Form Dr 7121 - Aviation Tax Refund Claim - 1997

ADVERTISEMENT

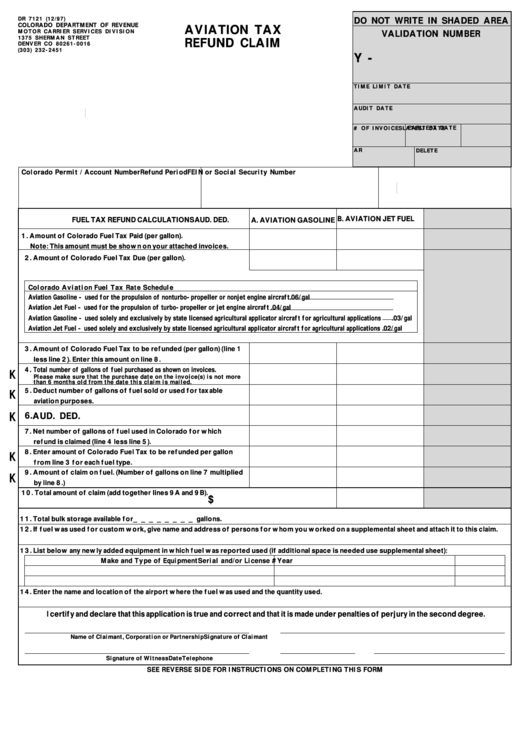

DR 7121 (12/97)

DO NOT WRITE IN SHADED AREA

COLORADO DEPARTMENT OF REVENUE

AVIATION TAX

MOTOR CARRIER SERVICES DIVISION

VALIDATION NUMBER

1375 SHERMAN STREET

REFUND CLAIM

DENVER CO 80261-0016

(303) 232-2451

Y -

TIME LIMIT DATE

AUDIT DATE

j u l

# OF INVOICES

EARLIEST DATE

LATEST DATE

AR

DELETE

Colorado Permit / Account Number

Refund Period

FEIN or Social Security Number

j u l

FUEL TAX REFUND CALCULATIONS

AUD. DED.

A. AVIATION GASOLINE B. AVIATION JET FUEL

1. Amount of Colorado Fuel Tax Paid (per gallon).

Note: This amount must be shown on your attached invoices.

2. Amount of Colorado Fuel Tax Due (per gallon).

Colorado Aviation Fuel Tax Rate Schedule

Aviation Gasoline - used for the propulsion of nonturbo-propeller or nonjet engine aircraft

.06/gal

Aviation Jet Fuel - used for the propulsion of turbo-propeller or jet engine aircraft

.04/gal

Aviation Gasoline - used solely and exclusively by state licensed agricultural applicator aircraft for agricultural applications

.03/gal

Aviation Jet Fuel - used solely and exclusively by state licensed agricultural applicator aircraft for agricultural applications

.02/gal

3. Amount of Colorado Fuel Tax to be refunded (per gallon) (line 1

less line 2). Enter this amount on line 8.

4. Total number of gallons of fuel purchased as shown on invoices.

K

Please make sure that the purchase date on the invoice(s) is not more

than 6 months old from the date this claim is mailed.

K

5. Deduct number of gallons of fuel sold or used for taxable

aviation purposes.

K

6. AUD. DED.

7. Net number of gallons of fuel used in Colorado for which

refund is claimed (line 4 less line 5).

8. Enter amount of Colorado Fuel Tax to be refunded per gallon

K

from line 3 for each fuel type.

9. Amount of claim on fuel. (Number of gallons on line 7 multiplied

K

by line 8.)

10. Total amount of claim (add together lines 9A and 9B).

$

11. Total bulk storage available for________gallons.

12. If fuel was used for custom work, give name and address of persons for whom you worked on a supplemental sheet and attach it to this claim.

13. List below any newly added equipment in which fuel was reported used (if additional space is needed use supplemental sheet):

Make and Type of Equipment

Serial and/or License #

Year

14. Enter the name and location of the airport where the fuel was used and the quantity used.

I certify and declare that this application is true and correct and that it is made under penalties of perjury in the second degree.

Name of Claimant, Corporation or Partnership

Signature of Claimant

Signature of Witness

Date

Telephone

SEE REVERSE SIDE FOR INSTRUCTIONS ON COMPLETING THIS FORM

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1