Form S-Es - Quarterly Installment Of Estimated Tax

ADVERTISEMENT

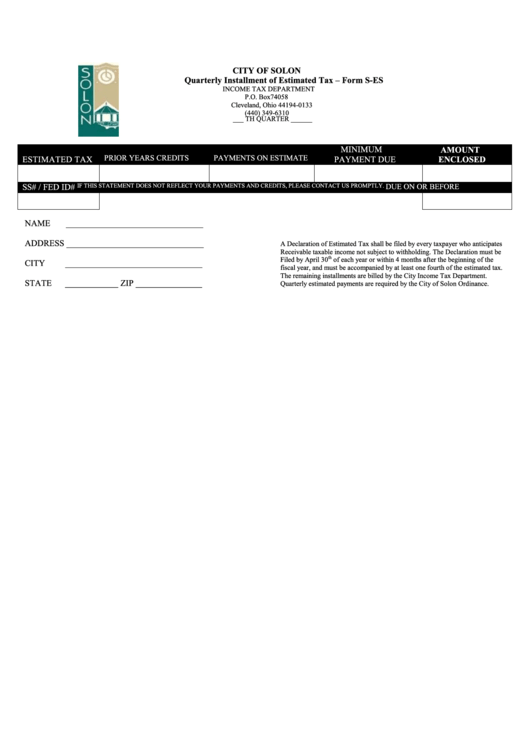

CITY OF SOLON

Quarterly Installment of Estimated Tax – Form S-ES

INCOME TAX DEPARTMENT

P.O. Box 74058

Cleveland, Ohio 44194-0133

(440) 349-6310

___ TH QUARTER ______

MINIMUM

AMOUNT

PRIOR YEARS CREDITS

PAYMENTS ON ESTIMATE

ESTIMATED TAX

PAYMENT DUE

ENCLOSED

SS# / FED ID#

IF THIS STATEMENT DOES NOT REFLECT YOUR PAYMENTS AND CREDITS, PLEASE CONTACT US PROMPTLY.

DUE ON OR BEFORE

NAME

_______________________________

ADDRESS _______________________________

A Declaration of Estimated Tax shall be filed by every taxpayer who anticipates

Receivable taxable income not subject to withholding. The Declaration must be

th

Filed by April 30

of each year or within 4 months after the beginning of the

CITY

_______________________________

fiscal year, and must be accompanied by at least one fourth of the estimated tax.

The remaining installments are billed by the City Income Tax Department.

STATE

____________ ZIP _______________

Quarterly estimated payments are required by the City of Solon Ordinance.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1