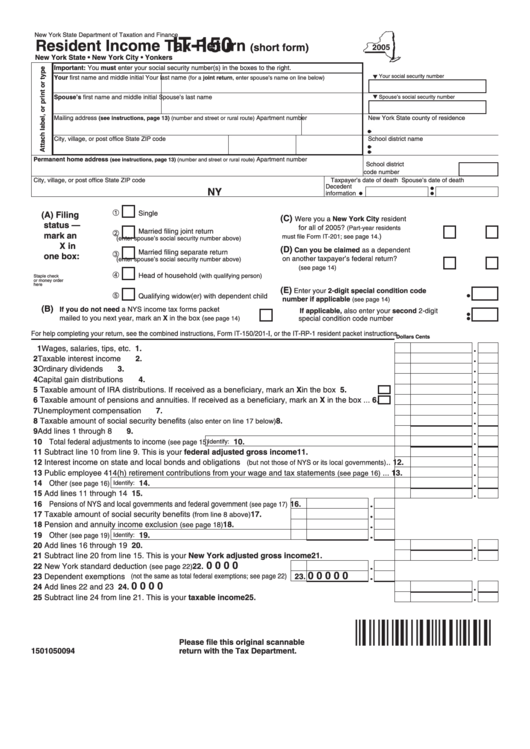

New York State Department of Taxation and Finance

IT-150

Resident Income Tax Return

(short form)

New York State • New York City • Yonkers

Important: You must enter your social security number(s) in the boxes to the right.

Your social security number

Your first name and middle initial

Your last name

(for a joint return, enter spouse’s name on line below)

Spouse’s first name and middle initial

Spouse’s social security number

Spouse’s last name

Mailing address

(see instructions, page 13) (number and street or rural route)

Apartment number

New York State county of residence

City, village, or post office

State

ZIP code

School district name

Permanent home address

Apartment number

(see instructions, page 13) (number and street or rural route)

School district

code number ..............................

City, village, or post office

State

ZIP code

Taxpayer’s date of death Spouse’s date of death

Decedent

NY

information

Single

(A) Filing

(C)

Were you a New York City resident

status —

for all of 2005?

(Part-year residents

Married filing joint return

mark an

) ................ Yes

No

must file Form IT-201; see page 14.

(enter spouse’s social security number above)

X in

(D)

Can you be claimed as a dependent

Married filing separate return

one box:

on another taxpayer’s federal return?

(enter spouse’s social security number above)

............................................... Yes

No

(see page 14)

Head of household

(with qualifying person)

Staple check

or money order

here

(E)

Enter your 2-digit special condition code

Qualifying widow(er) with dependent child

number if applicable

.............................

(see page 14)

(B)

If you do not need a NYS income tax forms packet

If applicable, also enter your second 2-digit

mailed to you next year, mark an X in the box (

see page 14) ..........

special condition code number

..........................................

For help completing your return, see the combined instructions, Form IT-150/201-

I

, or the IT-RP-1 resident packet instructions.

Dollars

Cents

1 Wages, salaries, tips, etc......................................................................................................................

1.

2 Taxable interest income .......................................................................................................................

2.

3 Ordinary dividends ...............................................................................................................................

3.

4 Capital gain distributions ......................................................................................................................

4.

5 Taxable amount of IRA distributions. If received as a beneficiary, mark an X in the box..............

5.

6 Taxable amount of pensions and annuities. If received as a beneficiary, mark an X in the box ...

6.

7 Unemployment compensation..............................................................................................................

7.

8 Taxable amount of social security benefits

.................................................

8.

(also enter on line 17 below)

9 Add lines 1 through 8 ...........................................................................................................................

9.

10 Total federal adjustments to income

10.

(see page 15)

Identify:

11 Subtract line 10 from line 9. This is your federal adjusted gross income ........................................ 11.

12 Interest income on state and local bonds and obligations

.. 12.

(but not those of NYS or its local governments)

13 Public employee 414(h) retirement contributions from your wage and tax statements

... 13.

(see page 16)

14 Other

14.

(see page 16)

Identify:

15 Add lines 11 through 14 ....................................................................................................................... 15.

16 Pensions of NYS and local governments and federal government

16.

(see page 17)

17 Taxable amount of social security benefits

............... 17.

(from line 8 above)

18 Pension and annuity income exclusion

............................ 18.

(see page 18)

19 Other

19.

(see page 19)

Identify:

20 Add lines 16 through 19 ....................................................................................................................... 20.

21 Subtract line 20 from line 15. This is your New York adjusted gross income ................................... 21.

0 0 0 0

22 New York standard deduction

22.

.........................................

(see page 22)

0 0 0 0 0

23 Dependent exemptions

23.

(not the same as total federal exemptions; see page 22)

0 0 0 0

24 Add lines 22 and 23 ............................................................................................................................. 24.

25 Subtract line 24 from line 21. This is your taxable income ................................................................. 25.

Please file this original scannable

1501050094

return with the Tax Department.

1

1 2

2