Form Mi-1040 - Michigan E-File And Telefile Payment Voucher - 2000

ADVERTISEMENT

(Rev. 11-00)

2000

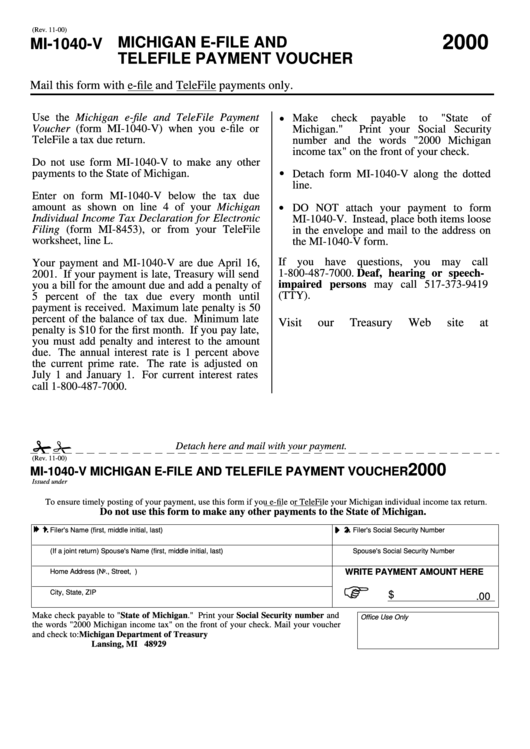

MICHIGAN E-FILE AND

MI-1040-V

TELEFILE PAYMENT VOUCHER

Mail this form with e-file and TeleFile payments only.

Use the Michigan e-file and TeleFile Payment

Make

check

payable

to

"State

of

Voucher (form MI-1040-V) when you e-file or

Michigan."

Print your Social Security

TeleFile a tax due return.

number and the words "2000 Michigan

income tax" on the front of your check.

Do not use form MI-1040-V to make any other

payments to the State of Michigan.

Detach form MI-1040-V along the dotted

line.

Enter on form MI-1040-V below the tax due

amount as shown on line 4 of your Michigan

DO NOT attach your payment to form

Individual Income Tax Declaration for Electronic

MI-1040-V. Instead, place both items loose

Filing (form MI-8453), or from your TeleFile

in the envelope and mail to the address on

worksheet, line L.

the MI-1040-V form.

If you have questions, you may call

Your payment and MI-1040-V are due April 16,

1-800-487-7000. Deaf, hearing or speech-

2001. If your payment is late, Treasury will send

impaired persons may call 517-373-9419

you a bill for the amount due and add a penalty of

(TTY).

5 percent of the tax due every month until

payment is received. Maximum late penalty is 50

percent of the balance of tax due. Minimum late

Visit

our

Treasury

Web

site

at

penalty is $10 for the first month. If you pay late,

you must add penalty and interest to the amount

due. The annual interest rate is 1 percent above

the current prime rate. The rate is adjusted on

July 1 and January 1. For current interest rates

call 1-800-487-7000.

Detach here and mail with your payment.

(Rev. 11-00)

2000

MI-1040-V MICHIGAN E-FILE AND TELEFILE PAYMENT VOUCHER

Issued under P.A. 281 of 1967. Filing is voluntary.

To ensure timely posting of your payment, use this form if you e-file or TeleFile your Michigan individual income tax return.

Do not use this form to make any other payments to the State of Michigan.

1.

2.

Filer's Name (first, middle initial, last)

Filer's Social Security Number

(If a joint return) Spouse's Name (first, middle initial, last)

Spouse's Social Security Number

WRITE PAYMENT AMOUNT HERE

Home Address (No., Street, P.O. Box or Rural Route)

City, State, ZIP

$

.00

Make check payable to "State of Michigan." Print your Social Security number and

Office Use Only

the words "2000 Michigan income tax" on the front of your check. Mail your voucher

and check to:

Michigan Department of Treasury

Lansing, MI 48929

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1