Declaration Of Estimated 2010 Bowling Green Income Tax Form

ADVERTISEMENT

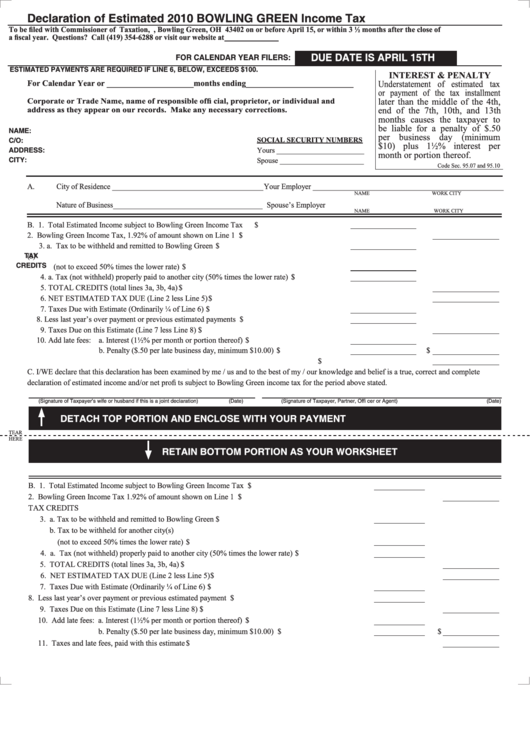

Declaration of Estimated 2010 BOWLING GREEN Income Tax

To be fi led with Commissioner of Taxation, P.O. Box 189, Bowling Green, OH 43402 on or before April 15, or within 3 ½ months after the close of

a fi scal year. Questions? Call (419) 354-6288 or visit our website at

DUE DATE IS APRIL 15TH

FOR CALENDAR YEAR FILERS:

ESTIMATED PAYMENTS ARE REQUIRED IF LINE 6, BELOW, EXCEEDS $100.

INTEREST & PENALTY

For Calendar Year or _____________________months ending__________________________

Understatement of estimated tax

or payment of the tax installment

Corporate or Trade Name, name of responsible offi cial, proprietor, or individual and

later than the middle of the 4th,

address as they appear on our records. Make any necessary corrections.

end of the 7th, 10th, and 13th

months causes the taxpayer to

be liable for a penalty of $.50

NAME:

per business day (minimum

SOCIAL SECURITY NUMBERS

C/O:

$10) plus 1½% interest per

ADDRESS:

Yours ________________________

month or portion thereof.

CITY:

Spouse _______________________

Code Sec. 95.07 and 95.10

A.

City of Residence ________________________________________Your Employer __________________________________________________

NAME

WORK CITY

Nature of Business________________________________________ Spouse’s Employer

NAME

WORK CITY

B. 1. Total Estimated Income subject to Bowling Green Income Tax

...............................................$

2. Bowling Green Income Tax, 1.92% of amount shown on Line 1 ...........................................................................................$

3. a. Tax to be withheld and remitted to Bowling Green ................................................................. $

TAX

b.Tax to be withheld for another city(s)

CREDITS

(not to exceed 50% times the lower rate) .................................................................................. $

4. a. Tax (not withheld) properly paid to another city (50% times the lower rate) ...........................$

5. TOTAL CREDITS (total lines 3a, 3b, 4a) ...............................................................................................................................$

6. NET ESTIMATED TAX DUE (Line 2 less Line 5) ................................................................................................................$

7. Taxes Due with Estimate (Ordinarily ¼ of Line 6) ..................................................................... $

8. Less last year’s over payment or previous estimated payments .................................................. $

9. Taxes Due on this Estimate (Line 7 less Line 8) ..................................................................................................................... $

10. Add late fees: a. Interest (1½% per month or portion thereof) ............................................... $

b. Penalty ($.50 per late business day, minimum $10.00) ................................ $

$

11.Taxes and late fees. Payment to the City of Bowling Green must accompany this form ...................................................... $

C. I/WE declare that this declaration has been examined by me / us and to the best of my / our knowledge and belief is a true, correct and complete

declaration of estimated income and/or net profi ts subject to Bowling Green income tax for the period above stated.

(Signature of Taxpayer’s wife or husband if this is a joint declaration)

(Date)

(Signature of Taxpayer, Partner, Offi cer or Agent)

(Date)

DETACH TOP PORTION AND ENCLOSE WITH YOUR PAYMENT

TEAR

HERE

RETAIN BOTTOM PORTION AS YOUR WORKSHEET

B. 1. Total Estimated Income subject to Bowling Green Income Tax ...............................................................$

2. Bowling Green Income Tax 1.92% of amount shown on Line 1 ................................................................................................ $

TAX CREDITS

3. a. Tax to be withheld and remitted to Bowling Green ...............................................................................$

b. Tax to be withheld for another city(s)

(not to exceed 50% times the lower rate) ..............................................................................................$

4. a. Tax (not withheld) properly paid to another city (50% times the lower rate) ......................................$

5. TOTAL CREDITS (total lines 3a, 3b, 4a) ...................................................................................................................................$

6. NET ESTIMATED TAX DUE (Line 2 less Line 5) ...................................................................................................................$

7. Taxes Due with Estimate (Ordinarily ¼ of Line 6) ...................................................................................$

8. Less last year’s over payment or previous estimated payment .................................................................$

9. Taxes Due on this Estimate (Line 7 less Line 8) ...........................................................................................................................$

10. Add late fees: a. Interest (1½% per month or portion thereof) .............................................................$

b. Penalty ($.50 per late business day, minimum $10.00) ...............................................$

$

11. Taxes and late fees, paid with this estimate ................................................................................................................................$

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1