Form T-204r-Annual - Sales And Use Tax Return - Annual Reconciliation - 2011

ADVERTISEMENT

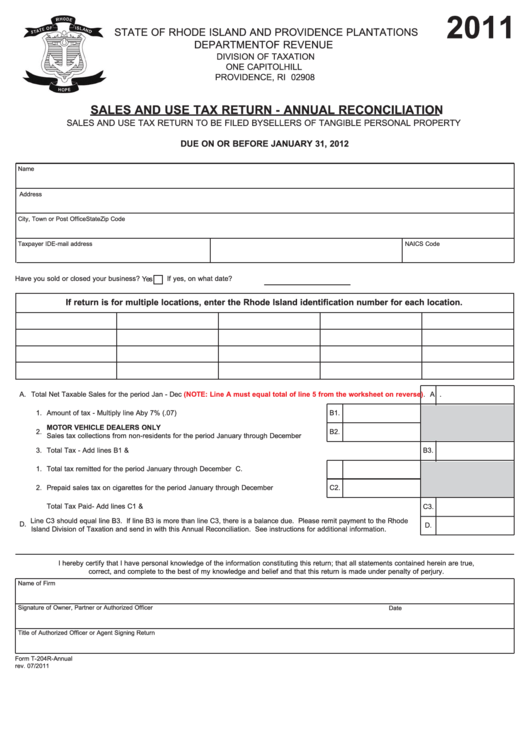

2011

STATE OF RHODE ISLAND AND PROVIDENCE PLANTATIONS

DEPARTMENT OF REVENUE

DIVISION OF TAXATION

ONE CAPITOL HILL

PROVIDENCE, RI 02908

SALES AND USE TAX RETURN - ANNUAL RECONCILIATION

SALES AND USE TAX RETURN TO BE FILED BY SELLERS OF TANGIBLE PERSONAL PROPERTY

DUE ON OR BEFORE JANUARY 31, 2012

Name

Address

City, Town or Post Office

State

Zip Code

Taxpayer ID

E-mail address

NAICS Code

Have you sold or closed your business?.......

If yes, on what date?

Yes

If return is for multiple locations, enter the Rhode Island identification number for each location.

A.

Total Net Taxable Sales for the period Jan - Dec

(NOTE: Line A must equal total of line 5 from the worksheet on

reverse). A.

B.

1.

Amount of tax - Multiply line A by 7% (.07)..............................................................................

B1.

MOTOR VEHICLE DEALERS ONLY

2.

B2.

Sales tax collections from non-residents for the period January through December .............

3.

Total Tax - Add lines B1 & B2..................................................................................................................................................

B3.

C.

1.

Total tax remitted for the period January through December ................................................. C1.

2.

Prepaid sales tax on cigarettes for the period January through December ...........................

C2.

3.

Total Tax Paid- Add lines C1 & C2...........................................................................................................................................

C3.

D. Line C3 should equal line B3. If line B3 is more than line C3, there is a balance due. Please remit payment to the Rhode

D.

Island Division of Taxation and send in with this Annual Reconciliation. See instructions for additional information. ..................

I hereby certify that I have personal knowledge of the information constituting this return; that all statements contained herein are true,

correct, and complete to the best of my knowledge and belief and that this return is made under penalty of perjury.

Name of Firm

Signature of Owner, Partner or Authorized Officer

Date

Title of Authorized Officer or Agent Signing Return

Form T-204R-Annual

rev. 07/2011

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3