Disclosure/representation Authorization Form Instructions

ADVERTISEMENT

Disclosure/Representation Authorization Form Instructions

PURPOSE OF FORM

Section 4- Scope of Authorization.

Form 285 enables any individual, sole proprietorship, joint filers, corporation,

At minimum, this authorization form authorizes the Department to release Taxpayer’s

group of consolidated or combined corporations, partnership, limited liability

confidential information to Appointee. However, Taxpayer may also grant specific

company, estate, trust, governmental agency, or other organization, association, or

additional powers in section 4 by checking the applicable “yes” box(es). A blank box

group thereof (“Taxpayer”) to designate a person (“Appointee”) to whom the

will be treated as a “no”, even if the Power of Attorney is granted by this form.

Arizona Department of Revenue can release confidential information, if the release

of such information is not otherwise authorized by A.R.S. § 42-2003.

The

The Appointee must be given the Power of Attorney (marking “yes” in Box vi of

disclosure of such confidential information may be necessary to fully discuss tax

Section 4) in order to represent taxpayer during any administrative tax

issues with, or respond to tax questions by such Appointee. The form can also grant

proceedings.

“Administrative tax proceedings” include proceedings before, and

additional powers to the Appointee, up to and including the power to represent

submissions to the Hearing Office or Director of the Department, or the Office of

Taxpayer at any formal administrative tax proceeding.

If Taxpayer grants

Administrative Hearings. In order to represent Taxpayer in an administrative

Appointee the power of representation, this authorization form shall operate as a

proceeding, in addition to receiving a Power of Attorney, the Appointee must

Power of Attorney.

meet the requirements of Rule 31(a)(4)(M) of the Arizona Rules of the Supreme

Court. The following individuals are authorized pursuant to Rule 31(a)(4)(M) to

represent Taxpayers if they have been given a Power of Attorney:

FILING INSTRUCTIONS

(1)

Any individual, IF the total amount in dispute, including tax, penalties, and

interest, is less than $5000.00;

If Taxpayer is working with a specific section/employee of the Arizona Department

(2)

A full-time officer, partner, member or manager of a limited liability company,

of Revenue (“Department”), mail Form 285 to such section/employee. Otherwise,

or employee, IF: (1) taxpayer is a legal entity, such as a corporation, a formal

mail Form 285 to:

partnership, a limited liability company, or a trust; (2) such representation is not

Arizona Department of Revenue

the appointee’s primary duty to the legal entity, but secondary or incidental to

Taxpayer Information and Assistance

other duties relating to the management or operation of the legal entity; and (3)

P.O. Box 29086

the person is not receiving separate or additional compensation (other than

Phoenix, AZ 85038

reimbursement for costs) for such representation.

Taxpayer may file an original, a photocopy, or a facsimile transmission (Fax) of

If either of the above two conditions are not met, then only the following individuals

Form 285.

can represent a Taxpayer if they have been given a Power of Attorney:

(3)

An active member of the State Bar of Arizona;

SPECIFIC INSTRUCTIONS

(4)

An Arizona Certified Public Accountant; or

(5)

A “Federally Authorized Tax Practitioner” within the meaning of Arizona

Section 1- Taxpayer(s) Information.

Revised Statutes § 42-2069(D)(1). Such person includes: (1) an enrolled agent

authorized to practice before the Internal Revenue Service; (2) an out-of-state

Enter Taxpayer’s name, address, and daytime telephone number on the lines

attorney or out-of-state certified public accountant, if such person is not

provided. Taxpayer may attach a supplemental page to the form if section 1 does

currently under suspension or disbarment from practice before the IRS and has

not provide sufficient space for the required information.

