Form R - Xenia City Income Tax - 2001

ADVERTISEMENT

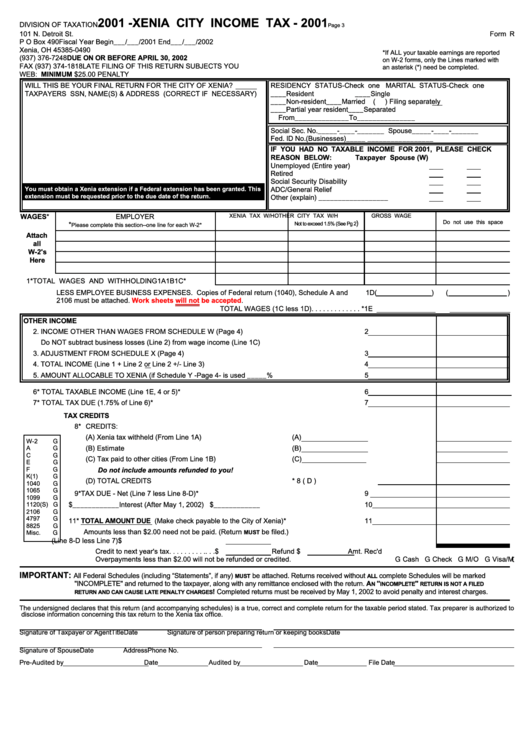

2001 - XENIA CITY INCOME TAX - 2001

DIVISION OF TAXATION

Page 3

101 N. Detroit St.

Form R

P O Box 490

Fiscal Year Begin___/___/2001 End___/___/2002

Xenia, OH 45385-0490

*If ALL your taxable earnings are reported

(937) 376-7248

DUE ON OR BEFORE APRIL 30, 2002

on W-2 forms, only the Lines marked with

FAX (937) 374-1818

LATE FILING OF THIS RETURN SUBJECTS YOU

an asterisk (*) need be completed.

WEB:

TO INTEREST AND A MINIMUM $25.00 PENALTY

WILL THIS BE YOUR FINAL RETURN FOR THE CITY OF XENIA?

RESIDENCY STATUS-Check one MARITAL STATUS-Check one

TAXPAYERS SSN, NAME(S) & ADDRESS (CORRECT IF NECESSARY)

____Resident

____Single

____Non-resident

____Married

(

) Filing separately

____Partial year resident

____Separated

From______________To_______________

Social Sec. No._____-____-_______ Spouse_____-____-_______

Fed. ID No.(Businesses)_____ _________________

IF YOU HAD NO TAXABLE INCOME FOR 2001, PLEASE CHECK

REASON BELOW:

Taxpayer Spouse (W)

Unemployed (Entire year) . . . . . . . . . . . . . . . . . .

Retired . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Social Security Disability . . . . . . . . . . . . . . . . . . .

You must obtain a Xenia extension if a Federal extension has been granted. This

ADC/General Relief . . . . . . . . . . . . . . . . . . . . . . .

extension must be requested prior to the due date of the return.

Other (explain) __________________ . . . . . . . .

WAGES*

EMPLOYER

XENIA TAX W/H

OTHER CITY TAX W/H

GROSS WAGE AMT.

TAX OFFICE USE ONLY

)

Do not use this space

*

Not to exceed 1.5% (See Pg 2

Please complete this section--one line for each W-2*

Attach

all

W-2's

Here

1*

TOTAL WAGES AND WITHHOLDING

1A

1B

1C*

LESS EMPLOYEE BUSINESS EXPENSES. Copies of Federal return (1040), Schedule A and

1D(

)

(

)

2106 must be attached.

Work sheets will not be

accepted.

TOTAL WAGES (1C less 1D). . . . . . . . . . . . . *1E

OTHER INCOME

2. INCOME OTHER THAN WAGES FROM SCHEDULE W (Page 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

Do NOT subtract business losses (Line 2) from wage income (Line 1C)

3. ADJUSTMENT FROM SCHEDULE X (Page 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

4. TOTAL INCOME (Line 1 + Line 2 or Line 2 +/- Line 3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

5. AMOUNT ALLOCABLE TO XENIA (if Schedule Y -Page 4- is used _____% . . . . . . . . . . . . . . . . . . . . . . .

5

6* TOTAL TAXABLE INCOME (Line 1E, 4 or 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . *

6

7* TOTAL TAX DUE (1.75% of Line 6) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . *

7

TAX CREDITS

8* CREDITS:

(A) Xenia tax withheld (From Line 1A) . . . . . . . . . . . . . . . . . . . . . .

(A)

W-2

G

(B) Estimate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(B)

A

G

C

G

(C) Tax paid to other cities (From Line 1B) . . . . . . . . . . . . . . . . . .

(C)

E

G

F

G

Do not include amounts refunded to you!

K(1)

G

(D) TOTAL CREDITS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . . . . . . . . *8(D)

1040

G

1065

G

9* TAX DUE - Net (Line 7 less Line 8-D) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . *

9

1099

G

10. Penalty $____________Interest (After May 1, 2002) $____________ . . . . . . . . . . . . . . .

10

1120(S) G

2106

G

4797

G

11* TOTAL AMOUNT DUE (Make check payable to the City of Xenia) . . . . . . . . . . . . . . . . . . *

11

8825

G

Amounts less than $2.00 need not be paid. (Return

be filed.)

MUST

Misc.

G

12. OVERPAYMENT (Line 8-D less Line 7) . . . . $

Credit to next year's tax. . . . . . . . . . . . . $

Refund $

Amt. Rec'd

Overpayments less than $2.00 will not be refunded or credited.

G Cash G Check G M/O G Visa/MC

IMPORTANT:

All Federal Schedules (including “Statements”, if any)

be attached. Returns received without

complete Schedules will be marked

MUST

ALL

"INCOMPLETE" and returned to the taxpayer, along with any remittance enclosed with the return. A

"

"

N

INCOMPLETE

RETURN IS NOT A FILED

! Completed returns must be received by May 1, 2002 to avoid penalty and interest charges.

RETURN AND CAN CAUSE LATE PENALTY CHARGES

The undersigned declares that this return (and accompanying schedules) is a true, correct and complete return for the taxable period stated. Tax preparer is authorized to

disclose information concerning this tax return to the Xenia tax office.

Signature of Taxpayer or Agent

Title

Date

Signature of person preparing return or keeping books

Date

Signature of Spouse

Date

Address

Phone No.

Pre-Audited by

Date

Audited by

Date

File Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2