are distributed to partners in proportion to

ownership interest. See tax credit forms for instructions and limitations. Attach appropriate tax credit schedules to your return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3