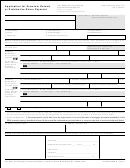

Form Hud-92900-B - Important Notice To Homebuyers Page 2

ADVERTISEMENT

About Prepayment

FHA-to-FHA Refinance: When a FHA insured loan is

refinanced; the refund from the old premium may be

This notice is to advise you of the requirements that

applied toward the upfront premium required for the

must be followed to accomplish a prepayment of your

mortgage, and to prevent accrual of any interest after

new loan.

the date of prepayment.

How are Refunds Determined?

You may prepay any or all of the outstanding indebted-

ness due under your mortgage at any time, without

The FHA Commissioner determines how much of the

penalty. However, to avoid the accrual of interest on

upfront premium is refunded when loans are terminated.

any prepayment, the prepayment must be received on

Refunds are based on the number of months the loan is

the installment due date (the first day of the month) if

insured.

the mortgagee stated this policy in its response to a

request for a payoff figure.

Monthly Insurance Premiums

Otherwise, you may be required to pay interest on the

amount prepaid through the end of the month. The

In addition to an upfront mortgage insurance premium

mortgagee can refuse to accept prepayment on any

date other than the installment due date.

(UFMIP), you may also be charged a monthly mortgage

insurance premium. You will pay the monthly premium

For all FHA mortgages closed on or after January 21,

2015, mortgagees may only charge interest through the

for either:

date the mortgage is paid in full.

the first 11 years of the mortgage term, or the

end of the mortgage term, whichever occurs

FHA Mortgage Insurance Information

first, if your mortgage had an original principal

Who may be eligible for a refund?

obligation (excluding financed UFMIP) with a

Premium Refund: You may be eligible for a refund of

loan-to-value (LTV) ratio of less than or equal to

a portion of the insurance premium if you paid an

90 percent; or

upfront mortgage insurance premium at settlement and

are refinancing with another FHA mortgage.

the first 30 years of the mortgage term, or the

Review your settlement papers or check with your

end of the mortgage term, whichever occurs first,

mortgage company to determine if you paid an upfront

for any mortgage involving an original principal

premium.

obligation (excluding financed UFMIP) with an

Exceptions:

LTV greater than 90 percent.)

Assumptions: When a FHA insured loan is assumed

the insurance remains in force (the seller receives no

refund). The owner of the property at the time the

insurance is terminated is entitled to any refund.

Important: The rules governing the eligibility for premium refunds are based on the

financial status of the FHA insurance fund and are subject to change.

SI USTED HABLA ESPANOL Y TIENE DIFICULTAD LEYENDO O HABLANDO INGLES, POR FAVOR LLAME A

ESTE NUMERO TELEFONICO 800.697.6967.

You, the borrower, must be certain that you understand the transaction. Seek professional advice if you are

uncertain.

Acknowledgment: I acknowledge that I have read and received a copy of this notice at the time of loan application.

This notice does not constitute a contract or binding agreement. It is designed to provide current HUD/FHA policy

regarding refunds.

Signature & Date:

Signature & Date:

X

X

Signature & Date:

Signature & Date:

X

X

Previous editions are obsolete

Page 2 of 2

form HUD-92900-B (11/2014)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2