Instructions For Form 2106 - Employee Business Expenses - 2011

ADVERTISEMENT

2011

Department of the Treasury

Internal Revenue Service

Instructions for Form 2106

Employee Business Expenses

$11,260 ($3,260 if you elect not to

necessary expenses for your job. See

Section references are to the Internal

Revenue Code unless otherwise noted.

claim the special depreciation

the flowchart below to find out if you

must file this form.

General Instructions

allowance). For more details, see the

discussion under Section D –

Depreciation of Vehicles, later.

An ordinary expense is one that is

What’s New

common and accepted in your field of

Future developments. The IRS has

trade, business, or profession. A

Standard mileage rate. The 2011

created a page on IRS.gov for

necessary expense is one that is

rate for business use of your vehicle

information about Form 2106 and its

helpful and appropriate for your

is 51 cents a mile (55

/

cents a mile

1

2

instructions, at

business. An expense does not have

after June 30, 2011).

form2106. Information about any

to be required to be considered

future developments affecting Form

necessary.

Depreciation limits on vehicles.

2106 (such as legislation enacted

For 2011, the first-year limit on

after we release it) will be posted on

depreciation, special depreciation

Form 2106-EZ. You can file Form

that page.

allowance, and section 179 deduction

2106-EZ, Unreimbursed Employee

for most vehicles is $11,060 ($3,060

Business Expenses, provided you

Purpose of Form

if you elect not to claim the special

were an employee deducting ordinary

depreciation allowance). For trucks

Use Form 2106 if you were an

and necessary expenses for your job

and vans, the first-year limit is

employee deducting ordinary and

and you:

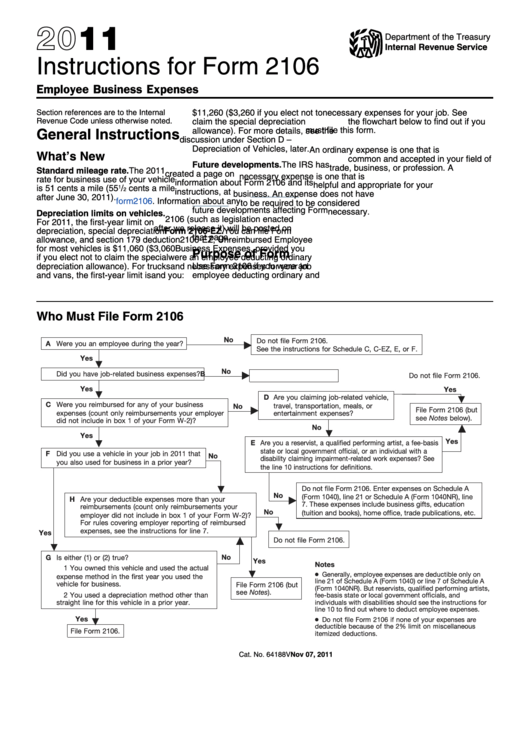

Who Must File Form 2106

No

Do not file Form 2106.

A Were you an employee during the year?

See the instructions for Schedule C, C-EZ, E, or F.

Yes

No

B

Did you have job-related business expenses?

Do not file Form 2106.

Yes

Yes

D

Are you claiming job-related vehicle,

C

Were you reimbursed for any of your business

travel, transportation, meals, or

No

File Form 2106 (but

expenses (count only reimbursements your employer

entertainment expenses?

see Notes below).

did not include in box 1 of your Form W-2)?

No

Yes

Yes

E

Are you a reservist, a qualified performing artist, a fee-basis

state or local government official, or an individual with a

F

Did you use a vehicle in your job in 2011 that

No

disability claiming impairment-related work expenses? See

you also used for business in a prior year?

the line 10 instructions for definitions.

Do not file Form 2106. Enter expenses on Schedule A

No

(Form 1040), line 21 or Schedule A (Form 1040NR), line

H

Are your deductible expenses more than your

7. These expenses include business gifts, education

reimbursements (count only reimbursements your

No

(tuition and books), home office, trade publications, etc.

employer did not include in box 1 of your Form W-2)?

For rules covering employer reporting of reimbursed

expenses, see the instructions for line 7.

Yes

Do not file Form 2106.

G

Is either (1) or (2) true?

No

Yes

Notes

1 You owned this vehicle and used the actual

● Generally, employee expenses are deductible only on

expense method in the first year you used the

line 21 of Schedule A (Form 1040) or line 7 of Schedule A

vehicle for business.

File Form 2106 (but

(Form 1040NR). But reservists, qualified performing artists,

see Notes).

2 You used a depreciation method other than

fee-basis state or local government officials, and

straight line for this vehicle in a prior year.

individuals with disabilities should see the instructions for

line 10 to find out where to deduct employee expenses.

● Do not file Form 2106 if none of your expenses are

Yes

deductible because of the 2% limit on miscellaneous

File Form 2106.

itemized deductions.

Nov 07, 2011

Cat. No. 64188V

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8