Form 20 Final - Oregon Corporation Excise Tax Return - 2001 Page 3

ADVERTISEMENT

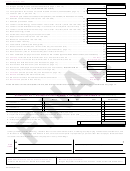

SCHEDULE AP — APPORTIONMENT OF INCOME

(See instructions, pages 18 and 19)

Describe the nature and location(s) of your Oregon business activities

(Do not enter an amount of less than zero)

SCHEDULE AP-1 — APPORTIONMENT FORMULA

1. Property Factor

(A)

(B)

(C)

Value of real and tangible personal property used

Total

Total Within

Percent Within

in the unitary business (owned, at average value;

Within

and Without

Oregon

rented, at capitalized value):

(A ÷ B) × 100

Oregon

Oregon

a. Owned property (at original cost; see instructions)

Inventories ..............................................................

Buildings and other depreciable assets ..................

Land ........................................................................

Other assets (describe) ____________________

(

)

(

)

Minus: Construction in progress .............................

Total of section a ....................................................

b. Rented property

........

(capitalize at 8 times the rental paid)

•

•

%

c. Total owned and rented property ............................

(not less than zero)

2. Payroll Factor

Wages, salaries, commissions, and other

compensation to employees:

a. Compensation of officers ........................................

b. Other wages, salaries, and commissions ...............

•

•

%

c. Total wages and salaries ........................................

(not less than zero)

3. Sales Factor

a. Sales delivered or shipped to Oregon purchasers:

(1) Shipped from outside Oregon ..........................

(2) Shipped from inside Oregon .............................

b. Sales shipped from Oregon to:

•

(1) The United States government .........................

(2) Purchasers in a state or country

•

where the corporation is not taxable

(e.g., under Public Law 86-272) .......................

c. Other business receipts ..........................................

•

•

%

d. Total sales and other business receipts .................

%

4. Sales factor (same as line 3d) ...................................

%

5. Total percent (add items 1c, 2c, 3d, and 4, within column C) ......................................................................

6. Average percent (divide line 5 by the number of factors in column B) (enter on Schedule AP-2, line 5)

•

_ _ _ . _ _ _ _

%

(compute percent to 4 decimal places [e.g., 12.34558 should be 12.3456%]) ............................................

SCHEDULE AP-2 — COMPUTATION OF TAXABLE INCOME

(See instructions, page 19)

1. Net income from business both in Oregon and other states

...... 1

(from Form 20, line 13, or Form 20-I, line 15)

•

2. Minus: Net nonbusiness income included in line 1. Attach schedule ....................................................... 2

•

3. Minus: Gains from prior year installment sales included in line 1. Attach schedule ................................. 3

4. Total net income subject to apportionment (line 1 minus line 2 and line 3) ................................................ 4

×

%

5. Oregon apportionment percentage (from Schedule AP-1, line 6) .............................................................. 5

6. Income apportioned to Oregon (line 5 times line 4) ................................................................................... 6

•

7. Add: Net nonbusiness income allocated entirely to Oregon. Attach schedule ......................................... 7

•

8. Add: Gain from prior year installment sales apportioned to Oregon. Attach schedule ............................ 8

9. Total of lines 6, 7, and 8 ............................................................................................................................. 9

•

10. Minus: (a) Oregon apportioned net loss from prior years $ ___________________, and .................... 10

(b) net capital loss from other years (see instructions for Form 20, line 14) $ ______________,

from tax year __________________.

11.

Oregon taxable income

(line 9 minus line 10) (carry to Form 20, line 15, or Form 20-I, line 16) ........... 11

150-102-020 (Rev. 9-01)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4