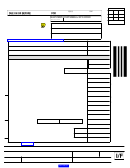

BOE-401-A2 (S2) REV. 98 (1-06)

STATE OF CALIFORNIA

BOARD OF EQUALIZATION

STATE, LOCAL and DISTRICT SALES and USE TAX RETURN

YOUR ACCOUNT NO.

REPORTING PERIOD

Deductions/Exemptions Schedule

50

$

4. SALES TO OTHER RETAILERS FOR PURPOSES OF RESALE

.00

51

5. NONTAXABLE SALES OF FOOD PRODUCTS

.00

52

(repair and installation)

6.

NONTAXABLE LABOR

.00

53

7. SALES TO THE UNITED STATES GOVERNMENT

.00

54

8. SALES IN INTERSTATE OR FOREIGN COMMERCE

.00

55

9. SALES TAX (if any) INCLUDED ON LINE 1 ON THE FRONT OF THE RETURN

.00

56

10. (a) (1) BAD DEBT LOSSES ON TAXABLE SALES

.00

62

(2) BAD DEBT LENDER LOSSES

.00

57

(b) COST OF TAX-PAID PURCHASES RESOLD PRIOR TO USE

.00

58

(c) RETURNED TAXABLE MERCHANDISE

.00

59

(d) CASH DISCOUNTS ON TAXABLE SALES

.00

(e)

PARTIAL STATE TAX EXEMPTION - IF YOU ARE REPORTING ANY TRANSACTIONS THAT

OCCURRED PRIOR TO 7-1-04, YOU MUST COMPLETE THE PARTIAL STATE TAX

EXEMPTION WORKSHEET, PAGE 3 OF BOE-531-T, SCHEDULE T, BEFORE YOU CLAIM

ANY OF THESE DEDUCTIONS.

(1) AMOUNT SUBJECT TO THE MANUFACTURER�S EQUIPMENT

63

[If you are completing Schedule T, enter the

EXEMPTION

amount from Partial State Tax Exemption Worksheet, Column D,

line 10(e)(1)]

00

.

(discontinued 12-31-03)

(2) AMOUNT SUBJECT TO THE TELEPRODUCTION EQUIPMENT

64

EXEMPTION

[If you are completing Schedule T, enter the

amount from Partial State Tax Exemption Worksheet, Column D,

.00

line 10(e)(2)]

[If you

(3) AMOUNT SUBJECT TO FARM EQUIPMENT EXEMPTION

65

are completing Schedule T, enter the amount from Partial State

Tax Exemption Worksheet, Column D, line 10(e)(3)]

.00

(4) AMOUNT SUBJECT TO THE DIESEL FUEL USED IN FARMING

66

[If you are completing

AND FOOD PROCESSING EXEMPTION

Schedule T, enter the amount from Partial State Tax Exemption

Worksheet, Column D, line 10(e)(4)]

.00

(5) AMOUNT SUBJECT TO THE TIMBER HARVESTING

67

[If you are

EQUIPMENT AND MACHINERY EXEMPTION

completing Schedule T, enter the amount from Partial State

.00

Tax Exemption Worksheet, Column D, line 10(e)(5)]

(6) AMOUNT SUBJECT TO THE RACEHORSE BREEDING STOCK

68

[If you are completing Schedule T, enter the

EXEMPTION

amount from Partial State Tax Exemption Worksheet, Column D,

.00

line 10(e)(6)]

TOTAL PARTIAL STATE TAX EXEMPTIONS - If you are required to

60

complete the Tax Adjustment and Partial State Tax Exemption

Worksheet, enter the amount from page 3, Column D, box 60. If you

.00

are not required to complete the Worksheet, enter the sum of boxes

63 through 68.

STATE TAX EXEMPTION FACTOR - Only for use if Partial State Tax

.8750

Exemption Worksheet is NOT required.

TOTAL ADJUSTED PARTIAL EXEMPTIONS - If you completed

61

BOE-531-T, Schedule T, enter the amount from page 1, Column D,

box 61. If you did not complete Schedule T, multiply the amount in

00

box 60 by the State Tax Exemption Factor shown above and enter the

.

result in box 61.

90

(f) OTHER

(clearly explain)

.00

11. TOTAL NONTAXABLE TRANSACTIONS

11

[Add lines 4 thru 10(d), box 61 and line 10(f), then enter here and on

$

the front page line 11]

.00

1

1 2

2