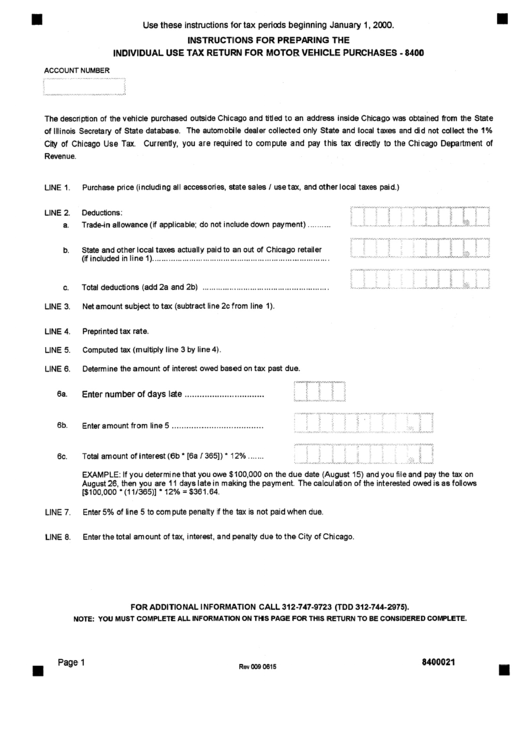

Instructions For Form 8400 Preparing The Individual Use Tax Return For Motor Vehicle Purchases

ADVERTISEMENT

B

ACCOUNTNUMBER

Use these instructions for tax periods beginning January 1,2000.

I N S T R U C T I O N S F O R P R E P A R I N G T H E

I N D I V I D U A L USE T A X R E T U R N F O R M O T O R V E H I C L E P U R C H A S E S - 8400

B

The description of the vehicle purchased outside Chicago and titled to an address inside Chicago was obtained fTom the State

of Illinois Secretary of State database. The automobile dealer collected only State and local taxes and did not collect the 1%

City of Chicago Use Tax.

Currentiy, you are required to compute and pay this tax directly to the Chicago Department of

Revenue.

LINE 1°

LINE 2.

a.

b.

Co

LINE 3.

Purchase price (including all accessories, state sales / usetax, and other local taxes paid.)

Deductions:

Trade-in allowance (if applicable; do not include down payment) ..........

State and other local taxes actually paid to an out of Chicago retailer

(if included in line 1) .............................................................................

i!' ~'•'":ii ............. i I ............. ii

....................................................................................................................

:.

:T

:.

i!:i:!:: i!

;i

.......................... ii ............. ii ............ ~i ....................................................................................

Total deductions (add 2a and 2b) ....................................................................

............................................. ~

...................................................................................

Net amount subject to tax (subtract line 2c from line 1).

LINE 4.

LINE 5.

LINE 6.

LINE 7.

Preprinted tax rate.

Computed tax (multiply line 3 by line 4).

Determine the amount of interest owed based on tax past due.

6a.

Enter

number

of days

late

................................

6b.

Enter amount from line 5 .....................................

! ............ ii ........... ii ......... Zi ............. ii .......... !i" "~ ........... i ~ ................... i Z .......... ii:~ii

:i

!

:i

i:

:, .-.w,,-.-.,.~......,-~,,.~.o.,,-. • ~.,...-,....-.-.........,.:.....~w,,,~.

~.~o..~..-,...., ~ ,,~ .., ~ .~,.,-,.............,.~.......,.

6c.

Total amount of interest (6b * [6a 1365]) * 12% .......

.......................... i i l

ii ii ii i l ....... ii i !

EXAMPLE: If you determine that you owe $100,000 on the due date (August 15) and you file and pay the tax on

August 26, then you are 11 days late in making the payment. The calculation of the interested owed is as follows

[$100,000 * (11/365)] * 12% = $361.64.

Enter 5% of line 5 to compute penalty if the tax is not paid when due.

LINE 8.

Enter the total amount of tax, interest, and penalty due to the City of Chicago.

FOR ADDITIONAL INFORMATION CALL 312-747-9723 (TDD 312-744-2975).

NOTE: YOU MUST COMPLETE ALL INFORMATION ON THIS PAGE FOR THIS RETURN TO BE CONSIDERED COMPLETE.

Page 1

8400021

B

Rev 009 0615

B

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1