Form R - Norwalk City Income Tax Return - 2004

ADVERTISEMENT

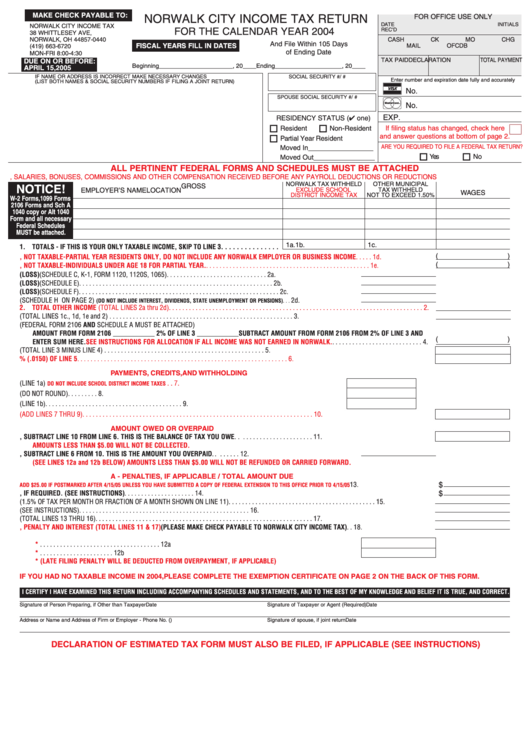

MAKE CHECK PAYABLE TO:

NORWALK CITY INCOME TAX RETURN

FOR OFFICE USE ONLY

DATE

INITIALS

NORWALK CITY INCOME TAX

FOR THE CALENDAR YEAR 2004

REC’D

38 WHITTLESEY AVE, P.O. BOX 440

NORWALK, OH 44857-0440

CASH

CK

MO

CHG

And File Within 105 Days

FISCAL YEARS FILL IN DATES

MAIL

OFC

DB

(419) 663-6720

of Ending Date

MON-FRI 8:00-4:30

TAX PAID

DECLARATION TOTAL PAYMENT

DUE ON OR BEFORE:

Beginning______________________, 20____

Ending____________________, 20____

APRIL 15, 2005

IF NAME OR ADDRESS IS INCORRECT MAKE NECESSARY CHANGES

SOCIAL SECURITY #/F.I.D. #

Enter number and expiration date fully and accurately

(LIST BOTH NAMES & SOCIAL SECURITY NUMBERS IF FILING A JOINT RETURN)

u

No.

SPOUSE SOCIAL SECURITY #/F.I.D. #

d

No.

EXP.

RESIDENCY STATUS (

one)

Resident

Non-Resident

If filing status has changed, check here

and answer questions at bottom of page 2.

Partial Year Resident

ARE YOU REQUIRED TO FILE A FEDERAL TAX RETURN?

Moved In_________________

Yes

No

Moved Out________________

ALL PERTINENT FEDERAL FORMS AND SCHEDULES MUST BE ATTACHED

1. ENTER GROSS WAGES, SALARIES, BONUSES, COMMISSIONS AND OTHER COMPENSATION RECEIVED BEFORE ANY PAYROLL DEDUCTIONS OR REDUCTIONS

NORWALK TAX WITHHELD

OTHER MUNICIPAL

GROSS

NOTICE!

EXCLUDE SCHOOL

TAX WITHHELD

EMPLOYER’S NAME

LOCATION

WAGES

DISTRICT INCOME TAX

NOT TO EXCEED 1.50%

W-2 Forms, 1099 Forms

2106 Forms and Sch A

1040 copy or Alt 1040

Form and all necessary

Federal Schedules

MUST be attached.

1a.

1b.

1c.

1.d

TOTALS - IF THIS IS YOUR ONLY TAXABLE INCOME, SKIP TO LINE 3. . . . . . . . . . . . . . .

(

)

1d. GROSS WAGES, NOT TAXABLE-PARTIAL YEAR RESIDENTS ONLY, DO NOT INCLUDE ANY NORWALK EMPLOYER OR BUSINESS INCOME . . . . . 1d.

(

)

1e. GROSS WAGES, NOT TAXABLE-INDIVIDUALS UNDER AGE 18 FOR PARTIAL YEAR.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1e.

2a. BUSINESS INCOME OR (LOSS) (SCHEDULE C, K-1, FORM 1120, 1120S, 1065) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2a.

2b. RENTAL INCOME OR (LOSS) (SCHEDULE E) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2b.

2c. FARM INCOME OR (LOSS) (SCHEDULE F) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2c.

2d. OTHER INCOME (SCHEDULE H ON PAGE 2)

2d.

(DO NOT INCLUDE INTEREST, DIVIDENDS, STATE UNEMPLOYMENT OR PENSIONS) . . .

2.d

TOTAL OTHER INCOME (TOTAL LINES 2a thru 2d) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.

