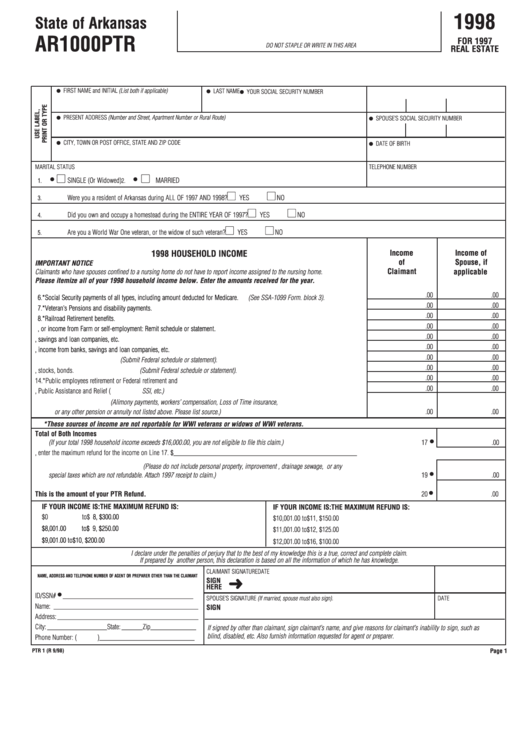

1998

State of Arkansas

AR1000PTR

FOR 1997

DO NOT STAPLE OR WRITE IN THIS AREA

REAL ESTATE

FIRST NAME and INITIAL (List both if applicable)

LAST NAME

YOUR SOCIAL SECURITY NUMBER

PRESENT ADDRESS (Number and Street, Apartment Number or Rural Route)

SPOUSE’S SOCIAL SECURITY NUMBER

CITY, TOWN OR POST OFFICE, STATE AND ZIP CODE

DATE OF BIRTH

MARITAL STATUS

TELEPHONE NUMBER

SINGLE (Or Widowed)

MARRIED

01.

2.

Were you a resident of Arkansas during ALL OF 1997 AND 1998?

YES

NO

03.

Did you own and occupy a homestead during the ENTIRE YEAR OF 1997?

YES

NO

04.

Are you a World War One veteran, or the widow of such veteran?

YES

NO

05.

Income

Income of

1998 HOUSEHOLD INCOME

of

Spouse, if

IMPORTANT NOTICE

Claimant

applicable

Claimants who have spouses confined to a nursing home do not have to report income assigned to the nursing home.

Please itemize all of your 1998 household income below. Enter the amounts received for the year.

.00

.00

6. * Social Security payments of all types, including amount deducted for Medicare.

(See SSA-1099 Form. block 3). .................. 6

0

.00

.00

7. * Veteran’s Pensions and disability payments. ............................................................................................................................. 7

0

.00

.00

8. * Railroad Retirement benefits. .................................................................................................................................................... 8

0

.00

.00

9.

Salaries, or income from Farm or self-employment: Remit schedule or statement. .................................................................. 9

0

.00

.00

10.

Interest income from banks, savings and loan companies, etc. ................................................................................................ 10

.00

.00

11.

Dividends, income from banks, savings and loan companies, etc. ........................................................................................... 11

.00

.00

(Submit Federal schedule or statement). ........................................................................................ 12

12.

Rent and royalties income.

.00

.00

13.

Sales of real estate, stocks, bonds. (Submit Federal schedule or statement). ........................................................................... 13

.00

.00

14. * Public employees retirement or Federal retirement and pensions. ............................................................................................. 14

.00

.00

15.

Cash, Public Assistance and Relief ( SSI, etc.) .......................................................................................................................... 15

16.

Miscellaneous income (Alimony payments, workers’ compensation, Loss of Time insurance,

.00

.00

or any other pension or annuity not listed above. Please list source.) ....................................................................................... 16

* These sources of income are not reportable for WWI veterans or widows of WWI veterans.

17. Total 1998 Income of claimant and spouse.

Total of Both Incomes

(If your total 1998 household income exceeds $16,000.00, you are not eligible to file this claim.)........................................................................................ 17

.00

18. From the table below, enter the maximum refund for the income on Line 17. $ ____________________________________________________

19. Enter your 1997 real estate taxes paid. (Please do not include personal property, improvement , drainage sewage, or any

special taxes which are not refundable. Attach 1997 receipt to claim.)

19

.00

20. Enter the SMALLER of Lines 18 or 19. This is the amount of your PTR Refund. .......................................................................................................... 20

.00

IF YOUR INCOME IS:

THE MAXIMUM REFUND IS:

IF YOUR INCOME IS:

THE MAXIMUM REFUND IS:

$0

to

$08,000.00................................for this income level

$300.00

$10,001.00

to

$11,000.00................................for this income level

$150.00

$8,001.00

to

$09,000.00................................for this income level

$250.00

$11,001.00

to

$12,000.00................................for this income level

$125.00

$9,001.00

to

$10,000.00................................for this income level

$200.00

$12,001.00

to

$16,000.00................................for this income level

$100.00

I declare under the penalties of perjury that to the best of my knowledge this is a true, correct and complete claim.

If prepared by another person, this declaration is based on all the information of which he has knowledge.

CLAIMANT SIGNATURE

DATE

NAME, ADDRESS AND TELEPHONE NUMBER OF AGENT OR PREPARER OTHER THAN THE CLAIMANT

SIGN

HERE

ID/SSN#

_____________________________________

SPOUSE’S SIGNATURE (If married, spouse must also sign).

DATE

Name: _________________________________________

SIGN

Address: ________________________________________

City: _________________State: ______Zip _____________

If signed by other than claimant, sign claimant’s name, and give reasons for claimant’s inability to sign, such as

blind, disabled, etc. Also furnish information requested for agent or preparer.

Phone Number: (

) ___________________________

PTR 1 (R 9/98)

Page 1

1

1