Atf Form 487-B - Application And Permit To Ship Liquors And Articles Of Puerto Rican Manufacture Taxpaid To The United States Page 2

ADVERTISEMENT

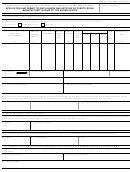

PART V - CERTIFICATE OF DISTRICT DIRECTOR OF CUSTOMS AT PORT OF ARRIVAL IN UNITED STATES

I hereby certify that the Iiquors or articles described in Part I were received and have been inspected and released as follows:

19. DATE

20. PORT OF

—

22A. Identify separately the quantity lost from each container and the serial number of each container.

CONTAINER SERIAL NUMBER

22. Lost by breakage or otherwise during

transportation to the United States:

—

.

.

23. INSPECTOR OF CUSTOMS

24. DISTRICT DIRECTOR OF CUSTOMS

INSTRUCTIONS

1. GENERAL. The shipper shall prepare this form in sextuplet

Rico, and return two copies to the shipper. (When the shipment

for each consignment. A separate ATF Form 487-B is required

covers packages of distilled spirits, the shipper shall next make

for each product covered by an approved formula. Forms shall

application for distilled spirits stamps, and affix such stamps, as

provided in 27 CFR Part 250.) The shipper shall then submit the

be serially numbered beginning with “1” each calendar year, and

running consecutively thereafter to the end of the year. The

two copies to the District Director of Customs in Puerto Rico

at least six hours prior to the intended lading of the merchandise.

serial number shall be prefixed by the last two digits of the cal-

endar year, e.g., “74-1.“

5. PART IV. The District Director of Customs in Puerto Rico,

on release of the merchandise for shipment, shall execute his

2. PART I. The shipper shall prepare Part I. Where the shipment

certificate in Part IV on all copies, retain one copy for his files,

covers wine, enter the tax class of the wine in column 2(h) and

mail the original to the director of customs at the port of arrival

disregard column 2(i). Where the shipment covers beer, modify

in the United States, dispatch a second copy to said District

the heading of column 2(g) to read “barrels” and enter quantity

Director on the vessel concerned for the guidance of the inspector

in barrels; disregard columns 2(h) and 2(i). After executing his

who will handle the cargo, and return two copies to the shipper.

application in Part 1, the shipper shall deliver all copies of the

After the shipment has been cleared, the shipper shall retain one

form to the Internal Revenue Agent.

copy of the form and send one copy, with other shipping docu-

ments, to the District Director of Customs at the port of arrival.

3, PART II. After executing his certificate in Part II, the ln-

ternal Revenue Agent shall forward all copies of the form to the

Secretary of the Treasury of Puerto Rico.

6.

PART V. The District Director of Customs at the port of arrival

in the United States, after executing his certificate on all copies of

4. PART Ill. After executing his permit to ship on all copies

the form received by him, shall retain the original for his files, and

of the form, the Secretary shall retain one copy, send the original

forward the two remaining copies to the Chief, Puerto Rican

and two copies to the District Director of Customs in Puerto

Operations, ATF, in Puerto Rico.

PAPERWORK REDUCTION ACT NOTICE

This request is in accordance with Section 3507, Public Law 96-511, December 11, 1980. The information collection documents transactions of taxable

commodities on which tax has not been paid. ATF uses the information to determine that the transaction is in accordance with laws and regulations and

establish the person responsible for the tax involved in the transaction. Information requested is mandatory by statute (26 USC 5314 and 7652).

,

ATF FORM 487-B (5170.7) (3-87)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2