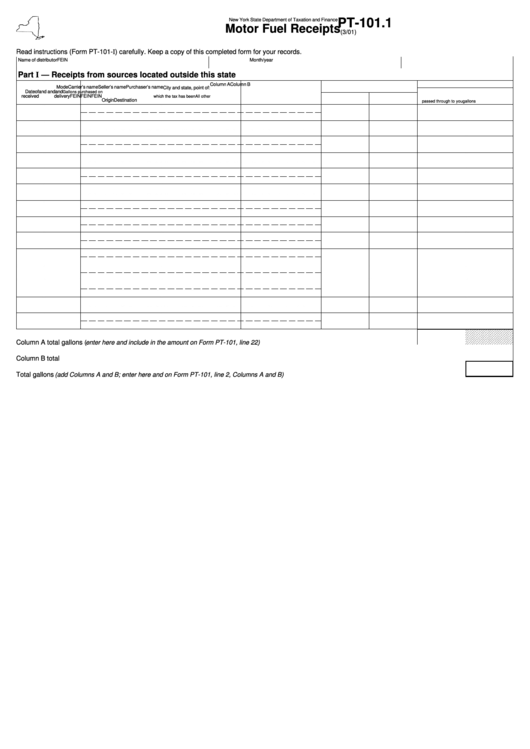

Form Pt-101.1 - Motor Fuel Receipts

ADVERTISEMENT

New York State Department of Taxation and Finance

PT-101.1

Motor Fuel Receipts

(3/01)

Read instructions (Form PT-101-I) carefully. Keep a copy of this completed form for your records.

Name of distributor

FEIN

Month/year

Part I — Receipts from sources located outside this state

Column A

Column B

Mode

Carrier’s name

Seller’s name

Purchaser’s name

City and state, point of:

Date

of

and

and

and

Gallons purchased on

received

delivery

FEIN

FEIN

FEIN

which the tax has been

All other

Origin

Destination

passed through to you

gallons

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

Column A total gallons

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

( enter here and include in the amount on Form PT-101, line 22) ....................................................................................

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

Column B total gallons ...........................................................................................................................................................................................................

Total gallons (add Columns A and B; enter here and on Form PT-101, line 2, Columns A and B)

....................................................................................................

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2