Form Sc1065 - Instructions Sheet For South Carolina Partnership Return Page 3

ADVERTISEMENT

INFORMATION TO BE FURNISHED TO PARTNERS

Partners who are residents of South Carolina must be provided with the total amount of their proportionate share of the following

items:

(1) South Carolina adjustments from Schedule SC-K Column (B) plus

(2) Schedule SC-K Column (D) amounts that are allocated or apportioned to states other than South Carolina.

This total amount would be the respective partner's "partnership modification" to federal taxable income to arrive at South Carolina

taxable income.

.

Partners who are nonresidents of South Carolina must be provided with their share of the Schedule SC-K Column (E) items. These

amounts are reportable to the state of South Carolina.

Note: The total of lines 1 through 7 of Schedule SC-K, Column (E) should equal the amount shown on line 10 of page 1, form SC1065.

Partnerships receiving passive activity income and losses pursuant to Internal Revenue Code Section 469, from investments located

within and without South Carolina, must furnish partners with detail for proper reporting of these amounts. Similar information must be

furnished to partners who did not materially participate in the trade or business of a partnership with multi-state operations. Such

partners may have nondeductible passive losses which cannot offset interest and other business related portfolio income apportioned

to South Carolina.

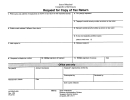

SCHEDULE W-H: WITHHOLDING ON INCOME OF PARTNERS WHO ARE NONRESIDENTS OF SOUTH CAROLINA

Partnerships are required annually to withhold 5% (percent) of the South Carolina taxable income of partners who are nonresidents of

South Carolina. Complete Schedule W-H to compute the withholding. (Note: Any South Carolina real estate gain subject to buyer

withholding is not subject to this withholding.) The income tax withheld must be paid to the South Carolina Department of Revenue

along with filing form SC1065 by the fifteenth day of the fourth month following taxable year end of the partnership. By this same

date, the partnership MUST provide nonresident partners a federal form 1099-MISC with "SC only" written at the top, showing

respective amounts of income and tax withheld. Along with filing form SC1065 and payment of tax, the partnership must attach a

schedule disclosing the name, address, tax identification number, SC taxable income and tax withheld for each nonresident partner.

For tiered or layered partnerships income tax should be withheld only by the partnership with activities in South Carolina. Related

partnerships should attach a statement explaining the pass-through withholding and provide 1099s to their partners. Partnerships

requesting an extension of time to file form SC1065 must estimate SC taxable income of nonresidents and pay 5% withholding tax on

this amount along with filing form SC4868 (Request for Extension) by the 15th day of the fourth month following its taxable year end.

Each nonresident must attach a copy of his form 1099-MISC to his respective income tax return as verification for claiming credit for

this withholding.

A nonresident partner may provide the partnership with an affidavit (form I-309) agreeing that he is subject to the jurisdiction of the SC

Department of Revenue and the Courts of this State for purposes of determining and collecting SC tax, interest and penalties which

may be due. An affidavit form may be obtained from the SC Department of Revenue. The partnership should mail the affidavit(s)

separately to the SC Department of Revenue, Partnership Section, Columbia, SC 29214-0008. The partnership is not required to

withhold income tax on behalf of such partner. If an affidavit has previously been filed it should not be resubmitted. Partnerships that

report the income of their nonresident partners on a composite return are not required to withhold tax or file affidavits. See

Composite Filing.

COMPOSITE FILING

A composite return is one individual income tax return (SC1040) filed by a partnership which computes and reports the income and tax

of its nonresident partners. The return is due on or before April 15th following the partners' taxable year end and any tax due is paid

along with filing the return. Each participating nonresident partner's separate income tax is computed in the same manner as if the

partner were separately reporting income on a form SC1040. A schedule should be attached showing the separate computations.

The separate tax amounts are totaled and entered on the "tax" line of page 1, form SC1040. The tax due in connection with this return

is subject to declaration of estimated tax rules. See form SC1040ES and instructions. The heading of the composite return states the

name, address and federal EIN of the partnership, and must be signed by a general partner of the partnership. Corporate partners

and nonresident partners having SC taxable income from sources other than the partnership may not participate in this filing.

Partnerships requesting an extension for filing a composite return must estimate tax due and pay the tax along with filing the extension

(SC4868) on or before April 15th following the partners' taxable year end.

INTEREST AND PENALTIES

A taxpayer that fails to remit tax when due will be charged interest from the time the tax was due until paid in its entirety.

Penalties may be applied for late payment of tax and for late filing of returns. Penalties may also be applied for negligence

and for disregard of regulations.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3