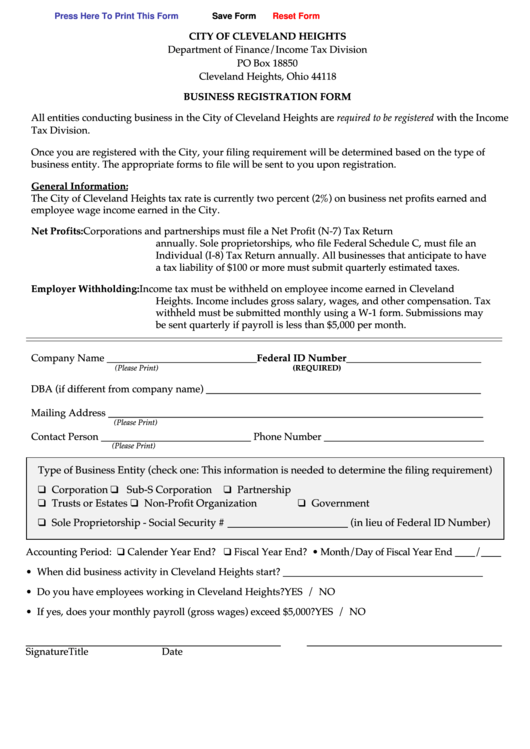

Press Here To Print This Form

Save Form

Reset Form

CITY OF CLEVELAND HEIGHTS

Department of Finance/Income Tax Division

PO Box 18850

Cleveland Heights, Ohio 44118

BUSINESS REGISTRATION FORM

All entities conducting business in the City of Cleveland Heights are required to be registered with the Income

Tax Division.

Once you are registered with the City, your filing requirement will be determined based on the type of

business entity. The appropriate forms to file will be sent to you upon registration.

General Information:

The City of Cleveland Heights tax rate is currently two percent (2%) on business net profits earned and

employee wage income earned in the City.

Net Profits:

Corporations and partnerships must file a Net Profit (N-7) Tax Return

annually. Sole proprietorships, who file Federal Schedule C, must file an

Individual (I-8) Tax Return annually. All businesses that anticipate to have

a tax liability of $100 or more must submit quarterly estimated taxes.

Employer Withholding:

Income tax must be withheld on employee income earned in Cleveland

Heights. Income includes gross salary, wages, and other compensation. Tax

withheld must be submitted monthly using a W-1 form. Submissions may

be sent quarterly if payroll is less than $5,000 per month.

Company Name ______________________________Federal ID Number___________________________

(Please Print)

(REQUIRED)

DBA (if different from company name) _______________________________________________________

Mailing Address ___________________________________________________________________________

(Please Print)

Contact Person ______________________________ Phone Number ________________________________

(Please Print)

Type of Business Entity (check one: This information is needed to determine the filing requirement)

Corporation

Sub-S Corporation

Partnership

Trusts or Estates

Non-Profit Organization

Government

Sole Proprietorship - Social Security # _______________________ (in lieu of Federal ID Number)

Accounting Period:

Calender Year End?

Fiscal Year End? • Month/Day of Fiscal Year End ____/____

• When did business activity in Cleveland Heights start? ________________________________________

• Do you have employees working in Cleveland Heights?

YES / NO

• If yes, does your monthly payroll (gross wages) exceed $5,000?

YES / NO

___________________________________________________

_______________________________________

Signature

Title

Date

1

1