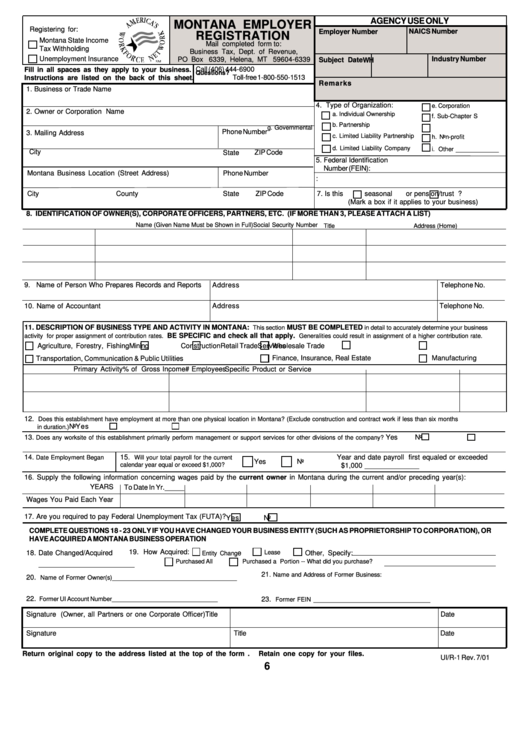

Form Ui/r-1 - Montana Employer Registration Form - 2001

ADVERTISEMENT

AGENCY USE ONLY

MONTANA EMPLOYER

Registering for:

Employer Number

NAICS Number

REGISTRATION

Montana State Income

Mail completed form to:

Tax Withholding

Business Tax, Dept. of Revenue,

Unemployment Insurance

Industry Number

PO Box 6339, Helena, MT 59604-6339

Subject Date

WH

Fill in all spaces as they apply to your business.

Call (406) 444-6900

Questions?

Instructions are listed on the back of this sheet.

Toll-free 1-800-550-1513

Remarks

1. Business or Trade Name

4. Type of Organization:

e. Corporation

2. Owner or Corporation Name

a. Individual Ownership

f. Sub-Chapter S

b. Partnership

g. Governmental

Phone Number

3. Mailing Address

c. Limited Liability Partnership

h. Non-profit

d. Limited Liability Company

___________

i. Other

City

ZIP Code

State

5. Federal Identification

Number (FEIN):

Montana Business Location (Street Address)

Phone Number

6. Date Incorporated:

City

County

State

ZIP Code

7. Is this

seasonal

or

pension/trust ?

(Mark a box if it applies to your business)

8. IDENTIFICATION OF OWNER(S), CORPORATE OFFICERS, PARTNERS, ETC. (IF MORE THAN 3, PLEASE ATTACH A LIST)

Social Security Number

Name (Given Name Must be Shown in Full)

Title

Address (Home)

9. Name of Person Who Prepares Records and Reports

Address

Telephone No.

10. Name of Accountant

Address

Telephone No.

11. DESCRIPTION OF BUSINESS TYPE AND ACTIVITY IN MONTANA:

MUST BE COMPLETED

This section

in detail to accurately determine your business

BE SPECIFIC and check all that apply.

activity for proper assignment of contribution rates.

Generalities could result in assignment of a higher contribution rate.

Agriculture, Forestry, Fishing

Mining

Construction

Wholesale Trade

Retail Trade

Services

Finance, Insurance, Real Estate

Manufacturing

Transportation, Communication & Public Utilities

Primary Activity

Specific Product or Service

% of Gross Income

# Employees

12.

Does this establishment have employment at more than one physical location in Montana? (Exclude construction and contract work if less than six months

Yes

No

in duration.)

13.

Yes

No

Does any worksite of this establishment primarily perform management or support services for other divisions of the company?

14.

15.

Year and date payroll first equaled or exceeded

Date Employment Began

Will your total payroll for the current

Yes

No

calendar year equal or exceed $1,000?

$1,000 ______________

16. Supply the following information concerning wages paid by the current owner in Montana during the current and/or preceding year(s):

YEARS

To Date In Yr._____

Wages You Paid Each Year

17. Are you required to pay Federal Unemployment Tax (FUTA)?

Yes

No

COMPLETE QUESTIONS 18 - 23 ONLY IF YOU HAVE CHANGED YOUR BUSINESS ENTITY (SUCH AS PROPRIETORSHIP TO CORPORATION), OR

HAVE ACQUIRED A MONTANA BUSINESS OPERATION

19. How Acquired:

18. Date Changed/Acquired

Lease

e

Other, Specify:

Entity Chang

Purchased All

Purchased a Portion -- What did you purchase?

21.

Name and Address of Former Business:

20.

________________________________

Name of Former Owner(s)

22.

23.

______________________________

Former UI Account Number_______________________________

Former FEIN

Signature (Owner, all Partners or one Corporate Officer)

Title

Date

Signature

Title

Date

Return original copy to the address listed at the top of the form .

Retain one copy for your files.

UI/R-1 Rev. 7/01

6

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1