If Taxpayer is a

filed with the IRS a written declaration that he or she is currently qualified as an

consolidated or combined group of corporations, Taxpayer must attach a federal

attorney or a CPA; and (3) an individual practicing with a federally authorized

Form 851 or a supplemental sheet, as applicable, containing the names of each

tax practitioner and who is subject to the same standards of practice and ethics

member of the consolidated or combined group and indicating the corporations for

requirements of such person.

which the signator of Form 285 is a principal corporate officer. If the principal

corporate officer signing the form is not a principal corporate officer of all

Section 5- Revocation of Earlier Authorizations.

members of the consolidated or combined group, this form will only be

effective as to the members of the consolidated or combined group in which the

This authorization does not revoke any earlier authorizations or Powers of Attorney

signator is a principal corporate officer.

on file with the Arizona Department of Revenue. If you want to revoke all prior

authorizations and Powers of Attorney, please check the box. If you wish to revoke

An individual taxpayer, sole proprietorship, or joint filer(s) must provide a Social

only some prior authorizations and/or Powers of Attorney, please check the box and

Security number(s), Withholding number, or Transaction Privilege Tax License

list those authorizations and Powers of Attorney that you wish to remain in effect.

number, as applicable. Taxpayers which are corporations, partnerships, or trusts

must provide their Federal Employer Identification number and a Withholding or

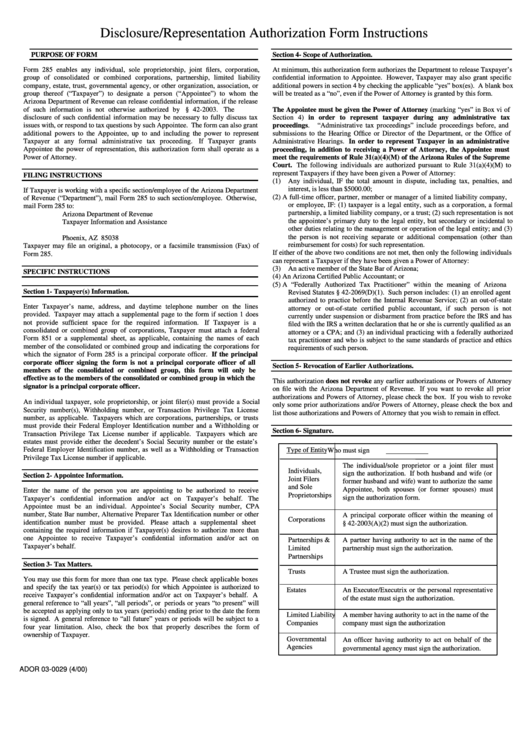

Section 6- Signature.

Transaction Privilege Tax License number if applicable. Taxpayers which are

estates must provide either the decedent’s Social Security number or the estate’s

Federal Employer Identification number, as well as a Withholding or Transaction

Type of Entity

Who must sign

Privilege Tax License number if applicable.

The individual/sole proprietor or a joint filer must

Individuals,

sign the authorization. If both husband and wife (or

Section 2- Appointee Information.

Joint Filers

former husband and wife) want to authorize the same

and Sole

Appointee, both spouses (or former spouses) must

Enter the name of the person you are appointing to be authorized to receive

Proprietorships

sign the authorization form.

Taxpayer’s confidential information and/or act on Taxpayer’s behalf. The

Appointee must be an individual. Appointee’s Social Security number, CPA

number, State Bar number, Alternative Preparer Tax Identification number or other

A principal corporate officer within the meaning of

Corporations

identification number must be provided.

Please attach a supplemental sheet

A.R.S. § 42-2003(A)(2) must sign the authorization.

containing the required information if Taxpayer(s) desires to authorize more than

one Appointee to receive Taxpayer’s confidential information and/or act on

Partnerships &

A partner having authority to act in the name of the

Taxpayer’s behalf.

Limited

partnership must sign the authorization.

Partnerships

Section 3- Tax Matters.

Trusts

A Trustee must sign the authorization.

You may use this form for more than one tax type. Please check applicable boxes

and specify the tax year(s) or tax period(s) for which Appointee is authorized to

An Executor/Executrix or the personal representative

Estates

receive Taxpayer’s confidential information and/or act on Taxpayer’s behalf. A

of the estate must sign the authorization.

general reference to “all years”, “all periods”, or periods or years “to present” will

be accepted as applying only to tax years (periods) ending prior to the date the form

Limited Liability

A member having authority to act in the name of the

is signed. A general reference to “all future” years or periods will be subject to a

Companies

company must sign the authorization

four year limitation. Also, check the box that properly describes the form of

ownership of Taxpayer.

Governmental

An officer having authority to act on behalf of the

Agencies

governmental agency must sign the authorization.

ADOR 03-0029 (4/00)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1