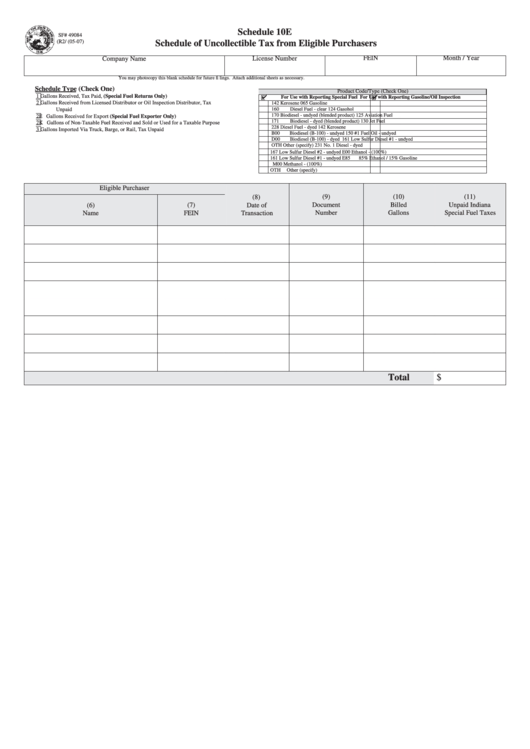

Form Sf# 49084 - Schedule 10e Schedule Of Uncollectible Tax From Eligible Purchasers 2007

ADVERTISEMENT

Schedule 10E

SF# 49084

(R2/ (05-07)

Schedule of Uncollectible Tax from Eligible Purchasers

FEIN

Month / Year

Company Name

License Number

You may photocopy this blank schedule for future fi lings. Attach additional sheets as necessary.

Schedule Type (Check One)

Product Code/Type (Check One)

1

Gallons Received, Tax Paid, (Special Fuel Returns Only)

For Use with Reporting Special Fuel

For Use with Reporting Gasoline/Oil Inspection

2

Gallons Received from Licensed Distributor or Oil Inspection Distributor, Tax

142

Kerosene

065

Gasoline

160

Diesel Fuel - clear

124

Gasohol

Unpaid

170

Biodiesel - undyed (blended product)

125

Aviation Fuel

2E

Gallons Received for Export (Special Fuel Exporter Only)

171

Biodiesel - dyed (blended product)

130

Jet Fuel

2K

Gallons of Non-Taxable Fuel Received and Sold or Used for a Taxable Purpose

228

Diesel Fuel - dyed

142

Kerosene

3

Gallons Imported Via Truck, Barge, or Rail, Tax Unpaid

B00

Biodiesel (B-100) - undyed

150

#1 Fuel Oil - undyed

D00

Biodiesel (B-100) - dyed

161

Low Sulfur Diesel #1 - undyed

OTH

Other (specify)

231

No. 1 Diesel - dyed

167

Low Sulfur Diesel #2 - undyed

E00

Ethanol - (100%)

161

Low Sulfur Diesel #1 - undyed

E85

85% Ethanol / 15% Gasoline

M00

Methanol - (100%)

OTH

Other (specify)

Eligible Purchaser

(8)

(9)

(10)

(11)

Document

Billed

Unpaid Indiana

(6)

(7)

Date of

Number

Gallons

Special Fuel Taxes

Name

FEIN

Transaction

Total

$

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2