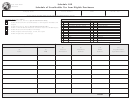

Form Sf# 49084 - Schedule 10e Schedule Of Uncollectible Tax From Eligible Purchasers 2007 Page 2

ADVERTISEMENT

Instructions for Completing

Schedule of Uncollectible Tax

from Eligible Purchasers

Schedule 10E

Who should fi le this schedule?

Only licensed Suppliers and Permissive Suppliers are eligible to fi le this schedule. A licensed Supplier or Permissive

Supplier is entitled to take a deduction on Form SF-900 Line 7, for the amount of Indiana special fuel tax that has

become uncollectible from an Eligible Purchaser.

Example: Tax due from ABC Oil Company for a sale on February 10, 2002, must be remitted to you by March

15, 2002. If this payment was not received by you before the next return due date, it becomes uncollectible and

may be claimed as a deduction on your March return, due April 15, 2002. This deduction is limited to the amount

due from the purchaser, plus any tax that accrues from that purchaser for a period of ten (10) days following the

date of failure to pay.

Before you begin:

Enter the identifying information as it is refl ected on your Indiana Special Fuel License. Be certain to complete

a separate schedule for each fuel product type that you circle.

Column instructions:

Columns 6 and 7: Enter the name, address, and Federal Identifi cation Number (FEIN) of the Eligible

purchaser from whom the tax is uncollectible.

Column 8: Enter the date of the transaction to which the uncollectible tax pertains.

Column 9: Enter the document number to which the uncollectible tax pertains.

Column 10: Enter the number of gallons billed on which the tax was uncollectible.

Column 11: Enter the amount of unpaid Indiana Special Fuel taxes. Carry this total to the SF-900, Line 7.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2