Form It-20s - Indiana S Corporation Income Tax Return - Yellow

ADVERTISEMENT

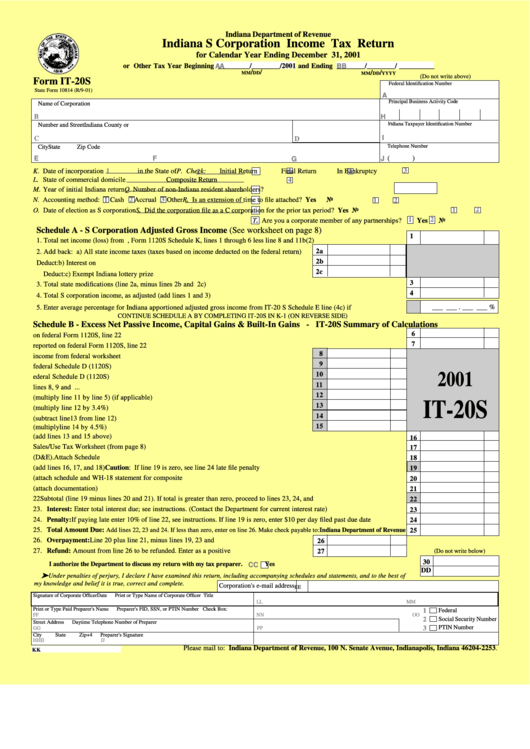

Indiana Department of Revenue

Indiana S Corporation Income Tax Return

for Calendar Year Ending December 31, 2001

or Other Tax Year Beginning _________/________/2001 and Ending ________/________/ __________

AA

BB

/

/

/

/

MM

DD

MM

DD

YYYY

(Do not write above)

Form IT-20S

Federal Identification Number

State Form 10814 (R/9-01)

A

Principal Business Activity Code

Name of Corporation

B

H

Indiana Taxpayer Identification Number

Number and Street

Indiana County or O.O.S.

I

C

D

Telephone Number

City

State

Zip Code

E

F

J

(

)

G

3

K. Date of incorporation

1

in the State of

P. Check:

1

Initial Return

2

Final Return

In Bankruptcy

2

L. State of commercial domicile

4

Composite Return

M. Year of initial Indiana return

Q. Number of non-Indiana resident shareholders?

3

N. Accounting method:

1

Cash

2

Accrual

Other

R. Is an extension of time to file attached? Yes

No

1

2

O. Date of election as S corporation

S. Did the corporation file as a C corporation for the prior tax period?

1

Yes

2

No

1

2

T. Are you a corporate member of any partnerships?

Yes

No

Schedule A - S Corporation Adjusted Gross Income (See worksheet on page 8)

1

1. Total net income (loss) from U.S. Corporation return, Form 1120S Schedule K, lines 1 through 6 less line 8 and 11b(2) ................

2a

2. Add back: a) All state income taxes (taxes based on income deducted on the federal return) .....

2b

Deduct:

b) Interest on U.S. Government Obligations ................................................................

2c

Deduct:

c) Exempt Indiana lottery prize receipts .......................................................................

3

3. Total state modifications (line 2a, minus lines 2b and 2c) ...................................................................................................................

4

4. Total S corporation income, as adjusted (add lines 1 and 3) .................................................................................................................

___ ___ . ___ ___ %

5. Enter average percentage for Indiana apportioned adjusted gross income from IT-20 S Schedule E line (4c) if completed ..............

CONTINUE SCHEDULE A BY COMPLETING IT-20S IN K-1 (ON REVERSE SIDE)

Schedule B - Excess Net Passive Income, Capital Gains & Built-In Gains - IT-20S Summary of Calculations

6

6. Excessive net passive income tax as reported on federal Form 1120S, line 22 a ................................................................................

7

7. Tax from federal Schedule D as reported on federal Form 1120S, line 22 b .......................................................................................

8

8. Excess net passive income from federal worksheet ......................................................................

9

9. Capital gains from federal Schedule D (1120S) ...........................................................................

10

2001

10. Built-in gains from federal Schedule D (1120S) ..........................................................................

11

11. Add the amounts on lines 8, 9 and 10 ...........................................................................................

12

12. Taxable income apportioned to Indiana (multiply line 11 by line 5) (if applicable) ....................

IT-20S

13

13. Adjusted gross income tax (multiply line 12 by 3.4%) ................................................................

14

14. Supplemental net income (subtract line 13 from line 12) ............................................................

15

15. Supplemental net income tax (multiply line 14 by 4.5%) ............................................................

16. Total income tax from Schedule B (add lines 13 and 15 above) .........................................................................................................

16

17. Sales/use tax on purchases subject to use tax from Sales/Use Tax Worksheet (from page 8) .............................................................

17

18. Total composite tax from completed Schedule IT-20COMP (D&E). Attach Schedule ......................................................................

18

19. Total tax (add lines 16, 17, and 18) Caution: If line 19 is zero, see line 24 late file penalty ..............................................................................................

19

20. Total composite tax return credits (attach schedule and WH-18 statement for composite members .................................................

20

21. Other credits belonging to the corporation (attach documentation) ....................................................................................................

21

22 Subtotal (line 19 minus lines 20 and 21). If total is greater than zero, proceed to lines 23, 24, and 25 ............................................

22

23. Interest: Enter total interest due; see instructions. (Contact the Department for current interest rate) .............................................

23

24. Penalty: If paying late enter 10% of line 22, see instructions. If line 19 is zero, enter $10 per day filed past due date ...................

24

25. Total Amount Due:

Add lines 22, 23 and 24. If less than zero, enter on line 26. Make check payable to:Indiana Department of Revenue

25

26. Overpayment: Line 20 plus line 21, minus lines 19, 23 and 24 .................................................

26

27. Refund: Amount from line 26 to be refunded. Enter as a positive figure ...................................

27

(Do not write below)

30

I authorize the Department to discuss my return with my tax preparer.

CC

Yes

DD

ä

Under penalties of perjury, I declare I have examined this return, including accompanying schedules and statements, and to the best of

my knowledge and belief it is true, correct and complete.

Corporation's e-mail address

EE

Signature of Corporate Officer

Date

Print or Type Name of Corporate Officer

Title

LL

MM

Print or Type Paid Preparer's Name

Preparer's FID, SSN, or PTIN Number

Check Box:

Federal I.D. Number

1

NN

OO

FF

2

Social Security Number

Street Address

Daytime Telephone Number of Preparer

PTIN Number

3

GG

PP

City

State

Zip+4

Preparer's Signature

HH

II

JJ

Please mail to: Indiana Department of Revenue, 100 N. Senate Avenue, Indianapolis, Indiana 46204-2253.

KK

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1