Form Mbt-V - Michigan Business Tax E-File Annual Return Payment Voucher

ADVERTISEMENT

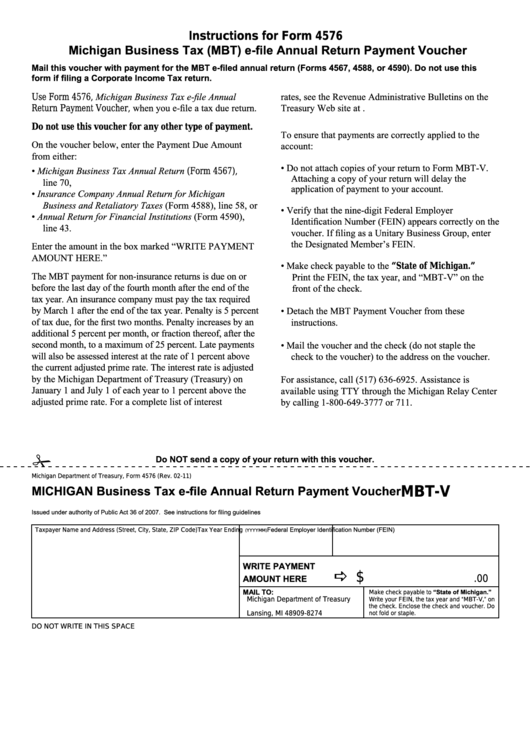

Instructions for Form 4576

Michigan Business Tax (MBT) e-file Annual Return Payment Voucher

Mail this voucher with payment for the MBT e-filed annual return (Forms 4567, 4588, or 4590). Do not use this

form if filing a Corporate Income Tax return.

Use Form 4576, Michigan Business Tax e-file Annual

rates, see the Revenue Administrative Bulletins on the

Return Payment Voucher, when you e-file a tax due return.

Treasury Web site at

Do not use this voucher for any other type of payment.

To ensure that payments are correctly applied to the

On the voucher below, enter the Payment Due Amount

account:

from either:

• Do not attach copies of your return to Form MBT-V.

• Michigan Business Tax Annual Return (Form 4567),

Attaching a copy of your return will delay the

line 70,

application of payment to your account.

• Insurance Company Annual Return for Michigan

Business and Retaliatory Taxes (Form 4588), line 58, or

• Verify that the nine-digit Federal Employer

• Annual Return for Financial Institutions (Form 4590),

Identification Number (FEIN) appears correctly on the

line 43.

voucher. If filing as a Unitary Business Group, enter

the Designated Member’s FEIN.

Enter the amount in the box marked “WRITE PAYMENT

AMOUNT HERE.”

• Make check payable to the “State of Michigan.”

The MBT payment for non-insurance returns is due on or

Print the FEIN, the tax year, and “MBT-V” on the

before the last day of the fourth month after the end of the

front of the check.

tax year. An insurance company must pay the tax required

by March 1 after the end of the tax year. Penalty is 5 percent

• Detach the MBT Payment Voucher from these

of tax due, for the first two months. Penalty increases by an

instructions.

additional 5 percent per month, or fraction thereof, after the

second month, to a maximum of 25 percent. Late payments

• Mail the voucher and the check (do not staple the

will also be assessed interest at the rate of 1 percent above

check to the voucher) to the address on the voucher.

the current adjusted prime rate. The interest rate is adjusted

by the Michigan Department of Treasury (Treasury) on

For assistance, call (517) 636-6925. Assistance is

January 1 and July 1 of each year to 1 percent above the

available using TTY through the Michigan Relay Center

adjusted prime rate. For a complete list of interest

by calling 1-800-649-3777 or 711.

#

Do NOT send a copy of your return with this voucher.

Michigan Department of Treasury, Form 4576 (Rev. 02-11)

MICHIGAN Business Tax e-file Annual Return Payment Voucher

MBT-V

Issued under authority of Public Act 36 of 2007. See instructions for filing guidelines

Federal Employer Identification Number (FEIN)

Taxpayer Name and Address (Street, City, State, ZIP Code)

Tax Year Ending

(YYYYMM)

WRITE PAYMENT

a $

AMOUNT HERE

.00

MAIL TO:

Make check payable to “State of Michigan.”

Michigan Department of Treasury

Write your FEIN, the tax year and “MBT-V,” on

P.O. Box 30774

the check. Enclose the check and voucher. Do

Lansing, MI 48909-8274

not fold or staple.

DO NOT WRITE IN THIS SPACE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1