Form 500-Uet - Underpayment Of Estimated Tax By Individuals

ADVERTISEMENT

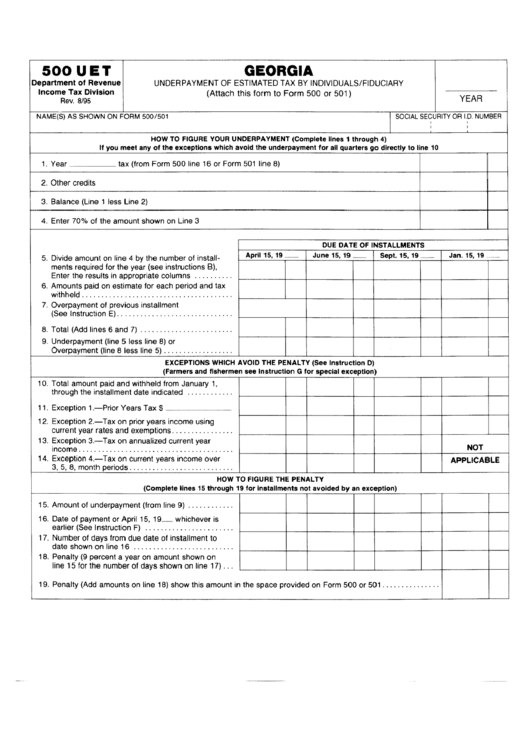

500UET

I

GEORGIA

Department o f Revenue

UNDERPAYMENT

OFESTIMATED

TAX BYINDIVIDUALS/FIDUCIARY

IncomeTaxDivision

(Attachthis formto Form500 or 501)

Rev. 8 /95

YEAR

I

I

NAME(S)

ASSHOWN ONFORM 500/501

SOCIAL

SECURITY

OR I.D. NUMBER

HOW TOFIGURE YOUR U NDERPAYMENT

(Complete lines1through 4)

Ifyoumeetanyoftheexceptions which avoid theunderpayment forallquarters g odirectly t o line10

I

I

1. Year

tax(from Form500line16or Form501line8)

2. Othercredits

3. Balance (Line 1 lessLine2)

4. Enter70%oftheamount s hownon Line 3

DUE DATE O FINSTALLMENTS

5. Divide a mount o n line4 bythe number o finstall-

April 1 5,19—

June15,19—

Sept.15,19_

Jan.15,19_

mentsrequired fortheyear(see instructions B),

Entertheresultsinappropriate c olumns. . . . . . . . . .

6. Amounts p aidonestimate foreachperiod andtax

withheld . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7. Overpayment ofprevious i nstallment

(Seeinstruction E ). . . . . . . . . . . . . . . . . . . . . . . . .

I

8. Total(Add lines6and 7) . . . . . . . . . . . . . . . . . . . . . . .

9. Underpayment (line5 lessline8)or

overpayment (line8

1ess

line

5)....... . . . . . . . . . .

EXCEPTIONS

WHICH AVOID THE PENALTY

(SeeInstruction D)

(Farmers a ndfishermen s ee Instruction Gforspecial e xception)

I

10.Totalamount p aidandwithheld f romJanuary1,

through theinstallment dateindicated

11.Exception 1 .—Prior YearsTax$

I

I

I

I

I

I

I

I

12.Exception 2 .—Tax o n prior yearsincome using

current y earratesandexemptions. . . . . . . . . . . . . . . .

13.Exception 3 .—Tax o nannualized c urrent y ear

income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

NOT

14.Exception 4 .—Tax o ncurrent y earsincome over

APPLICABLE

3,5, 8, monthperiods . . . . . . . . . . . . . . . . . . . . . . . . . . .

HOW TOFIGURE THE PENALTY

(Complete lines15through 19forinstallments notavoided byanexception)

15.Amount ofunderpayment (from line9) . . . . . . . . . . . .

16.Dateofpayment o rApril 1 5,19— whichever is

earlier (Seeinstruction F )......

. . . . . . . . . . . . . . . .

17.Number o fdaysfromduedateofinstallment to

dateshownonline16 . . . . . . . . . . . . . . . . . . . . . . . . . .

18.Penalty (9percenta yearonamount s hownon

line15forthe number o fdaysshownon line17)

19.Penalty (Add amounts on line18)showthisamount i nthe spaceprovided o n Form500or501. . . . . . . . . . . . . . .

I I

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1