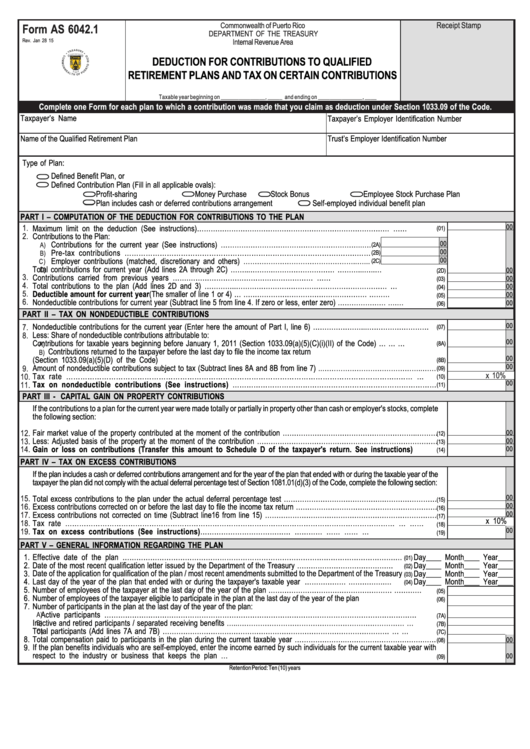

Form As 6042.1 - Deduction For Contributions To Qualified Retirement Plans And Tax On Certain Contributions - 2015

ADVERTISEMENT

Receipt Stamp

Commonwealth of Puerto Rico

Form AS 6042.1

DEPARTMENT OF THE TREASURY

Internal Revenue Area

Rev. Jan 28 15

DEDUCTION FOR CONTRIBUTIONS TO QUALIFIED

RETIREMENT PLANS AND TAX ON CERTAIN CONTRIBUTIONS

Taxable year beginning on _______________, _____ and ending on _______________, ____

Complete one Form for each plan to which a contribution was made that you claim as deduction under Section 1033.09 of the Code.

Taxpayer’s Name

Taxpayer’s Employer Identification Number

Name of the Qualified Retirement Plan

Trust’s Employer Identification Number

Type of Plan:

Defined Benefit Plan, or

Defined Contribution Plan (Fill in all applicable ovals):

Profit-sharing

Money Purchase

Stock Bonus

Employee Stock Purchase Plan

Plan includes cash or deferred contributions arrangement

Self-employed individual benefit plan

PART I – COMPUTATION OF THE DEDUCTION FOR CONTRIBUTIONS TO THE PLAN

00

1.

Maximum limit on the deduction (See instructions)………………………………………………………………………….................……

(01)

2.

Contributions to the Plan:

Contributions for the current year (See instructions) ……………………………………………………..….

00

A)

(2A)

00

Pre-tax contributions ……………………………………………………………………………….……..……

B)

(2B)

Employer contributions (matched, discretionary and others) …………………………………………..…...

00

C)

(2C)

Total contributions for current year (Add lines 2A through 2C) ……...……….………………………......................………...…..…

D)

00

(2D)

3.

Contributions carried from previous years …….……………………………………………….......................................................……

00

(03)

4.

Total contributions to the plan (Add lines 2D and 3) …………..…………………………………………………………......................…

00

(04)

5.

Deductible amount for current year (The smaller of line 1 or 4) …..........………………………………………………...............………

00

(05)

6.

Nondeductible contributions for current year (Subtract line 5 from line 4. If zero or less, enter zero) …………………..................….…

00

(06)

PART II – TAX ON NONDEDUCTIBLE CONTRIBUTIONS

00

Nondeductible contributions for the current year (Enter here the amount of Part I, line 6) …………………...………………………....

7.

(07)

8.

Less: Share of nondeductible contributions attributable to:

00

Contributions for taxable years beginning before January 1, 2011 (Section 1033.09(a)(5)(C)(i)(II) of the Code) ….......…....…

A)

(8A)

Contributions returned to the taxpayer before the last day to file the income tax return

B)

00

(Section 1033.09(a)(5)(D) of the Code) .....................................................................................................................................

(8B)

00

Amount of nondeductible contributions subject to tax (Subtract lines 8A and 8B from line 7) ..……………………………………..……

9.

(09)

x 10%

Tax rate …………………………………………………………………………………………………………………………..……........…

10.

(10)

00

Tax on nondeductible contributions (See instructions) ……………………………………………………………………………

11.

(11)

PART III - CAPITAL GAIN ON PROPERTY CONTRIBUTIONS

If the contributions to a plan for the current year were made totally or partially in property other than cash or employer's stocks, complete

the following section:

Fair market value of the property contributed at the moment of the contribution …………………………………………………..………

12.

00

(12)

13.

Less: Adjusted basis of the property at the moment of the contribution ……………………………………………….……………………

00

(13)

14.

Gain or loss on contributions (Transfer this amount to Schedule D of the taxpayer's return. See instructions) ...........

00

(14)

PART IV – TAX ON EXCESS CONTRIBUTIONS

If the plan includes a cash or deferred contributions arrangement and for the year of the plan that ended with or during the taxable year of the

taxpayer the plan did not comply with the actual deferral percentage test of Section 1081.01(d)(3) of the Code, complete the following section:

15.

Total excess contributions to the plan under the actual deferral percentage test …………………………………….……………………

00

(15)

00

16.

Excess contributions corrected on or before the last day to file the income tax return …………………………..…………………………

(16)

00

17.

Excess contributions not corrected on time (Subtract line16 from line 15) …………………………………………………………………

(17)

x 10%

18.

Tax rate ……………………………………………………………………………………………………………………………....…......……

(18)

00

19.

Tax on excess contributions (See instructions) ………………………………….....................…………....……..........……....…

(19)

...........................................................

PART V – GENERAL INFORMATION REGARDING THE PLAN

1.

Effective date of the plan ……………………………………………………………………………………………………….…

Day____ Month____ Year____

(01)

2.

Date of the most recent qualification letter issued by the Department of the Treasury …………………………………….....

Day____ Month____ Year____

(02)

3.

Date of the application for qualification of the plan / most recent amendments submitted to the Department of the Treasury

Day____ Month____ Year____

(03)

4.

Last day of the year of the plan that ended with or during the taxpayer's taxable year ……………….......…………….…

Day____ Month____ Year____

(04)

5.

Number of employees of the taxpayer at the last day of the year of the plan ……………………………………………….........…………

(05)

6.

Number of employees of the taxpayer eligible to participate in the plan at the last day of the year of the plan .......................................

(06)

7.

Number of participants in the plan at the last day of the year of the plan:

Active participants ……………………………………………………………………………………………………………………….......

A)

(7A)

Inactive and retired participants / separated receiving benefits …...………………………………………………………………......…

B)

(7B)

Total participants (Add lines 7A and 7B) ………………………………………………………………………………………....…......…

C)

(7C)

8.

Total compensation paid to participants in the plan during the current taxable year ………………….…………………………….……

00

(08)

9.

If the plan benefits individuals who are self-employed, enter the income earned by such individuals for the current taxable year with

respect to the industry or business that keeps the plan …..........................................................................................................

00

(09)

Retention Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2