Business Tax Refund Application Form - Department Of Finance

ADVERTISEMENT

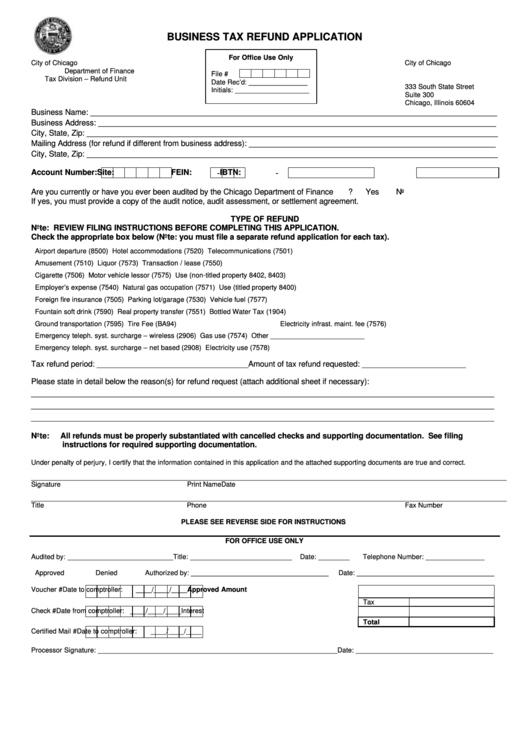

BUSINESS TAX REFUND APPLICATION

For Office Use Only

City of Chicago

City of Chicago

Department of Finance

File #

Tax Division – Refund Unit

Date Rec’d: _______________

333 South State Street

Initials: ___________________

Suite 300

Chicago, Illinois 60604

Business Name: ______________________________________________________________________________________________

Business Address: ____________________________________________________________________________________________

City, State, Zip: _______________________________________________________________________________________________

Mailing Address (for refund if different from business address): _________________________________________________________

City, State, Zip: _______________________________________________________________________________________________

Account Number:

Site:

FEIN:

IBTN:

-

-

Are you currently or have you ever been audited by the Chicago Department of Finance

?

Yes

No

If yes, you must provide a copy of the audit notice, audit assessment, or settlement agreement.

TYPE OF REFUND

Note: REVIEW FILING INSTRUCTIONS BEFORE COMPLETING THIS APPLICATION.

Check the appropriate box below (Note: you must file a separate refund application for each tax).

Airport departure (8500)

Hotel accommodations (7520)

Telecommunications (7501)

Amusement (7510)

Liquor (7573)

Transaction / lease (7550)

Cigarette (7506)

Motor vehicle lessor (7575)

Use (non-titled property 8402, 8403)

Employer’s expense (7540)

Natural gas occupation (7571)

Use (titled property 8400)

Foreign fire insurance (7505)

Parking lot/garage (7530)

Vehicle fuel (7577)

Fountain soft drink (7590)

Real property transfer (7551)

Bottled Water Tax (1904)

Ground transportation (7595)

Tire Fee (BA94)

Electricity infrast. maint. fee (7576)

Emergency teleph. syst. surcharge – wireless (2906)

Gas use (7574)

Other ________________________

Emergency teleph. syst. surcharge – net based (2908)

Electricity use (7578)

Tax refund period: ___________________________________

Amount of tax refund requested: ________________________

Please state in detail below the reason(s) for refund request (attach additional sheet if necessary):

___________________________________________________________________________________________________________

___________________________________________________________________________________________________________

___________________________________________________________________________________________________________

Note:

All refunds must be properly substantiated with cancelled checks and supporting documentation. See filing

instructions for required supporting documentation.

Under penalty of perjury, I certify that the information contained in this application and the attached supporting documents are true and correct.

_________________________________________________________________________________________________________________________

Signature

Print Name

Date

_________________________________________________________________________________________________________________________

Title

Phone

Fax Number

PLEASE SEE REVERSE SIDE FOR INSTRUCTIONS

FOR OFFICE USE ONLY

Audited by: ___________________________

Title: __________________________

Date: ________

Telephone Number: _______________

Approved

Denied

Authorized by: ___________________________________

Date: ___________________________________

Voucher #

Date to comptroller:

____/____/____

Approved Amount

Tax

Check #

Date from comptroller: ____/____/____

Interest

Total

Certified Mail #

Date to comptroller:

____/____/____

Processor Signature: _____________________________________________________________

Date: ___________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2