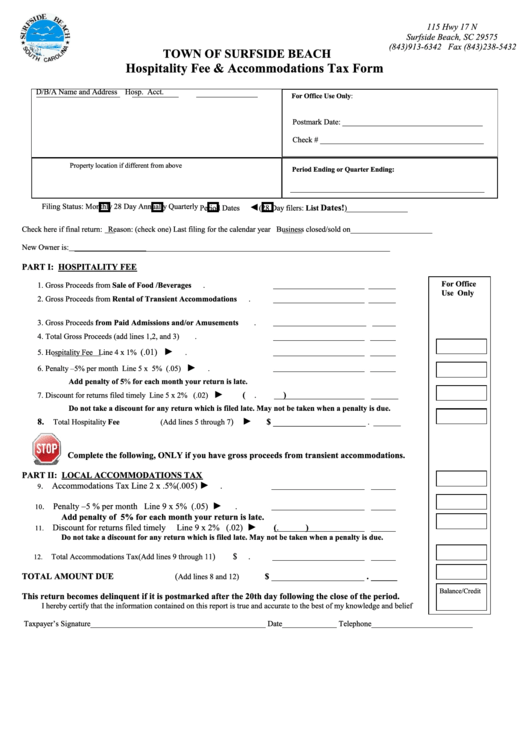

Hospitality Fee & Accommodations Tax Form

ADVERTISEMENT

115 Hwy 17 N

Surfside Beach, SC 29575

(843)913-6342 Fax (843)238-5432

TOWN OF SURFSIDE BEACH

Hospitality Fee & Accommodations Tax Form

D/B/A Name and Address

Hosp. Acct.

No.FEI or SSNo.

For Office Use Only:

Postmark Date: ____________________________________

Check # __________________________________________

Property location if different from above

Period Ending or Quarter Ending:

_______________________________________________________

Filing Status:

Monthly

Quarterly

Annually

28 Day

◄

Dates!

Period Dates

(28 Day filers: List

)

Check here if final return:

Reason: (check one) Last filing for the calendar year

Business closed/sold on_____________________

New Owner is:

_________________________________________________________________________________

PART I: HOSPITALITY FEE

For Office

1.

Gross Proceeds from Sale of Food /Beverages

.

Use Only

2.

Gross Proceeds from Rental of Transient Accommodations

.

3.

Gross Proceeds from Paid Admissions and/or Amusements

.

4.

Total Gross Proceeds (add lines 1,2, and 3)

.

►

(.01)

5.

Hospitality Fee

Line 4 x 1%

.

►

6.

Penalty –5% per month

Line 5 x 5% (.05)

.

Add penalty of 5% for each month your return is late.

►

(

.

)

7.

Discount for returns filed timely

Line 5 x 2% (.02)

Do not take a discount for any return which is filed late. May not be taken when a penalty is due.

►

___________________

8.

)

$

Total Hospitality Fee

(Add lines 5 through 7

. _______

Complete the following, ONLY if you have gross proceeds from transient accommodations.

PART II: LOCAL ACCOMMODATIONS TAX

►

. Accommodations Tax

Line 2 x .5%(.005)

.

9

►

. Penalty –5 % per month

Line 9 x 5% (.05)

.

10

Add penalty of 5% for each month your return is late.

►

Discount for returns filed timely

Line 9 x 2% (.02)

(

.

)

11.

Do not take a discount for any return which is filed late. May not be taken when a penalty is due.

)

$

.

Total Accommodations Tax

(Add lines 9 through 11

12.

TOTAL AMOUNT DUE

(

$ _____________________ . ______

Add lines 8 and 12)

Balance/Credit

This return becomes delinquent if it is postmarked after the 20th day following the close of the period.

I hereby certify that the information contained on this report is true and accurate to the best of my knowledge and belief

Taxpayer’s Signature_____________________________________________ Date______________ Telephone__________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1