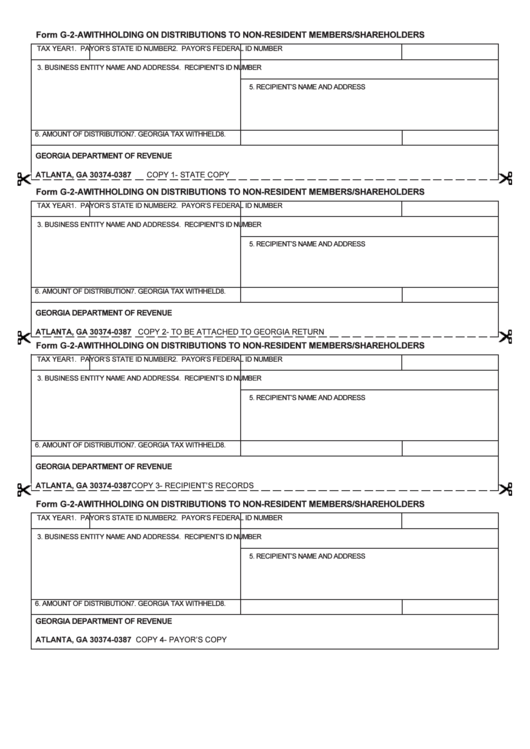

Form G-2-A - Withholding On Distributions To Non-Resident Members/shareholders F

ADVERTISEMENT

Form G-2-A

WITHHOLDING ON DISTRIBUTIONS TO NON-RESIDENT MEMBERS/SHAREHOLDERS

TAX YEAR

1. PAYOR’S STATE ID NUMBER

2. PAYOR’S FEDERAL ID NUMBER

3. BUSINESS ENTITY NAME AND ADDRESS

4. RECIPIENT’S ID NUMBER

5. RECIPIENT’S NAME AND ADDRESS

6. AMOUNT OF DISTRIBUTION

7. GEORGIA TAX WITHHELD

8.

GEORGIA DEPARTMENT OF REVENUE

P.O. BOX 740387

ATLANTA, GA 30374-0387

COPY 1- STATE COPY

Form G-2-A

WITHHOLDING ON DISTRIBUTIONS TO NON-RESIDENT MEMBERS/SHAREHOLDERS

TAX YEAR

1. PAYOR’S STATE ID NUMBER

2. PAYOR’S FEDERAL ID NUMBER

3. BUSINESS ENTITY NAME AND ADDRESS

4. RECIPIENT’S ID NUMBER

5. RECIPIENT’S NAME AND ADDRESS

6. AMOUNT OF DISTRIBUTION

7. GEORGIA TAX WITHHELD

8.

GEORGIA DEPARTMENT OF REVENUE

P.O. BOX 740387

ATLANTA, GA 30374-0387

COPY 2- TO BE ATTACHED TO GEORGIA RETURN

Form G-2-A

WITHHOLDING ON DISTRIBUTIONS TO NON-RESIDENT MEMBERS/SHAREHOLDERS

TAX YEAR

1. PAYOR’S STATE ID NUMBER

2. PAYOR’S FEDERAL ID NUMBER

3. BUSINESS ENTITY NAME AND ADDRESS

4. RECIPIENT’S ID NUMBER

5. RECIPIENT’S NAME AND ADDRESS

6. AMOUNT OF DISTRIBUTION

7. GEORGIA TAX WITHHELD

8.

GEORGIA DEPARTMENT OF REVENUE

P.O. BOX 740387

ATLANTA, GA 30374-0387

COPY 3- RECIPIENT’S RECORDS

Form G-2-A

WITHHOLDING ON DISTRIBUTIONS TO NON-RESIDENT MEMBERS/SHAREHOLDERS

TAX YEAR

1. PAYOR’S STATE ID NUMBER

2. PAYOR’S FEDERAL ID NUMBER

3. BUSINESS ENTITY NAME AND ADDRESS

4. RECIPIENT’S ID NUMBER

5. RECIPIENT’S NAME AND ADDRESS

6. AMOUNT OF DISTRIBUTION

7. GEORGIA TAX WITHHELD

8.

GEORGIA DEPARTMENT OF REVENUE

P.O. BOX 740387

ATLANTA, GA 30374-0387

COPY 4- PAYOR’S COPY

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1