Individual Income Tax Return - City Of Sidney - 2014

ADVERTISEMENT

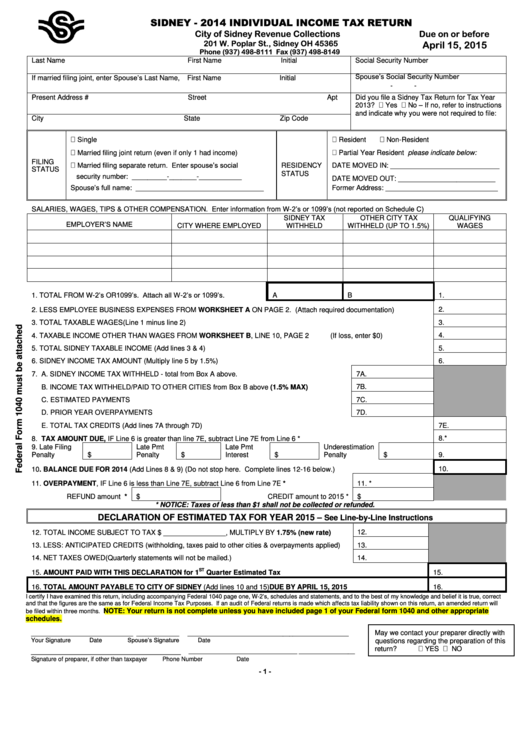

SIDNEY - 2014 INDIVIDUAL INCOME TAX RETURN

City of Sidney Revenue Collections

Due on or before

201 W. Poplar St., Sidney OH 45365

April 15, 2015

Phone (937) 498-8111 Fax (937) 498-8149

Last Name

First Name

Initial

Social Security Number

If married filing joint, enter Spouse’s Last Name,

Spouse’s Social Security Number

First Name

Initial

-

-

Present Address #

Street

Apt

Did you file a Sidney Tax Return for Tax Year

2013? Yes No – If no, refer to instructions

and indicate why you were not required to file:

City

State

Zip Code

Single

Resident

Non-Resident

Married filing joint return (even if only 1 had income)

Partial Year Resident please indicate below:

FILING

Married filing separate return. Enter spouse’s social

RESIDENCY

DATE MOVED IN: ____________________________

STATUS

STATUS

security number: _________-_______-___________

DATE MOVED OUT: _________________________

Spouse’s full name: _________________________________

Former Address: _____________________________

SALARIES, WAGES, TIPS & OTHER COMPENSATION. Enter information from W-2’s or 1099’s (not reported on Schedule C)

SIDNEY TAX

OTHER CITY TAX

QUALIFYING

EMPLOYER’S NAME

CITY WHERE EMPLOYED

WITHHELD

WITHHELD (UP TO 1.5%)

WAGES

1. TOTAL FROM W-2’s OR 1099’s. Attach all W-2’s or 1099’s.

A

B

1.

2. LESS EMPLOYEE BUSINESS EXPENSES FROM WORKSHEET A ON PAGE 2. (Attach required documentation)

2.

3. TOTAL TAXABLE WAGES (Line 1 minus line 2)

3.

4. TAXABLE INCOME OTHER THAN WAGES FROM WORKSHEET B, LINE 10, PAGE 2

(If loss, enter $0)

4.

5. TOTAL SIDNEY TAXABLE INCOME (Add lines 3 & 4)

5.

6. SIDNEY INCOME TAX AMOUNT (Multiply line 5 by 1.5%)

6.

7. A. SIDNEY INCOME TAX WITHHELD - total from Box A above.

7A.

B. INCOME TAX WITHHELD/PAID TO OTHER CITIES from Box B above (1.5% MAX)

7B.

C. ESTIMATED PAYMENTS

7C.

D. PRIOR YEAR OVERPAYMENTS

7D.

E. TOTAL TAX CREDITS (Add lines 7A through 7D)

7E.

8. TAX AMOUNT DUE, IF Line 6 is greater than line 7E, subtract Line 7E from Line 6 *

8.*

9. Late Filing

Late Pmt

Late Pmt

Underestimation

Penalty

$

Penalty

$

Interest

$

Penalty

$

9.

10. BALANCE DUE FOR 2014 (Add Lines 8 & 9) (Do not stop here. Complete lines 12-16 below.)

10.

11. OVERPAYMENT, IF Line 6 is less than Line 7E, subtract Line 6 from Line 7E *

11. *

REFUND amount *

$

CREDIT amount to 2015 *

$

* NOTICE: Taxes of less than $1 shall not be collected or refunded.

DECLARATION OF ESTIMATED TAX FOR YEAR 2015 –

See Line-by-Line Instructions

12. TOTAL INCOME SUBJECT TO TAX $ ________________, MULTIPLY BY 1.75% (new rate)

12.

13. LESS: ANTICIPATED CREDITS (withholding, taxes paid to other cities & overpayments applied)

13.

14. NET TAXES OWED (Quarterly statements will not be mailed.)

14.

ST

15. AMOUNT PAID WITH THIS DECLARATION for 1

Quarter Estimated Tax

15.

16. TOTAL AMOUNT PAYABLE TO CITY OF SIDNEY (Add lines 10 and 15) DUE BY APRIL 15, 2015

16.

I certify I have examined this return, including accompanying Federal 1040 page one, W-2’s, schedules and statements, and to the best of my knowledge and belief it is true, correct

and that the figures are the same as for Federal Income Tax Purposes. If an audit of Federal returns is made which affects tax liability shown on this return, an amended return will

NOTE: Your return is not complete unless you have included page 1 of your Federal form 1040 and other appropriate

be filed within three months.

schedules.

May we contact your preparer directly with

_______________________________ _____________

________________________________ _________________

Spouse’s Signature

Your Signature

Date

Date

questions regarding the preparation of this

YES NO

__________________________

return?

_________________________________ _________________

Signature of preparer, if other than taxpayer

Phone Number

Date

- 1 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2