Cancellation Of Homestead Deduction - Senior Citizen Tax Relief Form - Government Of The District Of Columbia

ADVERTISEMENT

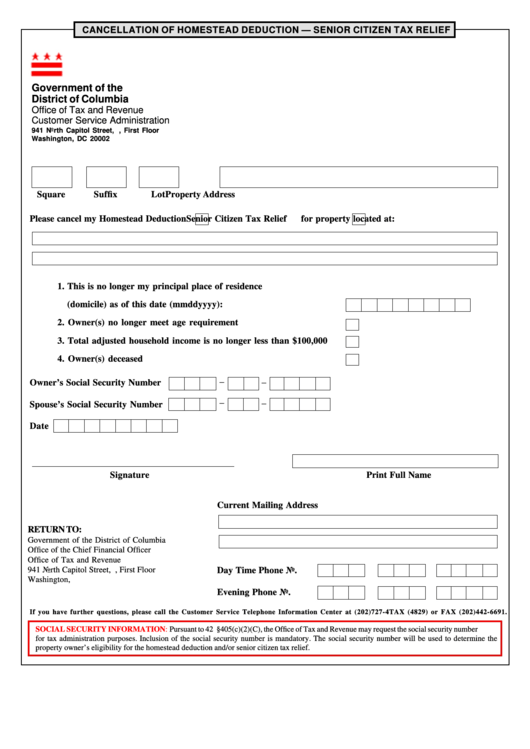

CANCELLATION OF HOMESTEAD DEDUCTION — SENIOR CITIZEN TAX RELIEF

Government of the

District of Columbia

Office of Tax and Revenue

Customer Service Administration

941 North Capitol Street, N.E., First Floor

Washington, DC 20002

Square

Suffix

Lot

Property Address

Please cancel my Homestead Deduction

Senior Citizen Tax Relief

for property located at:

1. This is no longer my principal place of residence

(domicile) as of this date (mmddyyyy):

2. Owner(s) no longer meet age requirement

3. Total adjusted household income is no longer less than $100,000

4. Owner(s) deceased

_

_

Owner’s Social Security Number

_

_

Spouse’s Social Security Number

Date

Signature

Print Full Name

Current Mailing Address

RETURN TO:

Government of the District of Columbia

Office of the Chief Financial Officer

Office of Tax and Revenue

941 North Capitol Street, N.E., First Floor

Day Time Phone No.

Washington, D.C. 20002

Evening Phone No.

If you have further questions, please call the Customer Service Telephone Information Center at (202)727-4TAX (4829) or FAX (202)442-6691.

SOCIAL SECURITY INFORMATION:

Pursuant to 42 U.S.C. §405(c)(2)(C), the Office of Tax and Revenue may request the social security number

for tax administration purposes. Inclusion of the social security number is mandatory. The social security number will be used to determine the

property owner’s eligibility for the homestead deduction and/or senior citizen tax relief.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1