Form 72-415 - Application For Permit To Remit Sales And Use Tax Directly To The State Tax Commission - 1999

ADVERTISEMENT

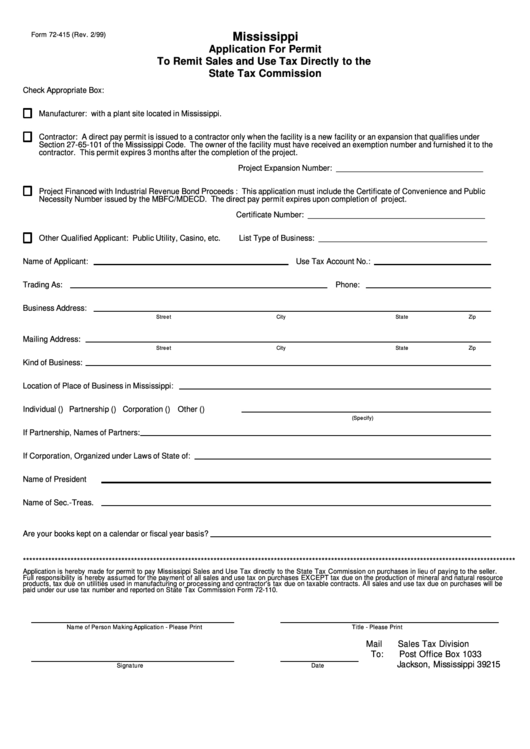

Form 72-415 (Rev. 2/99)

Mississippi

Application For Permit

To Remit Sales and Use Tax Directly to the

State Tax Commission

Check Appropriate Box:

Manufacturer: with a plant site located in Mississippi.

Contractor: A direct pay permit is issued to a contractor only when the facility is a new facility or an expansion that qualifies under

Section 27-65-101 of the Mississippi Code. The owner of the facility must have received an exemption number and furnished it to the

contractor. This permit expires 3 months after the completion of the project.

Project Expansion Number: __________________________________

Project Financed with Industrial Revenue Bond Proceeds : This application must include the Certificate of Convenience and Public

Necessity Number issued by the MBFC/MDECD. The direct pay permit expires upon completion of project.

Certificate Number: _________________________________________

Other Qualified Applicant: Public Utility, Casino, etc.

List Type of Business: _______________________________________

Name of Applicant:

Use Tax Account No.:

Trading As:

Phone:

Business Address:

Street

City

State

Zip

Mailing Address:

Street

City

State

Zip

Kind of Business:

Location of Place of Business in Mississippi:

Individual (

) Partnership (

) Corporation ( ) Other (

)

(Specify)

If Partnership, Names of Partners:

If Corporation, Organized under Laws of State of:

Name of President

Name of Sec.-Treas.

Are your books kept on a calendar or fiscal year basis?

***********************************************************************************************************************************************************

Application is hereby made for permit to pay Mississippi Sales and Use Tax directly to the State Tax Commission on purchases in lieu of paying to the seller.

Full responsibility is hereby assumed for the payment of all sales and use tax on purchases EXCEPT tax due on the production of mineral and natural resource

products, tax due on utilities used in manufacturing or processing and contractor's tax due on taxable contracts. All sales and use tax due on purchases will be

paid under our use tax number and reported on State Tax Commission Form 72-110.

Na me of Pe rson Ma king Applicatio n - Plea se Print

Title - Plea se Print

Mail

Sales Tax Division

To:

Post Office Box 1033

Jackson, Mississippi 39215

Signa ture

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1