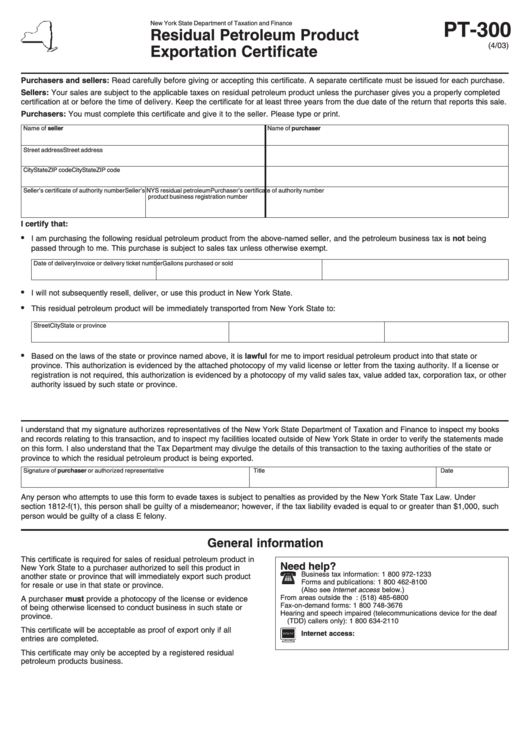

Form Pt-300 - Residual Petroleum Product Exportation Certificate Form - New York State Department Of Taxation And Finance

ADVERTISEMENT

New York State Department of Taxation and Finance

PT-300

Residual Petroleum Product

(4/03)

Exportation Certificate

Purchasers and sellers: Read carefully before giving or accepting this certificate. A separate certificate must be issued for each purchase.

Sellers: Your sales are subject to the applicable taxes on residual petroleum product unless the purchaser gives you a properly completed

certification at or before the time of delivery. Keep the certificate for at least three years from the due date of the return that reports this sale.

Purchasers: You must complete this certificate and give it to the seller. Please type or print.

Name of seller

Name of purchaser

Street address

Street address

City

State

ZIP code

City

State

ZIP code

Seller’s certificate of authority number

Seller’s NYS residual petroleum

Purchaser’s certificate of authority number

product business registration number

I certify that:

•

I am purchasing the following residual petroleum product from the above-named seller, and the petroleum business tax is not being

passed through to me. This purchase is subject to sales tax unless otherwise exempt.

Date of delivery

Invoice or delivery ticket number

Gallons purchased or sold

•

I will not subsequently resell, deliver, or use this product in New York State.

•

This residual petroleum product will be immediately transported from New York State to:

Street

City

State or province

•

Based on the laws of the state or province named above, it is lawful for me to import residual petroleum product into that state or

province. This authorization is evidenced by the attached photocopy of my valid license or letter from the taxing authority. If a license or

registration is not required, this authorization is evidenced by a photocopy of my valid sales tax, value added tax, corporation tax, or other

authority issued by such state or province.

I understand that my signature authorizes representatives of the New York State Department of Taxation and Finance to inspect my books

and records relating to this transaction, and to inspect my facilities located outside of New York State in order to verify the statements made

on this form. I also understand that the Tax Department may divulge the details of this transaction to the taxing authorities of the state or

province to which the residual petroleum product is being exported.

Signature of purchaser or authorized representative

Title

Date

Any person who attempts to use this form to evade taxes is subject to penalties as provided by the New York State Tax Law. Under

section 1812-f(1), this person shall be guilty of a misdemeanor; however, if the tax liability evaded is equal to or greater than $1,000, such

person would be guilty of a class E felony.

General information

This certificate is required for sales of residual petroleum product in

Need help?

New York State to a purchaser authorized to sell this product in

Business tax information: 1 800 972-1233

another state or province that will immediately export such product

Forms and publications: 1 800 462-8100

for resale or use in that state or province.

(Also see Internet access below.)

From areas outside the U.S. and outside Canada: (518) 485-6800

A purchaser must provide a photocopy of the license or evidence

Fax-on-demand forms: 1 800 748-3676

of being otherwise licensed to conduct business in such state or

Hearing and speech impaired (telecommunications device for the deaf

province.

(TDD) callers only): 1 800 634-2110

This certificate will be acceptable as proof of export only if all

Internet access:

entries are completed.

This certificate may only be accepted by a registered residual

petroleum products business.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1