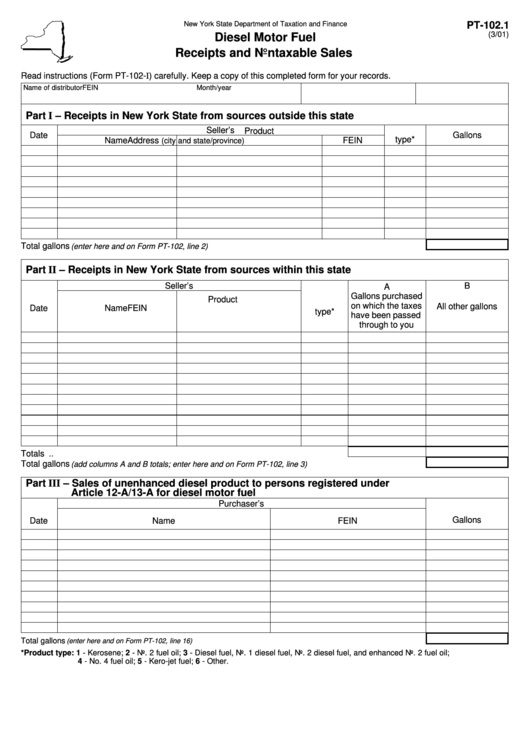

Form Pt -102.1 - Diesel Motor Fuel Receipts And Nontaxable Sales

ADVERTISEMENT

New York State Department of Taxation and Finance

PT-102.1

(3/01)

Diesel Motor Fuel

Receipts and Nontaxable Sales

Read instructions (Form PT-102-I) carefully. Keep a copy of this completed form for your records.

Name of distributor

FEIN

Month/year

Part I – Receipts in New York State from sources outside this state

Seller’s

Product

Date

Gallons

type*

Name

Address

FEIN

(city and state/province)

Total gallons

......................................................................................

(enter here and on Form PT-102, line 2)

Part II – Receipts in New York State from sources within this state

Seller’s

B

A

Gallons purchased

Product

on which the taxes

All other gallons

Date

Name

FEIN

type*

have been passed

through to you

Totals ...........................................................................................................................

Total gallons

.............................................

(add columns A and B totals; enter here and on Form PT-102, line 3)

Part III – Sales of unenhanced diesel product to persons registered under

Article 12-A/13-A for diesel motor fuel

Purchaser’s

Gallons

Date

Name

FEIN

Total gallons

(enter here and on Form PT-102, line 16) .......................................................................................................................

*Product type: 1 - Kerosene; 2 - No. 2 fuel oil; 3 - Diesel fuel, No. 1 diesel fuel, No. 2 diesel fuel, and enhanced No. 2 fuel oil;

4 - No. 4 fuel oil; 5 - Kero-jet fuel; 6 - Other.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2