3. TOTAL ADJUSTED NET NORWALK INCOME (TOTAL LINES 1c., 1d, 1e and 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.

4. UNREIMBURSED EMPLOYEE BUSINESS EXPENSES (FEDERAL FORM 2106 AND SCHEDULE A MUST BE ATTACHED)

AMOUNT FROM FORM 2106 ____________

2% OF LINE 3 ____________ SUBTRACT AMOUNT FROM FORM 2106 FROM 2% OF LINE 3 AND

(

)

ENTER SUM HERE.

SEE INSTRUCTIONS FOR ALLOCATION IF ALL INCOME WAS NOT EARNED IN NORWALK.

. . . . . . . . . . . . . . . . . . . . . . . . . . . 4.

5. TOTAL INCOME TAXABLE BY THE CITY OF NORWALK (TOTAL LINE 3 MINUS LINE 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5.

6. NORWALK CITY INCOME TAX LIABILITY 1.50% (.0150) OF LINE 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6.

PAYMENTS, CREDITS, AND WITHHOLDING

7. NORWALK CITY INCOME TAX WITHHELD FROM WAGES (LINE 1a)

7.

DO NOT INCLUDE SCHOOL DISTRICT INCOME TAXES . .

8. PAYMENTS MADE ON DECLARATION OF ESTIMATED NORWALK CITY INCOME TAX (DO NOT ROUND) . . . . . . . . . 8.

9. CREDIT FOR TAX PAID TO OTHER MUNICIPALITIES (LINE 1b) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9.

10. TOTAL PAYMENTS AND CREDITS (ADD LINES 7 THRU 9) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10.

AMOUNT OWED OR OVERPAID

11. IF LINE 6 IS GREATER THAN LINE 10, SUBTRACT LINE 10 FROM LINE 6. THIS IS THE BALANCE OF TAX YOU OWE. . . . . . . . . . . . . . . . . . . . . . . 11.

AMOUNTS LESS THAN $5.00 WILL NOT BE COLLECTED.

12. IF LINE 10 IS GREATER THAN LINE 6, SUBTRACT LINE 6 FROM 10. THIS IS THE AMOUNT YOU OVERPAID. . . . . . . . 12.

(SEE LINES 12a and 12b BELOW) AMOUNTS LESS THAN $5.00 WILL NOT BE REFUNDED OR CARRIED FORWARD.

A - PENALTIES, IF APPLICABLE / TOTAL AMOUNT DUE

13. LATE FILING PENALTY

13.

$

ADD $25.00 IF POSTMARKED AFTER 4/15/05 UNLESS YOU HAVE SUBMITTED A COPY OF FEDERAL EXTENSION TO THIS OFFICE PRIOR TO 4/15/05

14. PENALTY FOR FAILURE TO FILE DECLARATION OF ESTIMATED TAX FOR 2004, IF REQUIRED. (SEE INSTRUCTIONS) . . . . . . . . . . . . . . . . . . . . . 14.

$

15. INTEREST (1.5% OF TAX PER MONTH OR FRACTION OF A MONTH SHOWN ON LINE 11) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15.

16. INTEREST ON INSUFFICIENT ESTIMATED TAX PAYMENTS (SEE INSTRUCTIONS). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16.

17. TOTAL PENALTIES AND INTEREST (TOTAL LINES 13 THRU 16) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17.

18. TOTAL TAX LIABILITY, PENALTY AND INTEREST (TOTAL LINES 11 & 17)

(PLEASE MAKE CHECK PAYABLE TO NORWALK CITY INCOME TAX) . . 18.

*

12a. AMOUNT OF OVER-PAYMENT YOU WANT REFUNDED TO YOU . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12a

*

12b. AMOUNT OF OVER-PAYMENT YOU WANT CREDITED TO YOUR 2005 ESTIMATE . . . . . . . . . . . . . . . . . . . . . . 12b

* (LATE FILING PENALTY WILL BE DEDUCTED FROM OVERPAYMENT, IF APPLICABLE)

IF YOU HAD NO TAXABLE INCOME IN 2004, PLEASE COMPLETE THE EXEMPTION CERTIFICATE ON PAGE 2 ON THE BACK OF THIS FORM.

I CERTIFY I HAVE EXAMINED THIS RETURN INCLUDING ACCOMPANYING SCHEDULES AND STATEMENTS, AND TO THE BEST OF MY KNOWLEDGE AND BELIEF IT IS TRUE, AND CORRECT.

Signature of Person Preparing, if Other than Taxpayer

Date

Signature of Taxpayer or Agent (Required)

Date

Address or Name and Address of Firm or Employer - Phone No. (

)

Signature of spouse, if joint return

Date

DECLARATION OF ESTIMATED TAX FORM MUST ALSO BE FILED, IF APPLICABLE (SEE INSTRUCTIONS)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2