Seller'S Residency Certification/exemption Instructions

ADVERTISEMENT

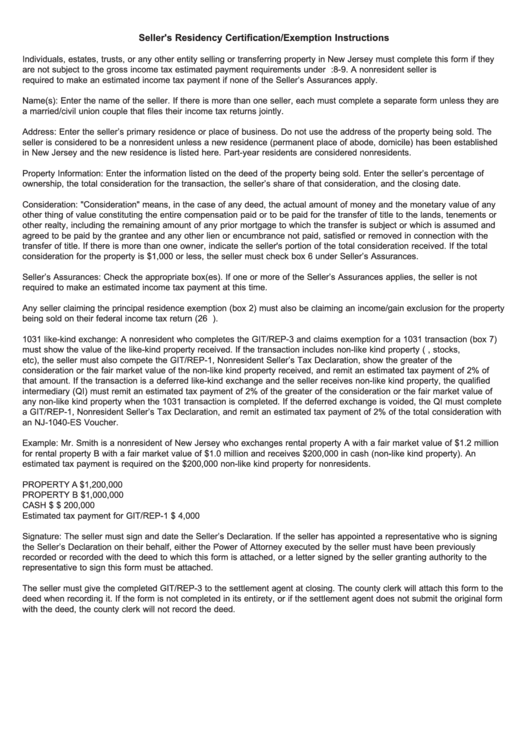

Seller's Residency Certification/Exemption Instructions

Individuals, estates, trusts, or any other entity selling or transferring property in New Jersey must complete this form if they

are not subject to the gross income tax estimated payment requirements under N.J.S.A. 54A:8-9. A nonresident seller is

required to make an estimated income tax payment if none of the Seller’s Assurances apply.

Name(s): Enter the name of the seller. If there is more than one seller, each must complete a separate form unless they are

a married/civil union couple that files their income tax returns jointly.

Address: Enter the seller’s primary residence or place of business. Do not use the address of the property being sold. The

seller is considered to be a nonresident unless a new residence (permanent place of abode, domicile) has been established

in New Jersey and the new residence is listed here. Part-year residents are considered nonresidents.

Property Information: Enter the information listed on the deed of the property being sold. Enter the seller’s percentage of

ownership, the total consideration for the transaction, the seller’s share of that consideration, and the closing date.

Consideration: "Consideration" means, in the case of any deed, the actual amount of money and the monetary value of any

other thing of value constituting the entire compensation paid or to be paid for the transfer of title to the lands, tenements or

other realty, including the remaining amount of any prior mortgage to which the transfer is subject or which is assumed and

agreed to be paid by the grantee and any other lien or encumbrance not paid, satisfied or removed in connection with the

transfer of title. If there is more than one owner, indicate the seller's portion of the total consideration received. If the total

consideration for the property is $1,000 or less, the seller must check box 6 under Seller’s Assurances.

Seller’s Assurances: Check the appropriate box(es). If one or more of the Seller’s Assurances applies, the seller is not

required to make an estimated income tax payment at this time.

Any seller claiming the principal residence exemption (box 2) must also be claiming an income/gain exclusion for the property

being sold on their federal income tax return (26 U.S. Code section 121).

1031 like-kind exchange: A nonresident who completes the GIT/REP-3 and claims exemption for a 1031 transaction (box 7)

must show the value of the like-kind property received. If the transaction includes non-like kind property (i.e. money, stocks,

etc), the seller must also compete the GIT/REP-1, Nonresident Seller’s Tax Declaration, show the greater of the

consideration or the fair market value of the non-like kind property received, and remit an estimated tax payment of 2% of

that amount. If the transaction is a deferred like-kind exchange and the seller receives non-like kind property, the qualified

intermediary (QI) must remit an estimated tax payment of 2% of the greater of the consideration or the fair market value of

any non-like kind property when the 1031 transaction is completed. If the deferred exchange is voided, the QI must complete

a GIT/REP-1, Nonresident Seller’s Tax Declaration, and remit an estimated tax payment of 2% of the total consideration with

an NJ-1040-ES Voucher.

Example: Mr. Smith is a nonresident of New Jersey who exchanges rental property A with a fair market value of $1.2 million

for rental property B with a fair market value of $1.0 million and receives $200,000 in cash (non-like kind property). An

estimated tax payment is required on the $200,000 non-like kind property for nonresidents.

PROPERTY A

$1,200,000

PROPERTY B

$1,000,000

CASH $

$ 200,000

Estimated tax payment for GIT/REP-1

$ 4,000

Signature: The seller must sign and date the Seller’s Declaration. If the seller has appointed a representative who is signing

the Seller’s Declaration on their behalf, either the Power of Attorney executed by the seller must have been previously

recorded or recorded with the deed to which this form is attached, or a letter signed by the seller granting authority to the

representative to sign this form must be attached.

The seller must give the completed GIT/REP-3 to the settlement agent at closing. The county clerk will attach this form to the

deed when recording it. If the form is not completed in its entirety, or if the settlement agent does not submit the original form

with the deed, the county clerk will not record the deed.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1