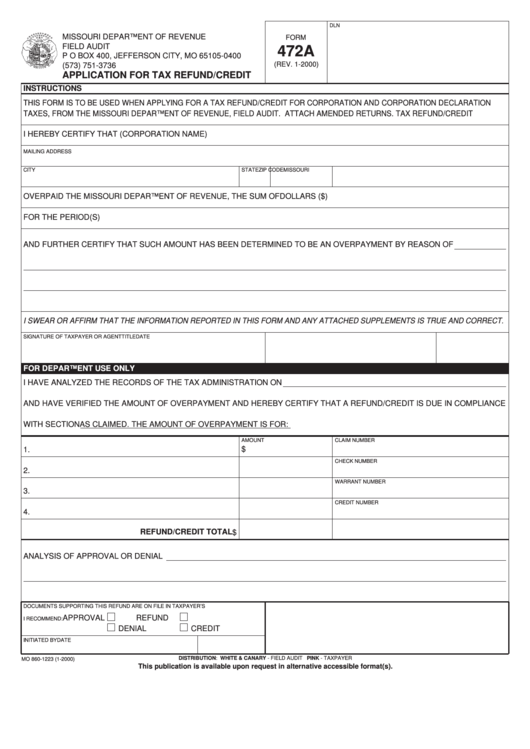

Form 472a - Application For Tax Refund/credit

ADVERTISEMENT

DLN

MISSOURI DEPARTMENT OF REVENUE

FORM

FIELD AUDIT

472A

P O BOX 400, JEFFERSON CITY, MO 65105-0400

(REV. 1-2000)

(573) 751-3736

APPLICATION FOR TAX REFUND/CREDIT

INSTRUCTIONS

THIS FORM IS TO BE USED WHEN APPLYING FOR A TAX REFUND/CREDIT FOR CORPORATION AND CORPORATION DECLARATION

TAXES, FROM THE MISSOURI DEPARTMENT OF REVENUE, FIELD AUDIT. ATTACH AMENDED RETURNS. TAX REFUND/CREDIT

I HEREBY CERTIFY THAT (CORPORATION NAME)

MAILING ADDRESS

CITY

STATE

ZIP CODE

MISSOURI I.D. NUMBER

OVERPAID THE MISSOURI DEPARTMENT OF REVENUE, THE SUM OF

DOLLARS ($

)

FOR THE PERIOD(S)

AND FURTHER CERTIFY THAT SUCH AMOUNT HAS BEEN DETERMINED TO BE AN OVERPAYMENT BY REASON OF

I SWEAR OR AFFIRM THAT THE INFORMATION REPORTED IN THIS FORM AND ANY ATTACHED SUPPLEMENTS IS TRUE AND CORRECT.

SIGNATURE OF TAXPAYER OR AGENT

TITLE

DATE

FOR DEPARTMENT USE ONLY

I HAVE ANALYZED THE RECORDS OF THE TAX ADMINISTRATION ON

AND HAVE VERIFIED THE AMOUNT OF OVERPAYMENT AND HEREBY CERTIFY THAT A REFUND/CREDIT IS DUE IN COMPLIANCE

WITH SECTION

AS CLAIMED. THE AMOUNT OF OVERPAYMENT IS FOR:

AMOUNT

CLAIM NUMBER

$

1.

CHECK NUMBER

2.

WARRANT NUMBER

3.

CREDIT NUMBER

4.

REFUND/CREDIT TOTAL

$

ANALYSIS OF APPROVAL OR DENIAL

DOCUMENTS SUPPORTING THIS REFUND ARE ON FILE IN TAXPAYER’S FOLDER.

GENERAL APPROVAL/DENIAL

APPROVAL

REFUND

I RECOMMEND:

DENIAL

CREDIT

INITIATED BY

DATE

DISTRIBUTION: WHITE & CANARY - FIELD AUDIT PINK - TAXPAYER

MO 860-1223 (1-2000)

This publication is available upon request in alternative accessible format(s).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1