Seller'S Residency Affidavit - Rhode Island Division Of Taxation

ADVERTISEMENT

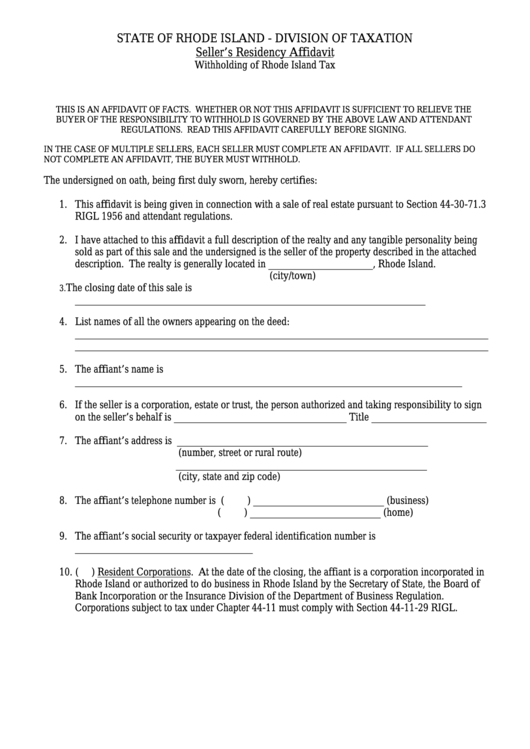

STATE OF RHODE ISLAND - DIVISION OF TAXATION

Seller’s Residency Affidavit

Withholding of Rhode Island Tax

R.I. General Laws 44-30-71.3

THIS IS AN AFFIDAVIT OF FACTS. WHETHER OR NOT THIS AFFIDAVIT IS SUFFICIENT TO RELIEVE THE

BUYER OF THE RESPONSIBILITY TO WITHHOLD IS GOVERNED BY THE ABOVE LAW AND ATTENDANT

REGULATIONS. READ THIS AFFIDAVIT CAREFULLY BEFORE SIGNING.

IN THE CASE OF MULTIPLE SELLERS, EACH SELLER MUST COMPLETE AN AFFIDAVIT. IF ALL SELLERS DO

NOT COMPLETE AN AFFIDAVIT, THE BUYER MUST WITHHOLD.

The undersigned on oath, being first duly sworn, hereby certifies:

1. This affidavit is being given in connection with a sale of real estate pursuant to Section 44-30-71.3

RIGL 1956 and attendant regulations.

2. I have attached to this affidavit a full description of the realty and any tangible personality being

sold as part of this sale and the undersigned is the seller of the property described in the attached

description. The realty is generally located in ____________________, Rhode Island.

(city/town)

The closing date of this sale is

3.

___________________________________________________________________

4. List names of all the owners appearing on the deed:

_______________________________________________________________________________

_______________________________________________________________________________

5. The affiant’s name is

__________________________________________________________________________

6. If the seller is a corporation, estate or trust, the person authorized and taking responsibility to sign

on the seller’s behalf is _________________________________ Title ______________________

7. The affiant’s address is ________________________________________________

(number, street or rural route)

________________________________________________

(city, state and zip code)

8. The affiant’s telephone number is (

) _________________________ (business)

(

) _________________________ (home)

9. The affiant’s social security or taxpayer federal identification number is

__________________________________

10. (

) Resident Corporations. At the date of the closing, the affiant is a corporation incorporated in

Rhode Island or authorized to do business in Rhode Island by the Secretary of State, the Board of

Bank Incorporation or the Insurance Division of the Department of Business Regulation.

Corporations subject to tax under Chapter 44-11 must comply with Section 44-11-29 RIGL.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2