Instructions For Local Earned Income Tax Return Form - Pennsylvania

ADVERTISEMENT

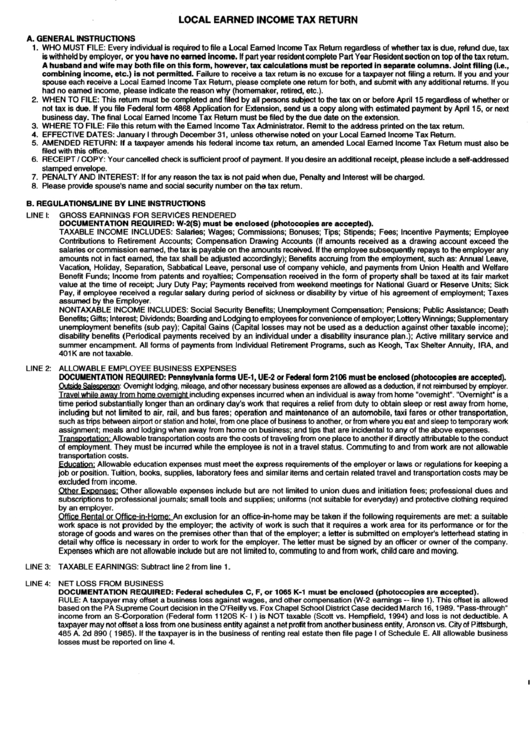

LOCAL EARNED INCOME TAX RETURN

A. GENERAL INSTRUCNONS

1. WHO MUST FILE: Every individual is required to file a Local Eamed Income Tax Retum regardless of whethertax is due, refund due, tax

is withheld by employer, or you have no eamed income. lf part year resident complete Part Year Resident section on top of the tax retum.

A husband and wife may both file on this form, however, tax calculations must be reported in separate columns. Joint filing (i.e.,

combining income, etc.) is not permitted. Failure to receive a tax retum b no excuse for a taxpayer not filing a rgtum. lf you and your

spouse each receive a Local Eamed Income Tax Retum, please complete one retum lor both, and submit with any additional returns. ll you

had no eamed income, please indicate the reason why (homemaker, retired, etc.).

2. WHEN TO FILE: This retum must be completed and filed by all persons subject to the tax on or before April 15 regardless of whether or

not tax is due. lf you file Federalform 4868 Application for Extension, send us a copy along with estimated payment by Apdl 15, or next

business day. The final Local Eamed Income Tax Retum must be filed by he due date on the extension.

3. WHERE TO FILE: File this retum with the Eamed lncome Tax Administrator. Remit to the address pdnted on the tax retum.

4. EFFECTIVE DATES: January I through December 31 , unless othenrise noted on your Local Eamed lncome Tax Return.

5. AMENDED RETURN: lf a taxpayer amends his federal income lax retum, an amended Local Eamed Income Tax Retum must also be

filed with this office.

6. RECEIPT / COPY: Your cancelled check is sutficient proof of payment. ll you desire an additional receipt, please include a self-addressed

stamped envelope.

7. PENALTY AND INTEREST: lf for any reason the tax is not paid when due, Penalty and lnteresl will be charged.

8. Please provide spouse's name and social security number on the tax retum.

B. REGULATIONS/LINE BY LINE INSTRUCTIONS

LINE l: GROSS EARNINGS FOR SERVICES RENDERED

DOCUIIENTATION REQUIRED: W-2(S) must be enclosed (photocopies are accepted).

TAXABLE INCOME INCLUDES: Salades; Wages; Commissions; Bonuses; Tips; Stipends; Fees; lncentive Payments; Employee

Contributions to Retirement Accounts; Compensation Drawing Accounts (lf amounts received as a drawing account exceed the

salaries or commission eamed, the tax is payable on the amounts received. lf the employee subsequently repays to the employer any

amounts not in fact earned, the tax shall be adjusted accordingly); Benefits accruing from the employment, such as: Annual Leave,

Vacation, Holiday, Separation, Sabbatical Leave, personal use of company vehicle, and payments from Union Heafth and Wellare

Benefit Funds; Income from patents and royalties; Compensation received in the form of property shall be laxed at its fair market

value at lhe time of receipt; Jury Duty Pay; Payments received from weekend meetings for National Guard or Reserve Units; Sick

Pay, if employee received a regular salary during period of sickness or disability by virtue of his agreement of employment; Taxes

assumed by the Employer.

