Instructions Form For Preparing The Ground Transportation Tax Return

ADVERTISEMENT

II

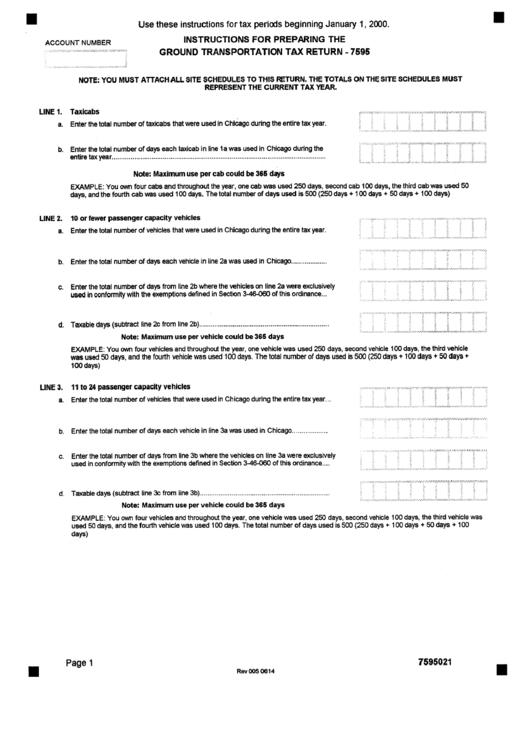

Use these instructions for tax periods beginning January 1, 2000.

ACCOUNT NUMBER

INSTRUCTIONS FOR PREPARING THE

............................................................................................

GROUND TRANSPORTATION TAX RETURN - 7595

NOTE:

YOU MUST ATTACH ALL SITE SCHEDULES TO THIS RETURN. THE TOTALS ON THE SITE SCHEDULES MUST

REPRESENT THE CURRENT TAX YEAR.

II

LINE 1.

a.

b.

LINE 2.

a.

Taxicabs

Enter the total number of taxicabs that were used in chicago during the entire tax year.

Enter the total number of days each taxicab in line l a was used in Chicago during the

entire tax year

..................................................................................................................

Note: Maximum use per cab could be 365 days

i ............. i ............. i ...............................................................

: ........................................ i

!; .......... ii ......... i .......................................................................................................................

EXAMPLE: You own four cabs and throughout the year, one cab was used 250 days, second cab 100 days, the third cab was used 50

days, and the fourth cab was used 100 days. The total number of days used is 500 (250 days + 100 days + 50 days + 100 days)

10 or fewer

passenger capacity vehicles

Enter the total number of vehicles that were used in Chicago during the entire tax year.

b.

Enter the total number of days each vehicle in line 2a was used in Chicago ...................

d.

LINE 3.

a.

Enter the total number of days from line 2b where the vehicles on line 2a were exclusively

used in conformity with the exemptions defined in Section 3-46-060 of this ordinance...

il . . . . . . . . ~ ! " "

! i " '

i ~ ¸ ¸ ' ' ' '

'i! ......

:'" '¸"

"':: "~'~""

: : " '~'

"':'

" ~ " "

'~

............

:

i ~ .......... ii ............. !~ ............ il ............. !i ............. i! ............. ii ............. ii ............. i! ............. i ............. i

..... ,...!i ............. i ............ i: ............. ii ............. zz ............. i! ............ ii .............. ~ ............. ~ ............. ii

..................... i i

............................................... i il

............ ........

Taxable

days (subtract line 2c from line 2b)

.....................................

................................

~

....... ~ . . . . . . . . . . . . .

~ .........

~ ............

~{ ...........

~ .............

~ .............

~{ .............

~ .............

~ .............

~{

Note:

Maximum use per vehicle could be 365 days

EXAMPLE: You own four vehicles and throughout the year, one vehicle was used 250 days, second vehicle 100 days, the third vehicle

was used 50 days, and the fourth vehicle was used 100 days. The total number of clays used is 500 (250 days + 100 days + 50 days +

100 days)

11 to 24

passenger capacity vehicles

Enter the total number of vehicles that were used in Chicago during the entire tax year...

b. Enter the total number of days each vehicle in line 3a was used in Chicago ...................

C.

il ......... ii ............ il ........ ~ ............ ~i ........... i ~ ............. !i ............. i ............. ii ............ il ............ !!

d.

Enter the total number of days from line 3b where the vehicles on line 3a were exclusively

used in conformity with the exemptions defined in Section 3-46-060 of this ordinance ....

Taxable days (subtract line 3c from line 3b) .....................................................................

: ............. : ............. ii ............. il ............. i ............. i ............. ii ............. il ............. ii ............. ;:i ............. ii

Note:

Maximum use per vehicle could be 365 days

EXAMPLE: You own four vehicles and throughout the year, one vehicle was used 250 days, second vehicle 1 O0 days, the third vehicle was

used 50 days, and the fourth vehicle was used 100 days. The total number of days used is 500 (250 days + 100 days + 50 days + 100

days)

Page I

7595021

B

Rev 005 0614

B

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2