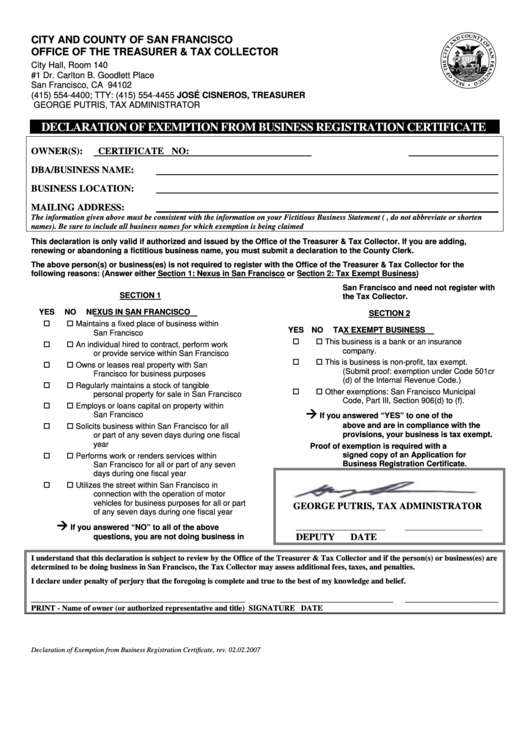

Declaration Of Exemption From Business Registration Certificate - City Of County Of Can Francisco

ADVERTISEMENT

CITY AND COUNTY OF SAN FRANCISCO

OFFICE OF THE TREASURER & TAX COLLECTOR

City Hall, Room 140

#1 Dr. Carlton B. Goodlett Place

San Francisco, CA 94102

(415) 554-4400; TTY: (415) 554-4455

JOSÉ CISNEROS, TREASURER

GEORGE PUTRIS, TAX ADMINISTRATOR

DECLARATION OF EXEMPTION FROM BUSINESS REGISTRATION CERTIFICATE

OWNER(S):

CERTIFICATE NO:

DBA/BUSINESS NAME:

BUSINESS LOCATION:

MAILING ADDRESS:

The information given above must be consistent with the information on your Fictitious Business Statement (i.e., do not abbreviate or shorten

names). Be sure to include all business names for which exemption is being claimed

This declaration is only valid if authorized and issued by the Office of the Treasurer & Tax Collector. If you are adding,

renewing or abandoning a fictitious business name, you must submit a declaration to the County Clerk.

The above person(s) or business(es) is not required to register with the Office of the Treasurer & Tax Collector for the

following reasons: (Answer either Section 1: Nexus in San Francisco or Section 2: Tax Exempt Business)

San Francisco and need not register with

SECTION 1

the Tax Collector.

YES

NO

NEXUS IN SAN FRANCISCO

SECTION 2

Maintains a fixed place of business within

YES

NO

TAX EXEMPT BUSINESS

San Francisco

This business is a bank or an insurance

An individual hired to contract, perform work

company.

or provide service within San Francisco

This is business is non-profit, tax exempt.

Owns or leases real property with San

(Submit proof: exemption under Code 501cr

Francisco for business purposes

(d) of the Internal Revenue Code.)

Regularly maintains a stock of tangible

Other exemptions: San Francisco Municipal

personal property for sale in San Francisco

Code, Part III, Section 906(d) to (f).

Employs or loans capital on property within

San Francisco

If you answered “YES” to one of the

above and are in compliance with the

Solicits business within San Francisco for all

provisions, your business is tax exempt.

or part of any seven days during one fiscal

year

Proof of exemption is required with a

signed copy of an Application for

Performs work or renders services within

Business Registration Certificate.

San Francisco for all or part of any seven

days during one fiscal year

Utilizes the street within San Francisco in

connection with the operation of motor

vehicles for business purposes for all or part

GEORGE PUTRIS, TAX ADMINISTRATOR

of any seven days during one fiscal year

If you answered “NO” to all of the above

DEPUTY

DATE

questions, you are not doing business in

I understand that this declaration is subject to review by the Office of the Treasurer & Tax Collector and if the person(s) or business(es) are

determined to be doing business in San Francisco, the Tax Collector may assess additional fees, taxes, and penalties.

I declare under penalty of perjury that the foregoing is complete and true to the best of my knowledge and belief.

_______________________________________________________

_____________________________

________________________

PRINT - Name of owner (or authorized representative and title)

SIGNATURE

DATE

Declaration of Exemption from Business Registration Certificate, rev. 02.02.2007

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1