NONTAXABLE INCOME INCLUDES: Social Security Benefits; Unemployment Compensation; Pensions; Public Assistance; Death

Benefits; Gifts; Interest; Dividends; Boarding and Lodging to employees lor convenience of employeq Lottery Winnings; Supplementary

unemployment benefits (sub pay); Capital Gains (Capital losses may not be used as a deduction against other taxable income);

disability benefits (Periodical payments received by an individual under a disability insurance plan.); Active military service and

summer encampment. All forms of payments from Individual Retirement Programs, such as Keogh, Tax Shelter Annuity, lRA, and

401K are not taxable.

LINE 2: ALLOWABLE EMPLOYEE BUSINESS EXPENSES

DOCUIIENTATION

REQUIRED: Pennsylvania forms UE-l, UE-2 or Federal form 2106 must be enclosed (photocopies are accepted).

O$ib Salesperson:

Ovemight lodging, mileage, and oher necessary business expenses are allowed as a deduc'lion, if not reimbunsed

by employer.

Travel while away from home ovemight including expenses incurred when an individual is away from home "ovemight". "Ovemight'is a

time period substantially longer than an ordinary day's work that requires a relief from duty to obtain sleep or rest away from home,

including but not limited to air, rail, and bus fares; operation and maintenance of an automobile, taxi fares or other transportation,

such as trips between airport or station and hotel, from one place of business to another, or from where you eat and sleep to temporary work

assignment; meals and lodging when away from home on business; and tips that are incidental to any of the above expenses.

Transpodation: Allowable transportation costs are the costs of traveling from one place to another if directly attributable to the conduct

of employment. They must be incurred while the employee is not in a travel status. Commuting to and from work are not allowable

transportation costs.

Education: Allowable education expenses must meet the express requirements of the employer or laws or regulations for keeping a

job or position. Tuition, books, supplies, laboratory fees and similar items and certain related travel and transporlation costs may be

excluded from income.

Other Expenses: Other allowable expenses include but are not limited to union dues and initiation fees; professional dues and

subscriptions to professionaljournals; small tools and supplies; uniforms (not suitable for everyday) and protective clothing required

by an employer.

Office Rental or Office-in-Home: An exclusion for an office-in-home may be taken if the following requirements are met: a suitable

work space is not provided by the employer; the activity of work is such that it requires a work area for its performance or for the

storage of goods and wares on the premises other than that of the employer; a letter is submitted on employer's letterhead stating in

detail why otfice is necessary in order to work for the employer. The letter must be signed by an otficer or owner of the company.

Expenses which are not allowable include but are not limited to, commuting to and from work, child care and moving.

LINE 3: TAXABLE EARNINGS: Subtract line 2 from line 1.

LINE 4: NET LOSS FROM BUSINESS

DOCUMENTATION REQUIRED: Federal schedules C, F, or 1065 K-l must be enclos€d (photocopies are accepted).

RULE: A taxpayer may offset a business loss against wages, and other compensation (W-2 earnings - line 1). This offset is allowed

based on the PA Supreme Court decision in the O'Reilly vs. Fox Chapel School District Case decided March 16, 'l 989. "Pass-through"

income lrom an S-Corporation (Federal lorm 11205 K- I ) is NOT taxable (Scott vs. Hempfield, 1994) and loss is not deduaible. A

taxpayer may not offset a loss from one business entity against a net profit from another business entity, Aronson vs. City of Piilsburgh,

485 A. 2d 890 ( 1985). lf the taxpayer is in the business of renting real estate then file page I of Schedule E. All allowable business

losses must be reported on line 4.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2