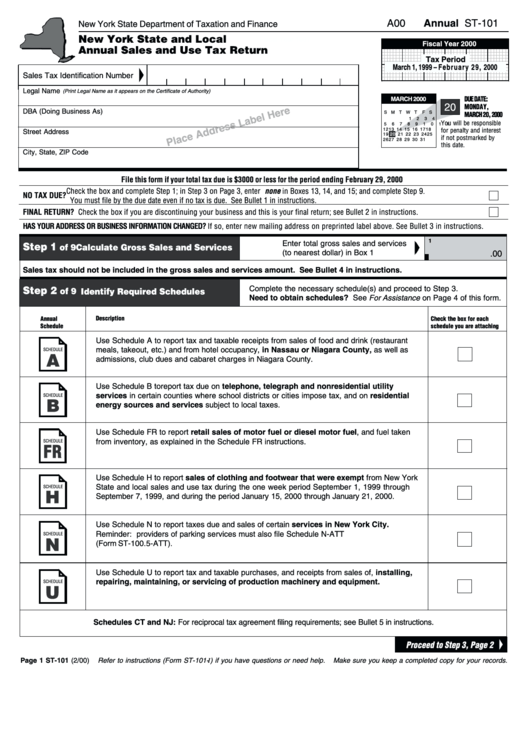

Form St-101 - Annual Sales And Use Tax Return - 2000

ADVERTISEMENT

A00

Annual

ST-101

New York State Department of Taxation and Finance

New York State and Local

Fiscal Year 1997

Fiscal Year 2000

Annual Sales and Use Tax Return

Tax Period

March 1, 1999 – February 29, 2000

Sales Tax Identification Number

June 1998

Legal Name

(Print Legal Name as it appears on the Certificate of Authority)

DUE DATE:

MARCH 2000

20

MONDAY,

DBA (Doing Business As)

S M

T W

T

F S

MARCH 20, 2000

1

2

3 4

You will be responsible

5

6

7

8

9 10 11

12 13 14 15 16 17 18

for penalty and interest

Street Address

19

20

21 22 23 24 25

if not postmarked by

26 27 28 29 30 31

this date.

City, State, ZIP Code

File this form if your total tax due is $3000 or less for the period ending February 29, 2000

Check the box and complete Step 1; in Step 3 on Page 3, enter none in Boxes 13, 14, and 15; and complete Step 9.

NO TAX DUE?

You must file by the due date even if no tax is due. See Bullet 1 in instructions.

FINAL RETURN? Check the box if you are discontinuing your business and this is your final return; see Bullet 2 in instructions.

HAS YOUR ADDRESS OR BUSINESS INFORMATION CHANGED? If so, enter new mailing address on preprinted label above. See Bullet 3 in instructions.

1

Enter total gross sales and services

Step 1

of 9 Calculate Gross Sales and Services

(to nearest dollar) in Box 1

.00

Sales tax should not be included in the gross sales and services amount. See Bullet 4 in instructions.

Complete the necessary schedule(s) and proceed to Step 3.

Step 2

of 9

Identify Required Schedules

Need to obtain schedules? See For Assistance on Page 4 of this form.

Description

Annual

Check the box for each

Schedule

schedule you are attaching

Use Schedule A to report tax and taxable receipts from sales of food and drink (restaurant

meals, takeout, etc.) and from hotel occupancy, in Nassau or Niagara County, as well as

SCHEDULE

A

admissions, club dues and cabaret charges in Niagara County.

Use Schedule B to report tax due on telephone, telegraph and nonresidential utility

services in certain counties where school districts or cities impose tax, and on residential

SCHEDULE

B

energy sources and services subject to local taxes.

Use Schedule FR to report retail sales of motor fuel or diesel motor fuel, and fuel taken

from inventory, as explained in the Schedule FR instructions.

SCHEDULE

FR

Use Schedule H to report sales of clothing and footwear that were exempt from New York

State and local sales and use tax during the one week period September 1, 1999 through

SCHEDULE

H

September 7, 1999, and during the period January 15, 2000 through January 21, 2000.

Use Schedule N to report taxes due and sales of certain services in New York City.

Reminder: providers of parking services must also file Schedule N-ATT

SCHEDULE

N

(Form ST-100.5-ATT).

Use Schedule U to report tax and taxable purchases, and receipts from sales of, installing,

repairing, maintaining, or servicing of production machinery and equipment.

SCHEDULE

U

Schedules CT and NJ: For reciprocal tax agreement filing requirements; see Bullet 5 in instructions.

Proceed to Step 3, Page 2

Page 1 ST-101 (2/00)

Refer to instructions (Form ST-101- I ) if you have questions or need help .

Make sure you keep a completed copy for your records.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4