Homestead And Senior Citizen Tax Benefit Appeal Application - Government Of The District Of Columbia

ADVERTISEMENT

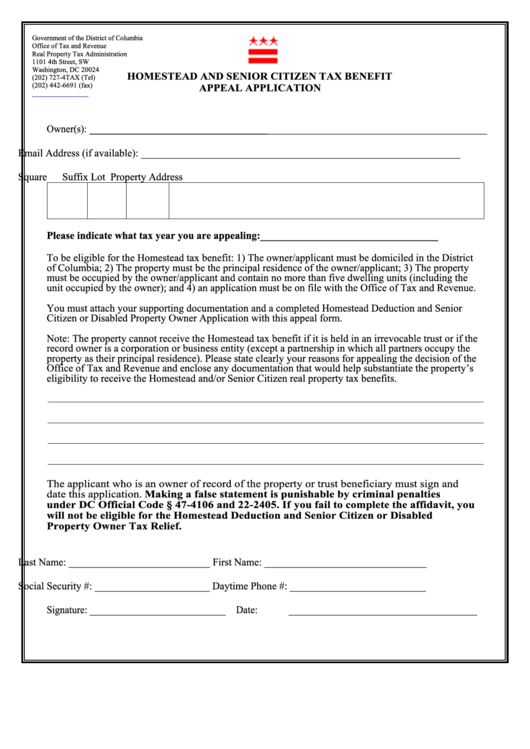

Government of the District of Columbia

Office of Tax and Revenue

Real Property Tax Administration

1101 4th Street, SW

Washington, DC 20024

HOMESTEAD AND SENIOR CITIZEN TAX BENEFIT

(202) 727-4TAX (Tel)

(202) 442-6691 (fax)

APPEAL APPLICATION

homestead@dc.gov

Owner(s): ____________________________________________________________________________

Email Address (if available): _____________________________________________________________

Square

Suffix

Lot

Property Address

Please indicate what tax year you are appealing: __________________________________

To be eligible for the Homestead tax benefit: 1) The owner/applicant must be domiciled in the District

of Columbia; 2) The property must be the principal residence of the owner/applicant; 3) The property

must be occupied by the owner/applicant and contain no more than five dwelling units (including the

unit occupied by the owner); and 4) an application must be on file with the Office of Tax and Revenue.

You must attach your supporting documentation and a completed Homestead Deduction and Senior

Citizen or Disabled Property Owner Application with this appeal form.

Note: The property cannot receive the Homestead tax benefit if it is held in an irrevocable trust or if the

record owner is a corporation or business entity (except a partnership in which all partners occupy the

property as their principal residence). Please state clearly your reasons for appealing the decision of the

Office of Tax and Revenue and enclose any documentation that would help substantiate the property’s

eligibility to receive the Homestead and/or Senior Citizen real property tax benefits.

The applicant who is an owner of record of the property or trust beneficiary must sign and

date this application. Making a false statement is punishable by criminal penalties

under DC Official Code § 47-4106 and 22-2405. If you fail to complete the affidavit, you

will not be eligible for the Homestead Deduction and Senior Citizen or Disabled

Property Owner Tax Relief.

Last Name: ___________________________

First Name: _______________________________

Social Security #: ______________________

Daytime Phone #: __________________________

Signature: __________________________

Date: ____________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1