Commercial Fishermen Exemption Certificate - Rhode Island Division Of Taxation

ADVERTISEMENT

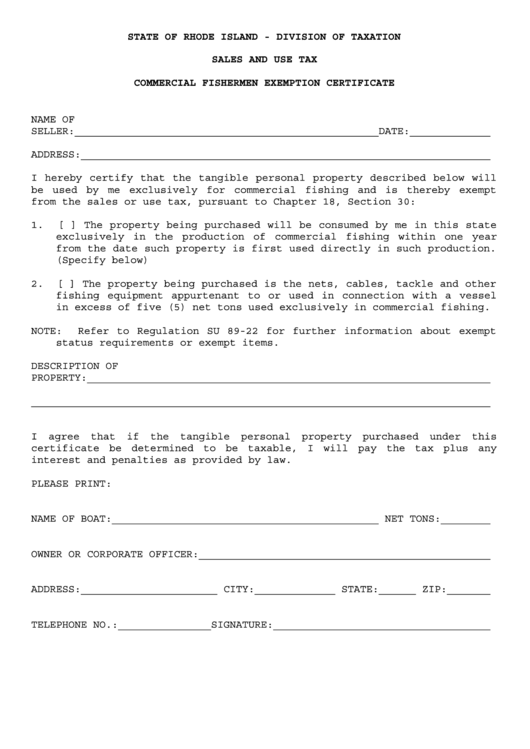

STATE OF RHODE ISLAND - DIVISION OF TAXATION

SALES AND USE TAX

COMMERCIAL FISHERMEN EXEMPTION CERTIFICATE

NAME OF

SELLER:_________________________________________________DATE:_____________

ADDRESS:__________________________________________________________________

I hereby certify that the tangible personal property described below will

be used by me exclusively for commercial fishing and is thereby exempt

from the sales or use tax, pursuant to Chapter 18, Section 30:

1.

[ ] The property being purchased will be consumed by me in this state

exclusively in the production of commercial fishing within one year

from the date such property is first used directly in such production.

(Specify below)

2.

[ ] The property being purchased is the nets, cables, tackle and other

fishing equipment appurtenant to or used in connection with a vessel

in excess of five (5) net tons used exclusively in commercial fishing.

NOTE:

Refer to Regulation SU 89-22 for further information about exempt

status requirements or exempt items.

DESCRIPTION OF

PROPERTY:_________________________________________________________________

__________________________________________________________________________

I

agree

that

if

the

tangible

personal

property

purchased

under

this

certificate be determined to be taxable, I will pay the tax plus any

interest and penalties as provided by law.

PLEASE PRINT:

NAME OF BOAT:___________________________________________ NET TONS:________

OWNER OR CORPORATE OFFICER:_______________________________________________

ADDRESS:______________________ CITY:_____________ STATE:______ ZIP:_______

TELEPHONE NO.:_______________SIGNATURE:___________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1