Form Fr-329 - Consumer Use Tax Return - 2000

ADVERTISEMENT

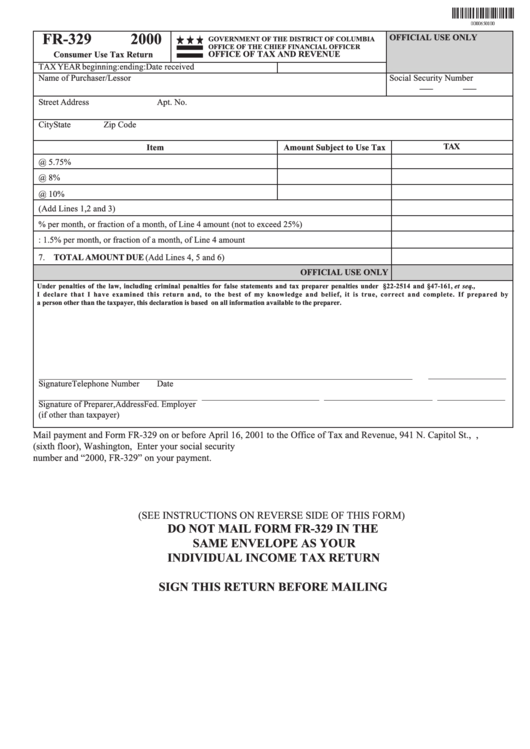

FR-329

2000

OFFICIAL USE ONLY

GOVERNMENT OF THE DISTRICT OF COLUMBIA

OFFICE OF THE CHIEF FINANCIAL OFFICER

OFFICE OF TAX AND REVENUE

Consumer Use Tax Return

TAX YEAR beginning:

ending:

Date received

Name of Purchaser/Lessor

Social Security Number

—

—

Street Address

Apt. No.

City

State

Zip Code

TAX

Item

Amount Subject to Use Tax

1. Purchases/rentals taxable @ 5.75%

2. Purchases/rentals taxable @ 8%

3. Purchases/rentals taxable @ 10%

4. Total tax due (Add Lines 1,2 and 3)

5. Penalty 5% per month, or fraction of a month, of Line 4 amount (not to exceed 25%)

6. Interest: 1.5% per month, or fraction of a month, of Line 4 amount

7. TOTAL AMOUNT DUE (Add Lines 4, 5 and 6)

OFFICIAL USE ONLY

Under penalties of the law, including criminal penalties for false statements and tax preparer penalties under D.C. Code §22-2514 and §47-161, et seq.,

I declare that I have examined this return and, to the best of my knowledge and belief, it is true, correct and complete. If prepared by

a person other than the taxpayer, this declaration is based on all information available to the preparer.

Signature

Telephone Number

Date

Signature of Preparer,

Address

Fed. Employer I.D. No. or SSN

Date

(if other than taxpayer)

Mail payment and Form FR-329 on or before April 16, 2001 to the Office of Tax and Revenue, 941 N. Capitol St., N.E.,

(sixth floor), Washington, D.C. 20002. Make check or money order payable to D.C. Treasurer. Enter your social security

number and “2000, FR-329” on your payment.

(SEE INSTRUCTIONS ON REVERSE SIDE OF THIS FORM)

DO NOT MAIL FORM FR-329 IN THE

SAME ENVELOPE AS YOUR

INDIVIDUAL INCOME TAX RETURN

SIGN THIS RETURN BEFORE MAILING

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1